Auto Insurance Rates By State – The average annual car insurance for car insurance fully covered in New York province is $ 2, 996, 996. This infographic comes from the team’s team in the field of the field, which comes in the infographic, which is based on all 50 US car insurance medium cars. This includes information on monthly and annual expenses for both full coverage and minimum coverage.

On an annual basis for the full coverage, car insurance in New York ($ 2, 996), Louisiana ($ 2, 864 $), Nevada ($ 2, 345 $), California ($ 2, 190 $), Colorado ($ 2, 190 $), Colorado ($ 2, 190 $), Colorado ($ 2, 190 $) ($ 2, 019 $) ($ 2, 002 per year), Georgia (1, 985 dollars per year) and Delaware ($ 1, 963 per year). Although car insurance rates are the most expensive in this ten state, Maine can claim to have the cheapest average prices.

Auto Insurance Rates By State

Maine is the average annual cost for the average annual car insurance for full coverage 876.00 is $ 876.00, it is the only state to be less than $ 1, 000. Drivers for minimum covered car insurance in Maine can expect to pay an average of $ 227 on an annual basis. Other states of other car insurance rates (on annual basis for full coverage), include Idaho ($ 1, $ 1,25 $), New Hampshire ($ 1, $ 1, 200 dollars).

Trump Calls Out Louisiana’s High Car Insurance Rates

By setting aside the annual costs, it can be excited by New York ($ 249.67 $ monthly), Florida ($ 230.17 $ 230.17) and Nevada ($ 23117).

According to the team’s research and information in the factory speech of the field, these were only four states in the ranks of $ 200 in the average monthly car insurance.

We take care of you using cookies on our website to give the most suitable experience by remembering your preferences and recall your repetition. By clicking the “Accept” button, you agree to the use of all cookies.

This website uses cookies to improve your experience while walking on the website. The cookies are stored in your browser, as necessary, because it is stored in your browser, because it is important for the main functions of the website. We also use third-party cookies that help and understand how you use this website. These cookies will only be kept in your browser with your consent. You also have the option to give up these cookies. However, a refusal of these cookies can affect your walking experience.

Right On The Money

The necessary cookies are definitely important for the web site to function properly. These cookies provide the main functions and security features of the website, anonymously.

GDPR Cookie is determined by the agreements plugin, it is used to record user consent for cookies in the “Advertising” category.

The cookies are built by the GDPR Cookie Condie consent plugin. Cookie is used to maintain user-consent for cookies in the “Analytics” category.

Cookie is determined by GDPR cookie consent to mark user consent for cookies in the “functional” category.

Car Insurance Rates On The Rise; Ct Average Premiums 14th Highest In U.s. — Connecticut By The Numbers

The cookies are built by the GDPR Cookie Condie consent plugin. Cookies are used to maintain user-consent for cookies in the “necessary” category.

The cookies are built by the GDPR Cookie Condie consent plugin. Cookie is used to maintain user-consent for cookies in the “other” category.

The cookies are built by the GDPR Cookie Condie consent plugin. Cookie is used to maintain user consent for cookies in the “Performance” category.

Note the status of the standard button of the relevant category and CCPA status. Only associated with the main cookie.

Top 10 Most Expensive Cities To Own A Car

Cookie is based on the GDP Cookie Concie plugin and is used to keep the user’s cookies do not agree or do not agree to the use of cookies. Does not store any personal information.

Functional biscuits help you to perform the content of the website, share the contents of social media platforms, collect comments, collect other third party features.

Performance biscuits are used to understand and analyze the main performance indexes of the website that helps to present a better user experience for visitors.

Analytical cookies are used to understand how visitors interact with the website. These cookies are dimensions, number of visitors, leap rate, traffic source, etc.

Average Cost Of Car Insurance (2024)

The __Gads set by Google, DoubleClick is stored under the domain and see an advertisement of users, measure the success of the campaign and calculates the success of the campaign. These cookies are read only from the domain where it is built and will not monitor any information while walking through other sites.

The _ga cookies installed by Google Analytics, calculates visitor, session and campaign information and also watches the site for the site analytical report. Cookie informs anonymously and sets a randomly generated number to recognize unique guests.

Informed by Google Analytics, _GID Cookie, information on how to use the website of visitors, as well as information about creating an analytical report of the website performance. Some of the information collected include the number of visitors, the number of visitors, the pages visited by anonymous.

Advertising cookies are used to provide guests with relevant advertising and marketing campaigns. These cookies are followed by visitors on the websites and collect information to provide special ads.

Auto Insurance Guide For 2025 (coverage Options, Rates, & More!)

CMPS Cookie is set by Casalemedia for anonymous user tracking based on the user’s website visits to show target ads.

