Automobile Insurance Adalah – What is the price of car insurance in Indonesia? This article discusses how to calculate prizes, all risks and TLO differences and factors that affect prices, locations, locations, demands and more. You can also find advanced simulations and tips to get the best prices based on your needs.

Today, car insurance is no longer just a supplement – but the main need for anyone who wants to protect the vehicle from damage, loss or accident risk.

Automobile Insurance Adalah

The answer is not a single one. Premium prices can vary significantly depending on the type of protection of the insurance company’s policy, the value of the vehicle and the place of residence.

Car Insurance Concept. Automobile Protection And Safety Assurance. Vehicle Collision Insurance. Cars Damage, Safety From Disaster. Salesman Agent And Stock Vector Image & Art

According to OJK, the penetration level for car insurance in Indonesia is still below 20%, one of which is due to a lack of knowledge of prices and benefits.

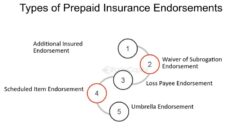

To understand the structure of premium prices, do we have to start from the foundation: What type of protection do you choose? Because this is the biggest difference.

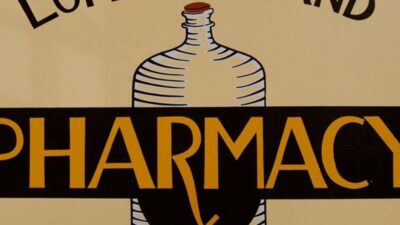

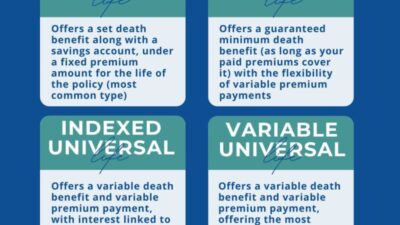

Before deciding on insurance products, it is important to understand the two main types available in Indonesia: all risk insurance and just TLO (loss) insurance. Both have different areas and advanced areas.

For a more detailed description of the differences in benefits, requirements restrictions and tips selected as needed, Read also: Understand all risk insurance: Benefits and their differences from TLO

Asuransi Total Bersama

When you know what types of protection are available, it is time to understand which variables make the high price cheaper or more expensive.

Premium prices are not only affected by insurance types. Here are some of the main factors that affect the total cost of your car insurance:

Usually new cars (0-5 years) are usually more easily insured by all risks. Older vehicles tend to only use TLO insurance, or require additional inspections.

Areas with higher risk levels such as Jakarta (traffic overload, flood, dense population) will have higher prizes than in smaller cities

Does Insurance Follow The Car Or Driver In Colorado? (2024)

The combination of all the above factors creates a unique formula for each car. Here are examples of real simulations that can give you a clearer picture.

Although the price of prizes is determined by many factors, you can still optimize the protective value with the right strategy. Here are some storage tips without sacrificing quality.

Compared to monthly installments, Oona is one of the insurance that offers annual premium discounts. Understand the benefits and annual installments: Annual car insurance against monthly: Which is more profitable?

Each car owner has different needs. Therefore, the ideal type of insurance may also be different. The following guide is based on user profiles and vehicle status.

Buy And Sell Cars & Motorcycles, New And Used In Indonesia

Choosing an insurance type (all risks or TLO) depends not only on the premium price, but also on the demand, the type of car and how the vehicle is used.

Now you have a comprehensive guide to the price of car insurance. To quit, let’s conclude with the key points we should remember before we buy a policy.

Car insurance has different prices, but to understand the type of protection, the determinants for prizes and personal needs, you can get the ideal protection without paying more expensive.

With transparent prizes, simple purchases and complete benefits, Oona can serve as a modern solution for your car insurance needs.

Car Insurance Website Or Landing Page Template With Cartoon Characters Of Agent And Car Owners, Flat Vector Illustration. Web Page For Automobile Insurance Agency. 25754774 Vector Art At Vecteezy

All risks are more expensive due to their larger scope of protection. However, it can be more profitable if you often park in public places or drive in busy areas.

Slightly higher because of the price of spare parts and special technology. But now many companies (including Oona) offer special electric vehicle products.

After the incident has occurred, reports to the insurance provider for up to 5 business days, fill in the requirement form and complete the documents according to the request.

The Oona insurance is provided as an insurance provider, and provides innovative solutions to facilitate complex insurance. Supported by a team of experts, Oona is obliged to help clients understand the insurance world while providing the best protection. This blog will discuss the latest trends and innovations in the insurance industry, so that individuals and companies can make more appropriate decisions. Comprehensive (extensive): Insurance provides compensation or repair costs for partial loss/loss, partly and directly caused by collision, collision, vice versa, slippage, mildew, evil, evil, theft, fire or other traffic accidents. (refers to Indonesian car insurance standards).

