Automobile Insurance Quotes Florida – Car insurance quotes Florida is essential for anyone seeking to drive legally in Heulwen province. With Florida’s unique landscape, busy cities, and tourism problematic places, finding the right car insurance policy can feel overwhelming. Whether you are an experienced driver or new to Florida roads, it is vital to get the right attention.

Navigating Florida car insurance can seem daunting, but a personalized service can make all the difference. Personal policies not only meet the requirements of the state but also provide for individual needs, providing peace of mind for drivers across the state.

Automobile Insurance Quotes Florida

My name is Jason Miller, and with over 20 years experience in the Florida insurance market, I understand that car insurance complications quote Florida. Let’s simplify the process together and find the perfect fit for your needs.

Best Cheap Sr-22 And Fr-44 Insurance In Florida

In terms of car insurance in Florida, understanding the minimum coverage requirements is essential. Florida’s law forces drivers to carry at least $ 10, 000 in personal injury protection (PIP) and $ 10, 000 in property damage liability (PDL). These covers ensure that your medical expenses and compensation to other properties are included in the event of an accident.

Florida is a no fault state, which means your PIP coverage will pay for your medical bills no matter who caused the accident. This setup aims to reduce the need for litigation and accelerate the claim process, but also affects the cost of insurance in the state.

While the state enforces PIP and PDL, it is advisable to consider the protection of additional liability. Florida law does not require physical injury (Bill) liability but is highly recommended. It pays medical costs, lost wages, and other expenses to the other party if you are to blame in an accident. The recommended minimum is $ 10, 000 per person and $ 20, 000 per crash.

Optional but other important comment is the attention of uninsured motorist (SU). Given that Florida has a high rate of uninsured drivers, UM’s attention protects you if you are in an accident with someone who has no insurance. This comment can also extend to uninsured motorists, ensuring that you are not left with hefty medical bills if the other driver’s insurance is not adequate.

Insurance Group Of Florida, Inc.

In summary, while Florida’s smallest requirements focus on PIP and PDL, expanding your attention to Bill and SU content can provide more comprehensive protection. This approach helps protect your finances and offers peace of mind on the road.

Understanding these requirements is the first step in getting Florida car insurance quotes. With this information, you can tailor your policy to meet legal standards and personal needs, ensuring that you are adequately protected in any situation.

Having car insurance quotes in Florida is easier than you would think, thanks to digital equipment and platforms on -lein. This is how you can achieve the best rates and adapt a policy that suits your needs.

The Internet has simplified the process of obtaining car insurance quotes. Many insurance companies, including Florida are all risk insurance, offer on -lein quotation systems. You can compare rates without leaving your home.

Commercial Auto Insurance Florida: 1 Easy Guide 2025

To get started, visit the insurance company website and complete a simple form. You will need to provide basic information about yourself, your vehicle and your driving history. This process is fast and easy to use, giving you a range of options in minutes.

One of the biggest advantages of using equipment on -lein is the ability to customize your policy. You can choose the types and attention limits that suit your lifestyle and budget. Whether you want a basic coverage or comprehensive plan, digital platforms make it easy to customize your choices.

For example, you may decide to add a comprehensive collision and attention if you lease or fund your car. These covers pay for repairs or replacements if your car is damaged, no matter who is to blame.

Digital equipment goes beyond just getting quotes. Many insurers offer apps and gates on -lein where you can manage your policy, pay bills, and file claims. These tools provide convenience and allows you to keep track of your insurance details effortlessly.

Best Car Insurance For Seniors In Florida (top 10 Companies)

Some companies also offer telematics programs, which use technology to monitor your driving habits. Safe driving can earn you discounts, helping you save money on your premiums.

In conclusion, using on -lein and digital equipment not only makes the car insurance quotes in Florida faster but also allows you to tailor a policy that meets your specific needs. This method ensures that you get the attention you want for a price you can afford.

In terms of determining car insurance rates in Florida, several key factors are played. Understanding these can help you navigate the insurance landscape and possibly reduce your costs.