These cookies are built by Doubleclick to record the user’s special user identity. Contain Hashed / encrypted unique ID.

Google DoubleClick Ide cookies are used to know how to use the user from the website to inform and submit information according to the user profile.

The cookie destined by Pubmatic is a unique identity document that determines a user’s device, which uses the websites that uses the same advertising network. ID is used for target ads.

Full Coverage Car Insurance Cost In 2025

A cookie developed by YouTube to measure the bandwidth that determines the user’s new or older player interface.

The YSSC cookie is based on YouTube and is used to follow the views of videos installed on YouTube pages.

Other level cookies are analyzed and not yet classified into a category. You are in a galactic layer, think about seeing on the full screen to open your phone or best optimize your experience.

The advertiser is one of the many proposals visible on this site, Motley compensation companies. This compensation can affect the products we write on this site and where the products appear on this site (such as an order), but our product ratings do not affect compensation. We do not include all companies or suggestions in the market.

Full Coverage Auto Insurance (2025)

Most or all of the products here are from our compensating partners. We make money. However, the editor’s integrity ensures that our product ratings are not affected by compensation.

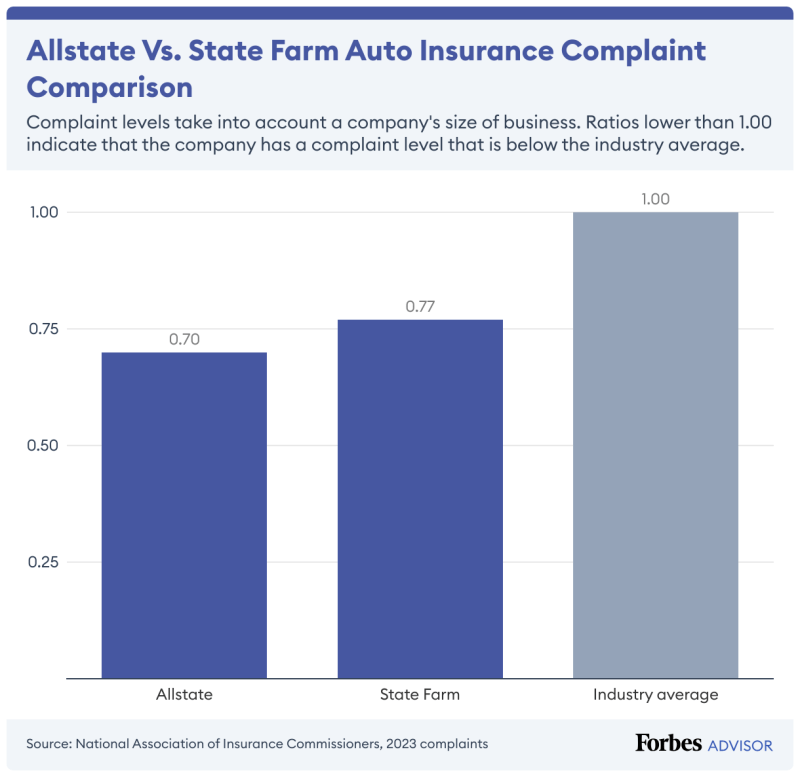

The national average number of car insurance in 2023 was $ 251 per year, $ 251 per year.

This is a decent part of the changes: it is more likely to spend in the middle of the average. And amounts to 4% of the average salary in America.

Car insurance rates vary by the state and provider and affect your driving record, your credit account and other factors. To see if a better deal is a good idea to regularly check out the car insurance providers outside one of your current.

Best Car Insurance In Washington, D.c.: 2025 Top Companies

In 2023, the national average annual cost of car insurance is 3, $ 017, according to the quadranta. This is about $ 251 per month.

Auto insurance was more expensive in the last three years. In 2021, the average annual Auto Insurance Award is $ 2, $ 640 or about $ 220 per month.

While various factors, age, space, driving history and credit accounts, the total cost of car insurance has caused more expensive and dangerous weather conditions in recent years and more intensely intense.

The car owner’s purchasing through the auto-insurance policy of the car owner has a serious impact on the price of this policy.

Car Insurance Rates Could Jump 50% In 3 States. Here’s Where.

The minimum coverage, which requires the purchase of state owners, is more comprehensively cheaper.

In 2023, the average auto insurance coverage was $ 787 per year, about $ 66 per year. More comprehensive coverage, 3, $ 296 per year, about $ 275 per month.

The minimum Auto insurance coverage usually includes liability of bodily injury commitment and damage to property. This coverage is often grouped together as instructions of responsibility. In the accident, they help to pay material damage and material damage to another person.

A reason for a more expensive car insurance in the Middle Atlantic is a higher level of responsibility and higher levels of state in the region