Auto Insurance Rates – You pay one amount for your car insurance policy. Your spouse, on the other hand, is due to the same provider.

Well, this can’t be an unusual scenario. In fact, it is quite prevalent special between couples using different car makes.

Auto Insurance Rates

And just when you thought the situation could not be stranger, you learn that the premiums of your neighbor are cooked yours.

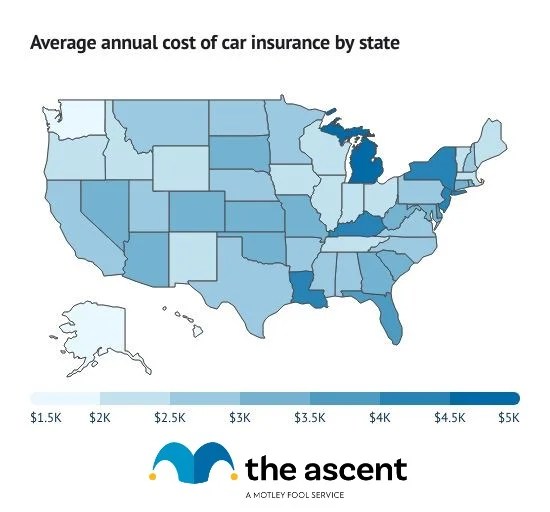

Infographic: Average Auto Insurance Premiums For All 50 States — My Money Blog

You’re pretty much in the same age group, and your vehicles are similar. You have even confused their vehicle for yours on several times.

Last time you checked, there is no state boundary between you and the neighbor. You both live in the same area, under the same federal and state insurance legislation.

Actuaries are in the center of the insurance industry. Insurance providers even need them way more than sales agents and customer service agents.

All because of one simple fact. They are literally the main determinants of profits their employers stand to make.

Calculating Car Insurance Premium

When you drive your car around, actuies are busy to search all the statistical nuances that predict the likelihood of her jump a claim in future.

To be beautiful, you may not have any plans to submit a claim. But actuaries have a rough idea of when you probably do it.

The data is subsequently extrapolated and used to determine your overall car insurance rates. The larger your chances of filing a claim, the higher your car insurance premiums will be.

Additionally, the more the money the insurance company stands to lose when commts you, the greater their efforts of protecting yourself with high rates.

How Often Should I Check For Better Auto Insurance Rates?

Some of the criteria used for this assessment could be quite obvious and widely fit. Other, unfortunately, are quite surprising and quite controversial.

At the moment the pricing variables are pretty normal across the industry. However, every insurance provider is using a unique formula to calculate the risk levels of the customer levels.

Look at the average rates in selected Texas companies, for example. While you could pay $ 2, 330 in one company, you stand almost half of which by simply switching to a different provider.

According to consumer suggest company JD power, the rate of reviewing pricing over different insurers is in fact dropping.

Map Shows States With Highest Car Insurance Rates

In 2015, there were 39 shops per 100 car insurance policies. Compare that to 2016, when only 33 per 100 car owners shopped for alternative cheaper policies.

Well, of course, 33% may seem like a tough number to most people. Sadly, most of the shoppers do not follow through the entire process. They only check offers by different companies, leave it in that.

Which leaves out a significant majority that do not know why they pay dearly for something as simple as car insurance.

To help you comprehensively compare variables and rates through different insurance companies, we will explore critical reasons that can increase your auto insurance rates. This will then help you minimize your premiums, and make informed decisions when shopping for cheaper providers.

Car Insurance Rate Increases

Credit score is by far one of the most controversial risk assessment causes. A poor score could potentially increase your car insurance premiums.

Some drivers and industry experts argue that the last financial decisions and driving hobites are not correlautional.

Insurance companies, contrary, feel that drivers with poor credit scores tend to submit more claims as their counterparts.

According to a survey by Canning & Co, only 92% of insurers use this to assess their clients’ premiums.

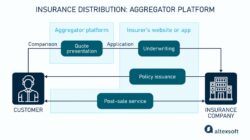

A Logistic Regression Based Auto Insurance Rate-making Model Designed For The Insurance Rate Reform

You are the particularly lucky if you are assured in Massachusetts, Hawaii or California since the practice is prohibited in the states.

Through a CBS news post, women pay $ 15, 000 less for their auto insurance in their lifetimes compared to people.

The debate on the connection between driving skills and gender apart, accident the statistics show that people are more likely to crash.

Since motoring began in the US. There, the gulk majority of accident victims are always male. This is because people, especially young drivers, hire at risk trainures.

Why Did Alberta Auto Insurance Premiums Increase By 5.24% In 2023 During A Rate Pause?

