Average Homeowners Insurance By State – If you are looking for a way to save money now, you may start by looking at the money you spend each year in home insurance. According to our last maple, home-home insurance cost depends entirely on your position.

We have found the data for the map of insurance.com, a price sites. There are some considerations behind the data on the map. Imagine a couple who had a good debt wanted to guarantee a $ 300, a single political feature, such as $ 1,000 per 5,000 per 5,000 people a month. We have set the annual insurance per minimum per state, then have developed a color-based map or more of each state price due to national average. This allows you to find relatives and the total number of home-home insurance.

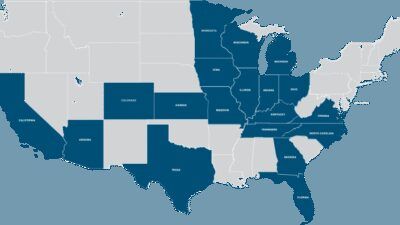

Average Homeowners Insurance By State

There are two interesting perspectives on the homeowner market on the map. First, the most expensive state is found in the south following Mexico and disperse in Tornado Alley. Oklahoma is the most expensive state in the country at $ 4, 445 a year, or 92.8% higher. If you have drawn a straight line from Montana to Florida, all state has more than average. This is because the geography is the largest identifier of natural disasters such as hurricanes, tour, and porch, which tend to damage to property and insurance.

States With The Least & Most Expensive Homeowners Insurance

Another interesting vision is how to insure homeowners will be cheaper to both sides. Vermont is the most expensive to northeast of $ 1, 212, or slightly more than $ 100 a month. And look at California, which contains about $ 1, 166. Remember, we considered the value of $ 300 $, and to come to these numbers, causing it to apple apples. We know that $ 300k is $ 300k to go more in some states instead of others.

But this is the most important thing to remember about homeowners insurance: protects from specific things or dangers, just like fire and drugs. Most of the current security policies of the market does not offer coverage for earthquake or flooding. These types of natural disasters will completely destroy the insurance and insurance industry. This is why other separate insurance policies are available in California, which is selling the commandment of the earthquake in some residents and requires new homes. The company will not present this kind of protection without the law required.

If you are trying to buy a house, even trying to save money on your budget, see our home insurance guidelines. And if you are still a reenter, see the insurance guidelines for our mother.

The commercial insurance company via direct Premium in 2020 Top 10 U.S. The cost of blocking state by U.S. Reoms Care payment due to COVID-19 (interact map) COVIZY COVEN COVENS COVID – There are undoubtedly one thing, but it is undoubtedly an important person who is undoubtedly the importance of buying insurance. But how much does it cost, and what is the main feature of the market?

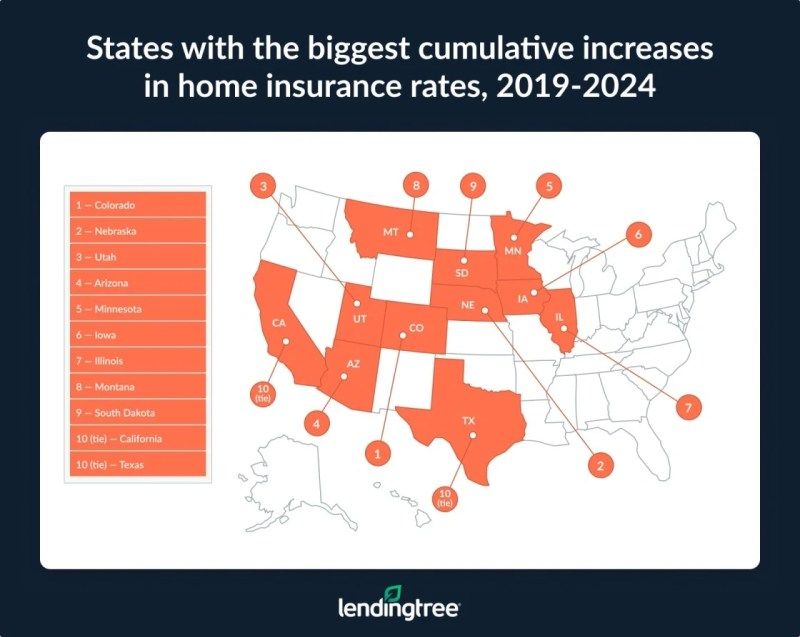

Homeowners Insurance Will Rise 8% Nationwide, Following Double-digit Increases In The Past Two Years.

