Auto Insurance Quotes For California – With more than 27 million drivers with license that fill the roads in California, it is important to have good car insurance. Here’s how to choose a good insurance policy that will not leave you with great accident bills.

The price is very important for many car insurance buyers. We evaluate average prices for 10 major car insurance companies in California for various drivers. Comparison purchases are important, as you will see, because the cheapest companies will vary according to their driving history and the insurance you are buying, among other factors.

Auto Insurance Quotes For California

Geico and Progressive are the cheapest companies in the state for good drivers, among the insurers we evaluate. Be sure to request a review of discounts regularly from your insurer.

Californians Say Car Insurance Harder To Get

Geico and CSAA (the AAA regional insurer) are California’s cheapest companies if you have a fast ticket. A fast ticket in California will usually produce a fine and a point in your license, which will last 39 months.

CSAA and Geico are the cheapest California’s cheapest car insurance companies if you caused an accident. The California Act says you should report an accident to the DMV if there was an injury, death or damage due to property greater than $ 1,000. An accident will remain in its registration for three years. Here is California’s guide on what comes after an accident.

Adding a teenage driver to a insurance policy is one of the most expensive insurance situations you can have. Farmers and mercury are California’s cheapest companies for adding a teenage driver, among the insurers we evaluate.

Progressive and Geico are the cheapest companies if you are buying only the minimum limits of California coverage. As long as you save money on the front, keep in mind the financial commitment: you may not have enough insurance if you cause an accident.

Cheapest Car Insurance In California For August 2025

California runs a program that makes car insurance more accessible to drivers who meet revenue guidelines. You can find out if your income level qualifies at Mylowcostauto.com. To qualify you must also:

Almost six out of 10 (58%) California voters said they are not satisfied with the fair insurance fees equity, according to a November 2020 survey conducted by EMC Research and commissioned by Root Insurance. Just over half of the respondents believe that the current method for determining car insurance rates in California is discriminatory.

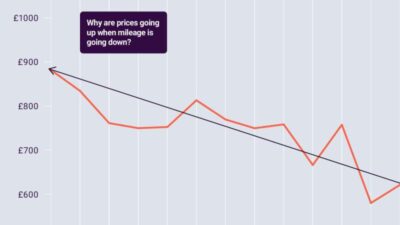

Ironically, California Law 103, passed in 1988, had to reduce these complaints. The law says car insurers in California must base their fees on the driving register, years of experience in driving and annual mileage.

The survey also found that 58% of Latin and black voters believe that the current form of car insurance is determined is discriminatory.

How Esurance Sharesmart Works For Rideshare Drivers

“Black and Latin voters feel discriminated against and that will not change unless we make changes to give them fairer and more equitable options,” said Edwin Lombard, California African American Chamber of Commerce, in a statement.

When asked if car insurance rates should be determined by how someone drives in front of their demographic makeup, California voters have chosen driving behavior as the most important.

At the national level, insurance regulators have pledged to address racism and discrimination within the industry. The National Association of Insurance Councilors has announced the formation of a special committee focused on breed and insurance. The Committee has the task of looking for potentially inherently discriminatory practices in the use of the unbeaten price factors such as the labor status, education, domestic property and insurance credit scores.

Responsibility insurance pays for damages and injuries that causes others. In turn, if someone else falls into you, you should be able to claim their responsibility coverage. Vehicle owners in California should buy at least:

Best And Cheapest Car Insurance In California For 2025

The best car insurance begins with liability insurance higher than state requirements. The minimums of the state are low and can leave you open to processes when you do not have enough insurance. If you have assets to protect yourself from a demand, such as savings, you will want a higher level of coverage. As your income and assets increase, it can become a demand target and you should consider generous car insurance limits.

COLLECTION AND COMPLETE COVERING: COLLECTION AND INTEGRAL PAYMENT FOR your car’s repairs from a wide variety of problems, including hail, flooding, fire, vandalism and flaws with other objects and animals. Integral insurance also covers theft of vehicles.

Non -secured motorcyclist coverage: If you are injured by a driver who has little or no responsibility insurance, the coverage of the non -insured biker (UM) can help. Pay your medical bills when someone else causes an accident and does not have insurance or not enough to cover your bills. Um can also pay for lost wages and pain and suffering due to the accident.

Umbrella insurance: This coverage provides an additional layer of liability insurance higher than your car insurance and owners. In the event of a disastrous car accident, umbrella coverage gives greater coverage of demands.

California Car Insurance By City

California Act allows you to display the insurance test from your mobile phone. If not, you should keep a paper copy in your car and show it when:

California drivers pay an average of $ 892.55 per year for car insurance. That average includes all levels of insurance bought. Below is the average premiums for common coverage types.

Automobile insurance companies usually use many factors to calculate your fees and prices may vary significantly among insurers. His driving history, past claims, vehicle model, and much more all play a role. In California companies can also use these factors.

The California Insurance Department is responsible for taking complaints against insurance companies. If you have any problems with your insurer you couldn’t solve, the insurance department can help. See the Getting Help page.

