Average Car Insurance Singapore – Here you need to know to find the best insurance for your car: We help you understand words such as types of coverage, NCD and additional as they affect your premium and more.

In Singapore, a car under your name is a must -have law enforcement. There are 3 types of car insurance plans that you can choose: only a third party, a third person, a fire and stealing and comprehensive car insurance.

Average Car Insurance Singapore

TPO provides the most basic insurance coverage and minimal required in Singapore. It covers only affected third parties and/or commitments.

Renters Pay Up To 11% More Than Homeowners For Car Insurance

TPFT provides additional coating at the top of origin covered with TPO. With TPFT your car will be covered with any damage or damage from the fire and theft.

A comprehensive car insurance is a scheme all included that includes you, your vehicles, passengers and your commitments in minor and serious accidents.

These are three car insurance conditions that every driver should know. They can greatly affect your annual premium, it depends on how you set up your policy.

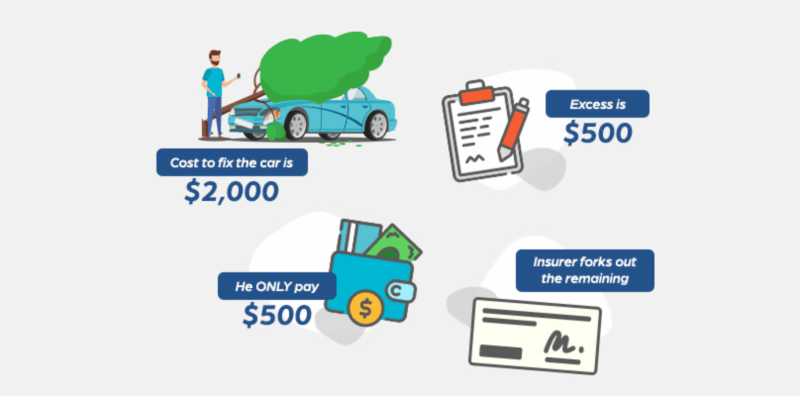

If you choose the car insurance, there is an additional amount paid from your own pocket, for the loss before the insurer covers the rest. You can customize extra debt.

Life In Singapore Is Becoming Affordable Again

Adam hovering the pie on the way to work. The tree suddenly falls in front of it. Inadvertently, it crashes into it, and the cost of fixing the car is $ 2,000. Fortunately, its additional $ 500. Therefore, it pays only $ 500, and the insurer removes the rest.

1. More “yourself”: This only applies to your car. It does not participate in third -party losses.

2. Excess in the “third side”: This concerns the harm done by an additional third person. You may need to pay it at the top of the extra loss.

3. Excess In “All Claims”: This refers to the total amount paid for each additional accident, no matter what additional coverage.

T-bill Yield Rebounds To 3.66%. What’s Driving The Bounce?

Usually the choice for higher supplements helps the car insurance. However, with a low payment of insurance you are exposed to the street.

This discount urges drivers to practice safe driving. You earn a 10% discount for each year you require up to 50%.

NCD is not necessarily violated by the requirements until the driver’s liability exceeds 20% under responsibility (Bola) agreement. If so, their NCD can reduce 10% or more.

Some drivers pay an extra fee for NCD Yojana guard. This allows them to make claims and still support their NCD privileges.

Ultimate Guide: Car Ownership In Singapore

Your NCD also moves from one car to another. Even if your car is scored, you can support your NCD at least 12 months. On the other hand, if you own two cars, your second car can’t enjoy the privileges of NCD, similar to the first car.

Drivers designed by insurers to driving a car are recognized. They are covered by the insurance policy of the main owner and are eligible for equal privileges/protection.

Family members are often added as a nominated driver to maintain financial risks. Should an anonymous driver get into an accident when using the car, the insurer can more put on your claim.

The insurance premium varies from the driver to the driver. In general, the higher the alleged risk of the accident, the higher the car insurance.

Economical Insurance For Home & Car

1

2. Automobile Age – Car Insurance Cutors Usually With Your Age Age

3.

