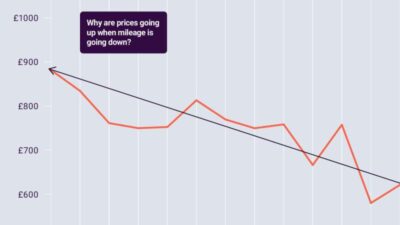

Auto Insurance Rates Going Up California – Prepare for a bad shock the next time you have to renew your car insurance. Industry observers say the former have already grown by 15 percent in the first half of 2023 and will be up to a total of 22 percent until the end of the year.

For American drivers, these increases follow an equally bleak 2023 in which the insurance costs jumped by 24 percent. Isourify calculates that the first full coverage average now costs $ 2, $ 329, although in some states, the total price could be more than 40 percent higher than the one.

Auto Insurance Rates Going Up California

Maryland has the highest insurance costs in America, which is at $ 3, 400 for the first average with full coverage, and this figure is expected to grow at $ 3, 749 at the end of 2024. South Carolina is hot on the heel, with an average of $ 3, 366 (366 was stipulated by $ 3, 387) ($ 3, 484).

Who Has The Cheapest Auto Insurance Quotes In California?

New Hampshire drivers enjoy the youngest first, their average total of $ 1,000,000 at the moment and will probably increase to 1, 053 to December. Tomorrow ($ 1, 209/1 $, 263) and Vermont ($ 1, 410 /1, 499) also shows as wonderful places to ensure a car. But Izurify stipulates that California, Missouri and Minnesota could see that car insurance costs increased by more than 50 percent in 2024.

The insurance industry reduces the increase to a multitude of factors, such as increasing the prices of new cars and increasing costs of repairing cars of all ages, including new electric vehicles. A greater incidence of meteorological disasters, such as floods and hail, pushes the first, as well as the regulatory changes.

The laws of South Carolina and Maryland put on a greater burden of financial responsibility on insurance companies compared to the legislation in other states. And with frozen insurance rates during Covid-19 Pandemic, California allowed them to grow again, which caused some companies to announce two-digit growth in the effort to improve profitability.Copyright © 2025, Los Angeles Times | Terms of service | Privacy Policy | As a collection notification Do not sell or share my personal information

The cost of car claims has increased in the United States from the beginning of the Covid-19 Pandemic, according to the Institute of Insurance Information.

Soaring Insurance Premiums Have People Shopping For Deals

The data analyzed by the Isourify insurance comparison site showed that the average annual cost of complete coverage in California was $ 2 in June, increasing from $ 1 666 a year before.

And the first will continue to grow, up to about $ 2, 681 for full coverage by the end of the year, found the report.

“The increases that were produced were largely determined by a continuation of the people who lead more, which led to an increasing frequency of inflationary requests and pressures related to the prices and repairs of the vehicle,” said Gabriel Sanchez, spokesman for the State Department.

?strip=all)

California car insurance regulatory authorities have approved some high rate increases in the last six months after a long break from Covid. And more are in the pipe.

The True Cost Of Auto Insurance In 2025

While many insurers have applied and were approved for the increase in the department, others – frustrated by state regulations – have limited the number of new California policies, or ceased to offer them altogether.

But the pandemic is not just to blame. Other factors include changes in driving habits, previous problems of the supply chain and how cars are made, said Michael Giusti, insurance analyst.

After the orders of residence were raised at home in the Pandemic era, Giusti said, people hit the drugs-they continue to drive longer than before.

The cars that people drive are also a factor in increasing coverage costs. New cars are more expensive, which means there is a higher cost to assure them, he said.

Cheap Car Insurance And Average Costs For 16-year-olds

Allstate, one of the largest insurers in the country, resumed the writing of new policies through its web site. But the costs increase.

The technological bells and whistles packaged in newer cars can increase the cost of a potential demand. For example, Giusti said that if he had returned to a pillar with his first car – a Dodge Aspen in 1977 – the pole would have suffered more damages than the steel bumper.

“Today, if I returned, not only will I break my plastic bumper, but it will kill the sensor,” he said.

