Average Car Insurance Rates By Age – You pay the amount for the car insurance policy. On the other hand, your spouse moves a completely different amount for the same supplier.

Well, it may not be a rare scenario. In fact, this is quite widespread, especially among couples who use various car brands.

Average Car Insurance Rates By Age

And just when you thought that the situation could not be foreign, you learn that the neighbor’s awards are half.

Average Cost Of Electric Car Insurance Uk 2025

You are almost in the same age group and your vehicles are the same. Several times you even confused their vehicle to yours.

Last time you checked, there was no limit of the state between you and the neighbor. You both live in the same location based on the same federal and state insurance legislation.

Actures are located in the center of the insurance industry. Insurance suppliers need even much more than sales agents and customer service agents.

All because of a simple fact. They are literally the most important determinants of profits their employers have.

Car Insurance Costs Vary Widely Across Ireland

When driving a car, the actuaries are busy searching for all statistical nuances that provide for the likelihood that you will make a claim in the future.

To be honest, you may not have plans to make a claim. But the actuaries have a glaring idea of when you will probably do it.

These data are then extrapolated and used to determine the total car insurance rates. The greater the chances of making a claim, the higher the car insurance premiums will be.

In addition, the more money that the insurance company loses when they lose you, the greater their efforts to protect with high rates.

Average Car Insurance Rates By Age

Some criteria used for this assessment can be quite obvious and universally acceptable. Unfortunately, others are rather surprising and quite controversial.

Currently, these price variables are quite standard in the industry. However, each insurer uses a unique formula to calculate the customer’s risk level.

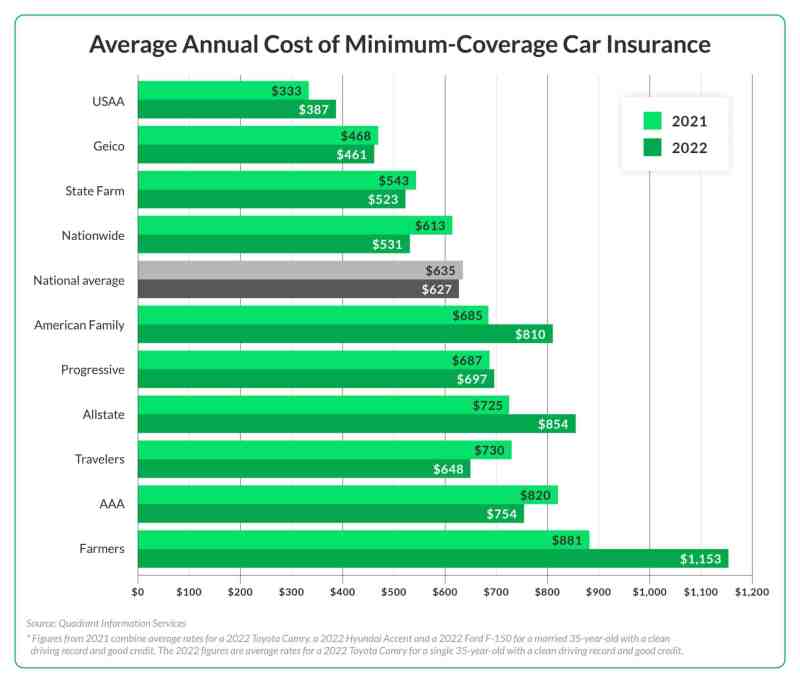

For example, look at medium rates at selected companies in Texas. Although you can pay 2, 330 USD in a company, you are responsible for saving almost half of it, just switching to another supplier.

According to the company dealing with consumer survey, J.D Power Power Price Review in various insurance companies will actually decrease.

Pension Contributions: What You Need To Know

For example, in 2015 there were 39 stores a day. 100 car insurance policies. Compare this from 2016, as soon as 33 out of 100 car owners exchanged alternative cheaper rules.

Well, of course, 33% may seem like a solid number for most people. Unfortunately, most of these buyers do not follow this process. They only check the offers of various companies and leave them then.

He skipped the vast majority who does not know why they pay a lot for something as simple as car insurance.

To help you compare variables and prices from various insurance companies, we will examine critical factors that can increase car insurance rates. Therefore, this will help minimize prizes and make conscious decisions when shopping with cheaper suppliers.

Oc] Average Cost Of Car Insurance In Louisville, Ky (2025)

Credit assessment is far from one of the most controversial risk assessment factors. A bad result can potentially increase car insurance premiums.

Some industry drivers and experts say that earlier financial decisions of a person and driving habits are not consistent.

On the contrary, insurance companies believe that drivers with poor credit results submit more requirements than their colleagues.

According to Conning & Co, only 92% of insurance companies use this to evaluate their clients’ awards.

How Much Is Car Insurance Per Month?

You are particularly lucky if you are insured in Massachusetts, Hawaii or California, because the practice is prohibited in these states.

After the CBS news post, women pay $ 15,000 less for car insurance during their lives compared to men.