Your driving record is one of the most significant factors that influence your insurance rates. History of clean driving with no accidents or crime can lead to lower premiums. Conversely, if you have speeding tickets or accidents to blame, expect your rates to be higher. Insurance companies see a spotless record as a sign of responsible driving, which reduces risk.

Best Car Insurance After A Dui In Florida For 2025 (top 10 Companies Ranked)

Where you live in Florida can also affect your insurance costs. Urban areas, such as Miami or Orlando, often have higher rates due to increased traffic and higher accident probability. On the other hand, rural areas may see lower premiums. In addition, areas prone to natural disasters, such as hurricanes, can face higher rates due to higher risk of damage.

The type of vehicle you drive affects your insurance rates as well. Sports cars or luxury vehicles usually cost more to insure because they are expensive to fix or replace. In contrast, vehicles with high security scales or those with advanced safety features may be eligible for discounts. Consider this when buying a vehicle if you want to keep insurance costs down.

Modern vehicles often come with a range of security features that can help reduce your insurance premiums. Features like anti-lock brakes, airbags and electronic stability management can reduce the risk of injury in an accident, making you a less dangerous client for insurers. Some companies even offer discounts for cars with advanced safety technology, such as lane exit alerts and automatic braking systems.

By understanding these factors, you can make informed decisions that could lead to savings on your car insurance policy. Whether it maintains a clean drive record, chooses a safer vehicle, or takes advantage of location -based discounts, each element plays a vital role in determining your insurance costs.

Best Car Insurance In Florida (august 2025)

Car insurance steering can be difficult, especially in Florida where rates tend to be higher than the national average. But don’t worry, there are several strategies you can use to save money on your policy. Let us explore some practical tips.

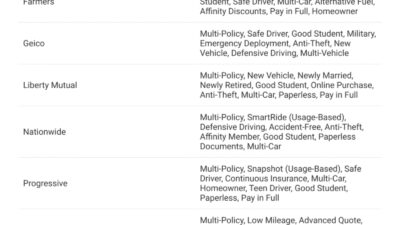

One of the easiest ways to reduce your insurance premium is to take advantage of the discounts available. Many insurers offer discounts to students with good grades, secure drivers, and even for the completion of a protective driving course. Teenagers can also benefit from discounts if they maintain “good student” status. In addition, some companies provide discounts to vehicles that have advanced safety features or for a clean driving record.

Another effective way to save is by bundling your insurance policies. This means buying many types of insurance (such as home and auto) from the same provider. In Florida, bundling can lead to significant savings. For example, new customers who bundle their home and car insurance can save a significant amount on their premiums.

Many insurance companies offer programs that reward safe driving practices. These programs often include installing a device in your car or using a mobile app to track your driving behavior. By showing safe driving, you can earn discounts on your premium. Safe driving rewards can lead to significant savings on your car insurance.

Get Free Auto/car Insurance Quotes In Bonita Springs, Florida

Paying your full insurance premium rather than in monthly installments can also lead to savings. Many insurers offer a discount for pre -payment, as it reduces administrative costs and ensures that they receive the full payment.

Finally, using on -lein tools to get car insurance quotes in Florida can help you find the most competitive rates. At -lein platforms allow you to easily compare different policies and prices, making sure you get the best deal. Also, some companies offer additional discounts for purchasing your policy on -lein.

By driving these tips, you can make your car insurance more affordable while making sure you have the attention you need. Whether through discounts, bundling, or secure driving rewards, there are plenty of ways to cut costs without sacrificing protection.

Florida is often named as one of the most expensive provinces for car insurance. There are a few reasons for this. First, Florida operates under no fault laws, which means that the insurance of each driver contains his own injuries no matter who caused the accident. This can lead to higher insurance claims, increase costs for all.

Cheap Auto Insurance In Florida For 2025 (save Money With These 10 Providers)

In addition, Florida has a high number of uninsured drivers. This increases the risk to insurance companies, leading them to raise premiums to pay for potential losses. The high frequency of accident claims also contributes to the overall cost. With these factors combined, it is easy to see why insurance rates in Florida can be steep.

The cost of car insurance in Florida can vary greatly on the basis of several factors such as your location, driving history, and the type of attention you choose. On average, full coverage insurance in Florida