Auto Insurance Apple Valley Ca: Top 5 Best Tips 2024

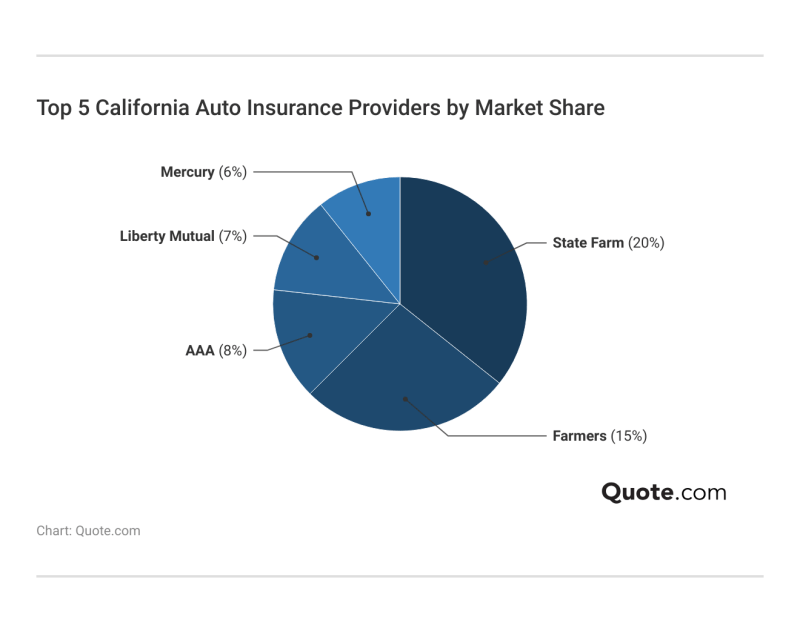

To find cheapest car insurance companies in California, we use average Quadrant Information Services, an insurance and analytical data provider. The companies evaluated for California were AAA (exchange of car club interrses), Alliance United, Allstate, CSAA, Farmers, Geico, Infinity, Mercury, Progressive and State Farm.

The opinions and opinions expressed in this document are the opinions and opinions of the author and do not necessarily reflect those of, Inc.

Forbes Advisor is a trusted destination for advice, news and criticism of impartial personal finance, dedicated to making smart financial decisions.

Sign up for the Tradetalks Bulletin to receive your weekly news of news, trends and education. Wednesday delivered.

California Insurance Quotes?

Now or see the quotes you care about, anywhere. Start the navigation of actions, funds, ETFs and more assets classes.

Now or see the quotes you care about, anywhere. Start navigating actions, indexes, ETPs and more assets classes.

Create your surveillance list to save your favorite quotes. Log in or create a free account to get started.

Now you can see the price and activity in real time for your symbols in my appointments.

Google Now Lets You Compare Auto Insurance Quotes In California, Will Launch In More States Soon

The smart portfolio is supported by our partner Typranks. By connecting my wallet to Typranks smart wallet, I agree with your terms of use.

By clicking “Accept all cookies”, you accept cookie storage on your device to improve site navigation, analyze site use, and help in our marketing efforts. COOKIE POLICYARE A company owner who needs comprehensive insurance coverage for your California manufacturing company from a higher agent?

The Allen Thomas group offers a variety of custom insurance policies for California manufacturers, including general responsibility insurance, product responsibility insurance, commercial property insurance, workers’ compensation insurance and more.

We work closely with our customers on the west coast to understand their unique needs and help develop a policy that provides complete coverage at a competitive price.

Cheap Car Insurance In Tampa: Affordable Rates (2025)

To protect their assets and operations, these companies must have the coverage of the appropriate insurance instead. The following is a selection of some common types and specific types of the manufacturing insurance coverage industry available in California.

This coverage protects your company against third -party claims due to bodily injury or property damage that may occur in its facilities or as a result of their products. For example, if a customer is injured while visiting their manufacturing installation or if anyone suffers from property damage due to a poorly functioning product caused by their company, general liability insurance would provide coverage for legal and medical expenses.

This coverage protects its installation of manufacturing, equipment and inventory of dangers such as fire, theft, vandalism or natural disasters. It can help repair or replace damaged property, ensuring that your operations can continue without major interruptions.

The responsibility of the product refers to the legal responsibility that manufacturers have for any damage caused by their products. This coverage will protect your company in case a defective product causes injuries or damage. It can help cover legal rates, settlements or judgments that derive from such incidents, providing financial protection and tranquility.

10 Best Car Insurance Companies Of 2025

Business interruption insurance is a complement that manufacturers should seriously consider. If a covered event forces your company to stop operations temporarily, business interruption insurance helps to cover ongoing expenses such as rent, payroll and public services. It can be a line of life during difficult times and help ensure business continuity.

Workers’ compensation insurance is essential as it provides coverage of medical expenses and lost wages for employees who experience work -related injuries or diseases. Not only do you support your employees, but also protect your company from possible processes related to work -related accidents.

If