If you need to proof, look at people arrested for failing to wear Sitbelts, driving while intoxicated and speeding.

Most of them are male. And then consequent crashes are usually more severe than cases with female drivers.

In the bright side, this criterion is not applied in all states. Male Drivers in Pennsylvania, Northah Karolina, Montana, Michigan, Massachusetts, and Hawaii are exempt from gender-specific rates.

The risk of a potential accident is the fundamental reason which drivers ensure their vehicles. Insurance companies are meant to protect people from possible output liabilities.

Auto Insurance Facts

Insurance providers know it all too well. So they also consider rental and corresponding work activities in the overall risk assessment process.

While vehicular traffic is not often experienced pilots, there is an integral part of regular operations handled by journalists and delivery drivers.

So the resulting vehicle mileage translates to a significantly high risk of accidents. And that, to insurance companies, is interpreted as increased premiums.

Driving is exceptionally exciting and fulfilling to young drivers that are starting. But insurance companies do not share the sentiments.

St Petersburg Best Auto Insurance Companies: Top 5 Trusted Picks 2025

Go through this, the highest rates are applicable to teenagers. They can potentially Cup with 20% at the age of 25, and progressively decline 30 until 60 years.

Thanks to statistics that have proven reduced crash risk, drivers between 30 and 60 continue to enjoy the lowest rates.

Marrying some sociologists, is not just a status change. This also affects your overall perception of life.

The National Institute of Health conducted an analysis on this and established that one drivers are twice as likely to be involved in motor accidents.

Average Cost Of Car Insurance For 19-year-olds (2024)

On the bright side, it is not all bad news, at least for one people in Massachusetts. It is the only state of legislation against this criterion.

Your insurance limit refers to the maximum amount your insurer will fork yourself in the case of a claim.

Well, all car owners wish to secure the highest amounts possible. However, on the flipside, no limited is proportional reflected in the corresponding premiums.

This is the nature of the insurance business. Your insurer cannot afford to punch up your potential payouts without revising your insurance course upwards.

5 Ways To Lower Your Auto Insurance Costs

Technically, a base model Porsche Carrera should attract higher insurance rates like a four-cylinder base model Tarota Camry.

Pretty much what you would expect. But things take a rather interesting move when switching to the six-cylinder camriai.

Compared to the Carrerer, that specific comri can be cheaper to obtain at the beginning. But subsequent insurance rates will finally be costlier.

Essentially, the bigger your engine, the more the horsepower your car will generate. Even to a motoring beginner, means increased speeds.

Brace Yourself For Another 22% Car Insurance Price Jump This Year

Records of all drivers and their traffic violations are readily available in the central violations Bureau and the National Driver Register.

Even the slightest offers are picked up by your insurance company and may trigger a revision of the rates.

So if you live in one, you may want to move yourself. If not, prepare your pockets for significantly higher premium rates.

State legislation only requires drivers to buy the most critical ones. And that’s letting you with the freedom to get as many as you can.

How To Lower Your Car Insurance Premium

The only risk factors would be theft, extreme weather and third party damage. And this would probably restrict himself for their low insurance rates.

When you think would be your best strategy for minimizing current auto insurance rates?

In signature insurance we want to help you understand your insurance coverage options so you make the best decision.

Contact us at (586) 274,9600 and we will be happy to get quote for you from many of the peak auto insurance companies in Metro Detroit.

The Average Cost Of Car Insurance In All 50 States

The price comparison company, the price of average 17-20-year-olds have seen insurance rise by more than £ 1, 000 from the same period last year.

Steve Dukes, Chief Executive from Product. ,, Tell radio 4’s today program: “The frequency in claims is up in the last couple of Ukraine, since the pandemic, but also the pandemic, but also the pandemic, but also the price of them.

“The price of second-hand cars are higher than they were, the cost of parts, the costs of work to make repairs – and this is all offered to consumers.”

Prices for second-hand cars – the usual first vehicle for a newly-qualified young driver – have been vovers since a few months in the Co. Pandemic. Demand for used cars spiked as the production of new vehicles have fallen because of a global shortage of computer chips and other materials needed manufacturing.

Top 10 Car Insurance Rates 2019

In March 2022, these prices increases increases in the used car market peaked at 31%, according to the Office for national statistics. They have since fallen back sharply.

But younger drivers faced the sharpest jump. For 17-year-olds, premiums surged by an average £ 1, 423, to 2 pounds, 877. For 18-year-old drivers, the average policy price reached £ 3, 162.

The data is calculated on an average of the best five quotes obtained on confused., Rather like prices actually paid for policies.

Mr Dux said that there are ways to reduce premiums. “Where they can legitimately share the driving with an older driver with more experience and add the person as a named driver,