We have gathered our needs from insurance.com, a website that raises consumers and develop direct contact with all their customers and get the right insurance in their current needs.

Color each state according to medium of moderate insurance. The red Kingdom is the most expensive, most expensive, worth $ 4, 000 / year, and dark blue state is the easiest of $ 1, 300 / year. The map here makes the geographical and weather conditions based on the home insurance cost.

Let’s get back to one second and surely we cover the foundation. Home insurance covers the value of all the house system and everything in it. Federal home loan requires buying insurance – if there is fire and burning homelessness, the lender is left without asset. Many people do not realize that insurance insurance is different from flood insurance and earthquake insurance. Complex market with various factors.

With everything mentioned, the hard weather has a direct impact on a home insurance price. The least expensive state for home insurance is in the middle of the Pacific Sea – just $ 703 in the Hawaii. The area of the top of the sky is Florida, which is the $ 6, 892 to ensure a building. Hurricane is a clear explanation of disagreements between the two states. Hawaii was almost worse, and only a few hurricanes hit the island in the last 70 years. Florida, on the other hand, is longer than any other government. The Miami’s Mascot University is – to announce: The hurricane.

What Californians Are Paying For Home Insurance In Every Zip Code

Let’s different difference between Hawaii and Florida in logical conclusions. A homeowner in Florida will pay $ 6, 189 a year. Think about the price for the 30-year-old loan: the middle floridian will fall over $ 185K than just a person in Hawaii. According to Zillow, nearly the price to buy a house in the first place.

It is not surprising that the state of Mexico’s Gulf has the highest tax insurance in the country. Louisiana is the most expensive for $ 6, 115, and Alabama is the third prick for $ 4, 532. The two kingdoms were a lot of memory than a hurricane. The red bands hang up around the Gulf of the views of the dark blue states on the northwest, where the harsh weather is never available. Things are cheaply across the upper middle and the east.

To put it simply, our great track of the map of the home insurance map is the price of a price is easier than Mexico’s thirst. The landlord can pay more in insurance, depending on where they are. Today Mark Twain may say: “Get me to Florida.”

The commercial insurance company via direct Premium in 2020 Top 10 U.S. The cost of blocking state by U.S. Reoms Care payment due to COVID-19 (interact map) Photographs of Colomb-19 on the other side, the best carrier, the customer service, and the offering of the danger. And on the other hand, the competition rate should not damage the budget. This is the last time this is the price of a home insurance for all state 2020.

What Is The Average Cost Of Homeowners Insurance In The Us?

For most people, their home is their greatest possession. The only way of the family of a financial home from a lost house of natural disasters is if it is safe. Home insurance is essential to financial security. We have found average average for 2020 in all the states in Valupenpensin, financial education website and comparison site. Seeing all the state of all the country in the country allows you to see if you get a good responsibility for a large part of your own money.

The state of the Tornado Alley has the highest home insurance rate in the country. Oklahoma stands as expensive, log in to $ 2, 559 of average average. The Kansas and Texas have the high rate and $ 2, 461 and $ 2, 451, individually. These kingdoms are not Triarchado more often than else, but they tend to be stronger and strengthens, stop F3-5. For example, Oklahoma City was only affected by two or more days. These reasons tend to make home insurance to be more expensive.

At the end of the space of the space, there are minorities that are less than $ 1, 000 average of average. Most of these places are mixed in the northeastern, like Vermont ($ 614), New Hampshire ($ 773) and Maine ($ 849). Delaware is proud to be the easiest rate in the country for $ 598, or around $ 50 a month. That’s what

Average state farm homeowners insurance, average homeowners insurance premium by state, average homeowners insurance colorado, average annual homeowners insurance, average yearly homeowners insurance, usaa homeowners insurance average cost, average homeowners insurance washington state, average cost of homeowners insurance by state, average monthly homeowners insurance, average homeowners insurance massachusetts, average homeowners insurance per month, average homeowners insurance rates by state