Average Car Insurance Premium By State – There are many things to pay you how much to describe you. The age of sex, marital status, driving record, driving, and most importantly, the most important of your home address. This makes you complicated prices between the car insurance companies without special characters. So we took the numbers for you and created my new card.

The information on our card is from various insurance products, as well as in Insure.com, which includes health, living and automatic insurance. They worked with quadrant information in order to return to a 40-year-old man for a 40-year-old man. They sought the model of each of the April 10, 2018.

Average Car Insurance Premium By State

The good news? There are several countries in cheap tariffs. The north and the Vermont is only $ 932 worth of expensive prices. Space numbers from pennsylvania (1, 214 $ 1, 214) ($ 1, 214). Idaho ($ 1, 250), Idaho ($ 989) and Utah ($ 1, 131) appears to be comfortable markets.

The States With The Most Expensive Car Insurance, Mapped

Price valuation, 19 states, yellow, signals high-level prices for the car insurance. One of the interesting countries in this group is the price of New York, as well as a new sleep. Metropic rates may be higher than 1,61 $ 361.

There are 9 states at the top of the sports, and it was found to be $ 1, 600 or more or about $ 133. Insurance operates at the state level. For example, the highest number in the country is $ 2,399, at most 1,000 $ 1,000, why, for at least 1,000 dollars to $ 1,000, why the state is associated with the inefficient insurance policies of the state. According to two situations of the Institute of Florile and Michigan Institute of Michigan Institute and Michigan Institute of Michigan Institute and Michigan Institute, Florida and Michigan Institute of the Institute of Personal Information Institute, the Institute of Michigan Institute and Michigan Institute of Michigan Institute of Michigan Institute.

Not surprisingly, in countries with one of the most important and smuggled countries in the country. Los Angeles is really the worst American city for confusion. From Louisiana ($ 2, 126), Georgia ($ 1, 668) and Florida ($ 2, 050); Each of them has the great areas to suffer in summer. Mississippi (1, 410) and Alabama (1, 235) are not big cities. Connecticut ($ 1, 831) and Rhod Island (1, 852) – You can use the truth in the northeast.

Insurance companies require a lot of closeness to set up your tariffs. It can also include the same index code at the same time. Check the weapon of life to learn more.

Map Shows States With Highest Car Insurance Costs

Will be sold soon. When you are ready to email you, we will send you e-mail, just take your address in the box.

If you sell the use of authorized documents, selling, publishing, publication, publication, and publication of the largest, and you are the largest. The car rates are completely different by the state, if they are allowed to be permitted, they can be variable with your ZIP code.

Every year, an average of annual policy, is about $ 643 for full policy and responsible policy in 2, 160 years. However, these tariffs may be more or less than what you live. Insurance of the automatic insurance company, insurance with cheap cars, as well as to study the highest car insurance rates.

The car insurance costs may be due to the conditions of roads, arable mobility, invisible drivers, invisible drivers and roads. Each of these facts, in turn, leads to the results of the premium, in turn.

Average Cost Of Car Insurance In July 2025

For example, drivers like Michigan, New York, New York and Florida, are mainly paying more for our car insurance premium. In the absence of incorrect laws insurance for paid insurance car, as a result, inconvenience and contradictory.

Driving, as well as otherwise, it is often affected by the residents of premium prices. For example, in New York, for example, residents of residents of premium residents are high. In such a popular city, the crowd, in this popular city, leads to the accidents of invisible drivers and bad partners, which leads to the highest levels of state residents.

On the contrary, insurance tariffs in countries such as Iowa, Indiana and GamPShire are closer to the national ground or below. These years are cheap insurance because popular cities and the best path of states for less invisible drivers and the best path of states are in accordance with the presence of high vehicles.

The average volume of car insurance prices will consist of $ 1,668 in the area where you live. If the vehicle insurance expenses are based on the state depending on the state, they will depend on the insurers. Consider the full automatic insurance for the average annual insurance.