Manfaat Reparasi Dasar: Pengertian, Cara Kerja, Dan Contoh

Only loss of total loss (TLO): Guaranteed the total loss/damage to the vehicle directly caused by the fire truck, vehicle (damage, repair value exceeds more than 75% of the vehicle price). (refers to Indonesian car insurance standards)

Mr. A has a car protected by RP’s insurance policy. 151,000,000. When he had an accident, Mr. A made a claim for the accident. After estimates, the total injury value reaches RP114 760,000, or exceeds 75% of coverage.

If the requirement is approved, the insurance will provide compensation for the loss, and Mr. A must pay 5% x RP151,000,000 = RP7.550,000 (based on the risk related to the total loss) as the risk costs for the insurance company.

Mr. A has a car protected by RP’s insurance policy. 151,000,000. At the time of the accident, Mr. A filed a claim for the accident.

Cara Memilih Asuransi Mobil Yang Tepat

The insurance company led Mr. A to a partner workshop to estimate damage and repairs. According to estimates and requirements for approval, the value of the car repair is RP. 20,000,000. After repairing the car, Mr. A will demand a RP fee. 300,000 (based on his own risk of repairs at a non-AtPM partner workshop), it must be paid to the insurance company as a risk cost in itself.

This coverage does not guarantee losses, losses, car costs and/or legal liability against third parties, and is caused by the following

If: Comprehensive insurance is a type of car insurance that does not guarantee losses, losses and/or expenses for the car and/or legal responsibility, this is a type of car insurance that covers the damage to your car for reasons other than collisions. If damaged by a tornado, painted by a deer, carried by a deer, damaged by a deer, crushed by a collapsed garage, or many other slums, will cover your vehicle.

Extensive insurance, collision insurance and liability insurance are three components of a car insurance. In most states, drivers are required to bear the prescribed liability insurance, but collision and extensive insurance are optional if someone directly owes their own action coverage. If a man -made vehicle is merged, the theater loan company may need extensive insurance, plus ruling driver or clearance insurance.

6 Types Of Car Insurance Explained

If you buy a brand new car, it makes sense to have extensive car insurance, whether you finance it or pay cash. Full coverage protects you from minor and significant damage caused by things you cannot control, regardless of coverage you may have extended to accidents. Collision cover average $ 290 per year.

Where you live can also play a role in your decision on when you do full coverage. If you live in a rural area where an animal collides with or in a storm area that provides hail, you may want to buy extensive insurance. The same is true if you live in a high criminal in the city and theft often happens.

Collision insurance protects you under a bicycle flip, another vehicle crashes or collision with an object. It does not cover brewing, theft or weather -related damage. If you rent a car, you must buy collision insurance. Collision insurance is useful when you have an accident to pay for the vehicle repair, covering any damage to the car due to giant pots on the road.

Extensive insurance is called “outside collision”. If you have an accident, there is no insurance that covers medical expenses for accidents or damage to other people’s vehicles.

Automobile Insurance: Actuarial Models

When buying extensive coverage or other type of car insurance, you must compare the best car insurance companies to find the most affordable price.

It covers car damage caused by accidents and disasters beyond accidents. The average cost for the total average is about $ 134 per year, but it may be double depending on the factors that the state you live in.

Collision and extensive insurance each have their own deductibles, so the driver chooses different deductibles based on the risk level in each area. (There is no deduction for liability insurance.)

If any people are hardly to submit a comprehensive requirement, but they do not want to give up extensive insurance Altoger, they should choose a relatively high $ 1000 that can be deduced to lower your business. A higher cash value at Avehicle will be more expensive for wealth insurance.

Automobile Insurance Ppt Powerpoint Presentation Complete Deck With Slides

Understanding how insurance companies determine driver risk categories can help you estimate the full coverage you may need to pay for. Where you live, driving history and coverage can determine what you pay for your car insurance, including full coverage.

The most expensive state to secure car insurance is New York, where the average driver spends $ 1,511 per year on all car insurance. The cheapest North Dakota pays drivers on average only $ 692 per year to secure the vehicle.

Extensive car insurance protects you from theft, natural accidents and weather assessments. This means that if a tree falls on a car or a thief steals a catalyst, you will not end up paying out of your pocket.

There are disadvantages. If you have an accident, extensive insurance will not pay for losses: Collision insurance does. Extensive insurance can also be expensive if you buy collision insurance. If your vehicle is older and paid off, you can save money by not buying full coverage, especially if theft and weather -related events do not involve your home.

The Indispensable Intersection Of Automotive And Insurance: Safeguarding Your Vehicle And Peace Of Mind

Extensive insurance is similar to other types of car insurance

Indiana automobile insurance, arizona automobile insurance, automobile insurance massachusetts, kentucky automobile insurance, ohio automobile insurance, automobile insurance orlando, automobile insurance austin, colorado automobile insurance, nevada automobile insurance, arkansas automobile insurance, nc automobile insurance, maine automobile insurance