In the statement, he should report the replacement, recharge and recalibration of the sensor and the buffer of the area. What could have been a simple protective bender once “turned into a major statement,” he said.

Surging Auto Insurance Rates Squeeze Drivers, Fuel Inflation

Another factor that composes insurance rates is the cost of medical invoices in case of accident. The costs of hospital services increased by 6.7% at national level between January 2023 and January 2024, reported the Bureau of Labor Statistics.

But despite the head winds, there are still ways to save money on your first while you sail in the concrete jungle as safe as possible:

The insurers say that the state regulatory authorities are responsible for the difficulties that some drivers have new policies. Consumer lawyers blame greed.

Whether or not you have an insurance provider, Giusti said you should always shop. It is a thing in the past to stay with an insurance supplier just because you have been a client for a long time – it does not guarantee any economy.

Car Insurance Rates Are Rising In California. Why And What To Do

“I’m not saying that Jump Ship Willy-nilly, but you want to make sure you get the competitive tariff,” he said.

The price of the sticker only goes so far. The Institute of Insurance Information also recommends that you ask friends and relatives for their recommendations.

After you have made a few calls to the company agents or representatives, you may find that an insurer will give you a different drastic price than another based on your credit score.

This is why it is important to maintain your credit score, paying -time invoices, not getting more credit than you need and keep the credit balances as low as possible, according to the Insurance Institute.

Premiums For Covered California Insurance Will Go Up In 2025. Here’s How Much

The unusual increase in car insurance rates are the squeezing of car owners and stores inflation. Car insurance rates increased by 2.6% in March and increased by 22% compared to one year ago.

The age of your car also determines what kind of policy you have offered and how much it will cost, Giusti said.

If you have a car that is at least 10 years old, he advises to think about whether you need a collision policy or comprehensive policy.

“Reducing your coverage. If your car is paid and you don’t need as much is a good way to save money, especially if the value of the car is a kind of creepy,” said Giusti.

Average Cost Of Car Insurance (2024)

Ask for greater deductibles before your insurance policy is in, recommends the Institute. Requesting a greater deductible – the amount you have to pay before your policy starts to pay the covered expenses – you can substantially reduce your costs. For example, deductible increase from 200 to $ 500 could reduce the cost of collision and comprehensive coverage by 15% to 30%. Going to $ 1,000,000 can save you 40% or more.

The insurance department says that car insurers create barriers for new and renewal members, possibly violate the right of the state.

The Institute has provided a list of some common discounts, although their availability depends on the insurer and where do you live from:

Karen Garcia is a reporter breaking news at Los Angeles Times. She was formerly a reporter in the utility journalism team, which focused on service journalism. Its main extinguishers include reporting to San Luis Uspo New Times and KCBX Central Coast Public Radio. One of the biggest concerns for many California drivers is the growth of car insurance after an accident. When a person is to blame, it is understandable that the consequences would involve an increase in the insurance rate. But if the driver is not blame?

California Map Shows Where Insurance Nonrenewals For Homes Are Worst

At Sally Morin, as California car accidents, our customers often ask us: “How much will my insurance increase after an accident?” Or “my first will they grow if I had no blame?” So we decided to answer these questions and a few, asking this list of frequent questions about insurance rates and car accidents.

If you have been seriously injured in a car accident, before reading about your insurance, you should really talk to an expert car accident to protect your rights! Call us at 877-380-8852 or contact us online for a free cases.

When you are considered to be guilty for an accident, your first insurance will grow almost certainly. For 2025, national data shows that drivers can expect an average car insurance increase from 44% to 49% after a guilty accident (source: Bankrate and Consumershield).

In California, this increase in rate is often more severe due to higher life and traffic density. While an accurate average percentage for 2025 is still being developed, it is expected to be significant, especially with the new liability laws (more about the ones below). The exact amount your insurance will increase depending on several factors:

Brace Yourself For Another 22% Car Insurance Price Jump This Year

A major change entered into force in 2025, which has an impact on each driver in the state. For the first time in decades, California has increased the minimum minimum liability insurance limits.

(Source: California insurance department