4. Business – External work shows that you will use your car more often and present a high risk of accident. This can translate to a high premium

How Much Does Small Business Insurance Cost? (2023)

5. Family Status – Insurers can reduce the car premium if you have a family you can see

6. Year of driving – drivers with experience less than four years will have to pay an insurance premium for high car

7. Types Private Insate Premium Type Private Towards Than Private Vehicles

8. Claims on History at the wheel of the accident – “Payment” applies when you have stated the requirement above $ 10,000 or made two or more requirements over the last three years.

Grab And Uber Cost Less Than Owning A Car In Singapore

9. There are no claims if you are applying for a certain number of years, you will be awarded update discounts. Get more information about NCD here.

10. Honesty and integrity – dishonesty regarding your management history may cost you a high premium if false information is provided

11. Amendment to the LTA-Non-Non-Non-Coating Cap that will increase the premium price

• Put in a police report for victims and launched accidents, a conflict with vehicles registered

Car Insurance Information & Coverage Guide

Some common errors were made here when making requirements for car insurance. Avoid their rapid processing of your claim and pay your payment on time.

1. Failure to comply with the proper claim over 24 hours MOS should be described within 24 hours and submitted according to it. Otherwise your claims may be zero. You may also need to send your vehicle to check on a specific time scale.

2. Don’t contact the insurer if an accident happens, your insurer should go to you. They will redirect you to the hotline, if any, and advise you to go to the master classes.

3. Acceptance to error or responsibility – agrees to make or give personal proposals to a settlement means accepting. The involvement party can use it against you to take responsibility from the accident.

Average Cost Of Car Insurance

4. The whole picture does not receive – the less detail you have noted, the less the likelihood of your claims, they will be quickly approved. Here you need to pay attention to the car accident

5. Introducing poorly documented evidence – usually the insurer uses footage from the car camera to connect the story together. If you do not have a car camera to submit as evidence, you will need many images of different angles. Try to get a good mixture of close, medium and wide shots.

6. To translate the vehicle too much – it affects your evidence documentation, as you can skip important details and this gives the other side the opportunity to challenge your requirements. Look for a witness if necessary.

7. Visiting an unauthorized workshop – Usually the insurer uses footage from the car camera to connect the story together. If you do not have a car camera to submit as evidence, you will need many images of different angles. Try to get a good mixture of close, medium and wide shots.

Why Do We Need Insurance Agent??

This is not more often, the best car insurance does not mean the cheapest car insurance. Here are some best car insurance for different needs and love:

No discount with the requirements – what is it and how does it affect me? What you need to look to share an online car in Singapore: Let’s talk about drivers who buy car drivers buys a car drivers and use a car in Singapore, understand the types of car insurance in Singapore when someone has a check -in? Why did the car dealers use love guarantees

Do not think that emergency assistance is easily accessible in the case of car accidents. Some insurers do not provide emergency assistance 24-hour and settled emergency unauthorized services, may complicate your requirements.

No, your climate discount (NCD) will not be canceled immediately if you get into an accident. If the accident is not your fault, you can still support your NCD privileges.

Why Your Electric Car Needs Ev Car Insurance

No, your NCD is not necessarily less than one claim. Usually the requirement within your policy reduces NCD by 30%. However, some insurers have additions to protect your NCD in such events.

Revised vehicles can be insured, but mostly include additional fees. Any modifications of vehicles when switching insurer or your insurer can cancel a policy or reject your claim.

Insurancelers use coverage/preference or even loss of the politeness car only if it is included in your insurance plan. It also depends on the downtime and the severity of the disadvantages.

Not all accidents should be announced, but this is subject to your insurer. Some insurers do not need to announce accidents where they don’t make mistakes.

Global Insurance Market Trends 2024

The number one car is classified to buy cars such as a sports car, hybrid car, COE, OPC, Hatchback, Stationwagan, MPV, SUV, Fargon, truck and parallel imported cars. Buy new car dealers, parallel imports, car auctions, etc. Also useful products and services such as audio car, cars, solar film, car goods, car spare parts, car repair, car workshop, car building Bodikit, car tires, sports disks, car mat, car stickers, engine and car insurance. See prices for our car blog and coe. Learn about car rental rental rental, long -term lease, private higher cars, wedding cars and cars. You know how much you know

Singapore iq average, average rainfall in singapore, singapore average hotel price, singapore average income, average wage singapore, average temperatures singapore, average life expectancy singapore, average car insurance ma, average rent singapore, insurance car singapore, singapore average, average bra size singapore