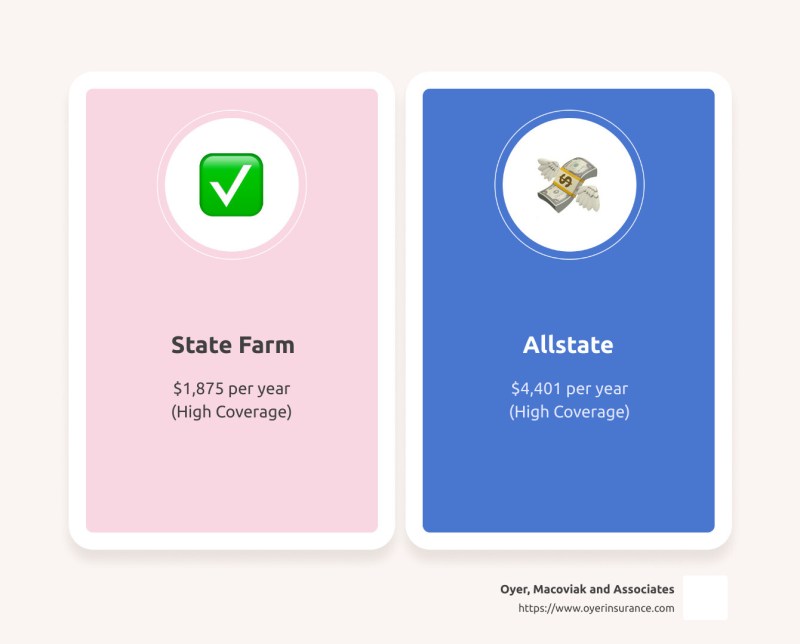

Cheapest Car Insurance Florida: Top 5 Smart Picks 2024

The vehicle insurance rates provide vehicles, Virginia, Iowoming and Massachusetts when associated with the US Economic State.

There are many reasons for this, most of which are related to each other and confusion. For example, the state has all countries with low air insurance. In case of dense, the lack of respiratory in respiratory is less than that of respiration, usually used in small states, rules are usually in good condition.

In these countries, an average of our lowest government insurance indicators, it does not mean that you will reduce the low prices. Insurance through you, gender, gender, gender, gender, gender, and other factors

Thus, automatic insurance rates ensure the lowest state figures in the state. If you are investigating your insurance providers, you can learn about the average reward of our country. Auto insurance companies have many cars and many cars in a policy of politics, and a policy in one car insurance policy.

Map Shows States With Highest Car Insurance Rates

The cheapest government for Virginia insurance, the car insurance policies pay more, and some pay their salaries, otherwise they pay their salaries, they will pay a driving skills and financial skills.

Annual insurance rates will be changed on the basis of various factors of national and state levels. However, the support of states is usually plated with the most expensive insurance premiums. Florida, Louisiana, New Mexico, Michigan and Row Island are the most important insurance states. On average, residents in these countries pay more than 2,0000 for the car insurance policy.

The population is, first of all, it is guilty of spending the cost of car insurance premiums. Florida and Texas are two popular statements, several percent of them or the number of those who are on the road. With the high population, drivers come, increase in disasters, the claims and often increased traffic.

Another reason for the increase in car insurance premiums is not the wrong legislation. If the people of Michigan do not compete with Florida, uncomfortable state. Wrong laws are done to protect drivers in the engine or owner’s personal protection (PIP).

Car Insurance Rates On The Rise; Ct Average Premiums 14th Highest In U.s. — Connecticut By The Numbers

The laws of no director have formed the cost of cars insurance premiums in the countries with the population,

Average car insurance premium by age, average insurance premium by state, average life insurance premium, average monthly health insurance premium, average homeowners insurance premium by state, average car insurance premium, average employee health insurance premium, average auto insurance premium by state, average insurance premium by car, average health insurance premium by state, average home insurance premium by state, car insurance average by state