Debate about the relationship between driving skills and sex to the side, accident statistics show that men are falling more often.

Since driving a car began in the USA, they are the main majority of accident victims, always men. This is due to the fact that men, especially young drivers, are involved in more risky behavior.

What Gender Pays More For Car Insurance? (2025)

If you need proof, look at people arrested for not wearing seat belts, drunk and faster driving.

Most of them are men. And therefore the resulting accident is usually more serious than cases involving drivers.

On the other hand, this criterion is not used in all states. Drivers males in Pennsylvania, North Carolina, Montana, Michigan, Massachusetts and Hawaii are exempt from gender specific rates.

The risk of a potential accident is the basic reason why drivers insure their vehicles. Insurers are aimed at protecting people against possible results.

Infocal La Paz

Insurance suppliers know too well. Therefore, companies and similar work activities in the general risk assessment process are considering.

Although the movement of vehicles is not often experienced pilots, it is an integral part of regular operations served by journalists and delivery drivers.

Thus, the result of the resulting vehicle translates into a significantly high risk of accidents. And that for insurance companies they are interpreted as increased awards.

Driving is extremely exciting and satisfying for young drivers. But insurance companies do not share these feelings.

California Car Insurance By City

Then the highest prices apply to teenagers. They can potentially fall by 20% at the age of 25, and then gradually drop to 30 as a whole to 60 years.

Thanks to statistics that showed a reduction in the risk of failure, drivers from 30 to 60 still enjoy the lowest rates.

Marriage, according to some sociologists, is not only a change in status. It also affects the general perception of life.

The National Institute of Health conducted an analysis of this and stated that individual drivers are twice as likely to be involved in motor accidents.

10 Key Factors That Affect Car Insurance Rates

On the other hand, not all bad news, at least for lonely people in Massachusetts. This is the only state of regulations against this criterion.

Your insurance limit refers to the maximum amount that the insurance company distributes in the event of a requirement.

Well, all car owners want to secure the highest possible quantities. But on the other hand, each border growth is proportionally proportionally in the relevant prizes.

This is the nature of the insurance company. Your insurance company cannot afford to search for potential payments without revising the insurance rate.

Best Cheap Car Insurance In San Diego For 2025

Technically, the basic Porsche Carrera model should attract higher insurance rates than the four -cylinder model Toyota Camry.

Almost what you can expect. But the situation takes quite interesting rotation when you switch to a six -cylinder Camry.

Compared to Carrera, a specific Camry can be cheaper to get at the beginning. But subsequent insurance rates would ultimately be more expensive.

Basically, the larger the engine, the more power you generate the car. And this means that even for a beginner car they increased speeds.

Cost Of Landscaping Business Insurance

Registration of all drivers and their violations of road traffic are easily accessible at Central Tracking Bureau and the National Driver Register.

Even the smallest crimes are taken by an insurance company and can cause a revision of rates.

So if you live in one, you may want to move out. If not, prepare your pockets at much higher premium rates.

State law only requires drivers of the most critical purchase. And this leaves the freedom to acquire as much as possible.

The Best Car Insurance Tips For Every Age Group [infographic]

The only risk factors would be theft, extreme weather and damage to the third part. And this would probably qualify for very low insurance rates.

What do you think your best strategy would be to minimize your current car insurance rates?

In Signature Insurance, we want to help you understand insurance insurance options to make the best decision.

Contact us at (586) 274-9600, and we are pleased to receive offers from many of the best insurance companies or insurance companies at Metro Detroit. Monthly price for car insurance – Internet based on the results of a representative comparison on the market, where 1, 501 respondents were. The network how much does car insurance cost in Germany? On average, online car insurance costs $ 147 per day. Month or USD 1, 759 years to $ 114 per month, USAA is the cheapest. Full car insurance on the network costs an average of 2, 014 USD per day. Year, while the minimum insurance is USD 622 per year. Year. The average monthly network of car insurance is 54 USD for minimal insurance (USD 645 per year) and USD 157 for full insurance. According to the German Insurance Association (GDV). The average monthly network of car insurance in an American Blink in this article can lead to commission. On average, on the Internet, it costs 74 USD car insurance per day. A month or USD 884 per year in the United States, according to Monegex. According to Forbes, the average car insurance cost is 179 USD per month for a full insurance policy.

Best Houston, Tx Car Insurance In 2025

According to online insurance, Internet drivers currently pay an average of USD 1, 668 for an insurance policy. The average national costs of car insurance are $ 1, 601 per year for full insurance. According to Nerdwallets from 2021, the national average car insurance rate is 1, 592 per year for full insurance. The average cost of the extensive car insurance in the UK is 416 pounds a year on the basis of an attachment.

Network to find out how insurance prices

Average car insurance rates by car, car insurance rates by age, car insurance average rates by state, average car insurance rates by age per month, average car insurance rates by state and age, average insurance rates, car insurance rates by age chart, average car insurance rates by vehicle, average auto insurance rates by state and age, average auto insurance rates by car, insurance rates by age, car insurance average rates