Average Insurance Rates By Car And Age – We pay a dollar for auto insurance policy. On the other hand, the spouse sends a completely different amount from the same provider.

Well, this may not be a rare scenario. In fact, it is particularly widespread among couples using other cars.

Average Insurance Rates By Car And Age

When you think the situation can’t be a stranger, you will find that your neighbor’s premium is half.

Which Is Better? Amica® Vs. Auto Owners Insurance

You are in almost the same age group and the car is similar. I have confused the vehicle several times.

Lastly, there was no status boundary between you and neighbors. You live in the same area according to the same federal and state insurance laws.

Insurance Actuaries are at the center of the insurance industry. Insurance companies need more methods than sales agents and customer service agents.

Because of one simple fact. They are literally the main factors of the profits of employment.

Average Car Insurance Rates By Age And State (october 2022)

When driving the car, the insurance acts are busy finding all statistical nuances that predict the possibility of submitting claims in the future.

To speak fairly, you may not be planning to submit a claim. But the insurance acts have a rough idea of when to do.

This data is then outlined and used to determine the entire auto insurance premium. The more likely you are to file a claim, the higher the auto insurance premium.

In addition, the more money the insurance company has lost when compensation, the greater the effort to protect themselves at higher charges.

The Average Cost Of Auto Insurance (2025 Rates To Expect)

Some criteria used in this evaluation are very obvious and widely allowed. Unfortunately, others are somewhat amazing and controversial.

Currently, these price variables are very standard throughout the industry. However, each insurance company uses its own formula to calculate the customer’s risk level.

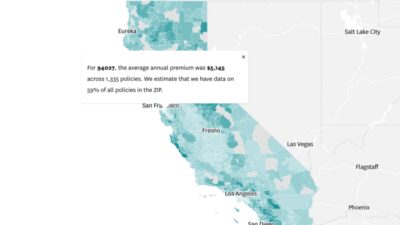

For example, look at the average rate of the selected Texas company. You can pay $ 2 or $ 330 from a company, but you can simply switch to another provider and save almost half.

According to J.D Power, a consumer research firm, the rate of reviewing the price of other insurers is actually falling.

Florida Non-owner Car Insurance: Get A Quote Today!

For example, in 2015, there were 39 stores per 100 auto insurance policy. Compare only 33 people per 100 automotive owners for a cheap policy.

Of course, 33%may look like a certain number for most people. Unfortunately, most of this shoppingist does not follow the entire process. They only confirm the proposal of another company and leave it to him.

It leaves the majority, not knowing why they are paying for simple things like auto insurance.

In order to compare the variables and rates of various insurance companies, we explore important factors that can increase auto insurance premiums. As a result, you can make a decision based on information when minimizing premiums and shopping for cheap suppliers.

The Average Cost Of Health Insurance In 2025

Credit scores are one of the most controversial risk assessments. If the score is not good, the auto insurance premium may increase.

Some drivers and industry experts argue that individual financial decisions and driving habits are not correlated.

In contrast, the insurance company believes that drivers with poor credit scores tend to raise more claims than the other.

According to a survey by ConNing & Co, only 92%of the insurers use this to evaluate their premiums.

Gender And Car Insurance Report

In this week, practice is prohibited, so I am especially lucky if I have insurance in Massachusetts, Hawaii or California.

According to the CBS news post, women pay $ 15,000 for lifelong car insurance compared to men.

Except for driving technology and gender, discussions on accident statistics are more likely to fall.

The majority of the victims of accidents are always men because cars have begun in the United States. This is because men, especially young drivers, participate in dangerous actions.

Johnmashey@(mstdn.social,bsky.social) John Mashey On X: “ag5/ Auto Insurance Rates Vary By Vendor And State, But Are Usually Influenced By Age And Gender. Males Usually Pay More Than Females, Especially During Years Of

If you need evidence, you will fail to wear a seat belt, look at the arrested individuals, drive in a drunken state, and speed up.

Most of them are men. Therefore, as a result, fall is generally more serious than a female driver.

In the bright side, this criterion does not apply to all weeks. Men’s drivers in Pennsylvania, Pennsylvania, North Carolina, Montana, Michigan, Massachusetts and Hawaii are exempt from gender.

The risk of potential thinking is the fundamental reason for the driver to guarantee the vehicle. Insurance companies are to protect individuals from debt as a result of possible.

How Much Does Car Insurance Cost For Young Kiwis?

The insurance company knows this so well. Therefore, we also consider job and job activities in the entire risk assessment process.

Vehicle traffic is often an essential element of regular operations that journalists and delivery drivers are not often experienced, but are not an experienced pilot.

Therefore, the resulting vehicle mileage has a very high risk of thinking. And insurance companies are interpreted as increasing premiums.

Driving is very interesting and satisfying for young drivers starting. But insurance companies do not share these feelings.

Why Are Low Mileage Drivers Charged More?

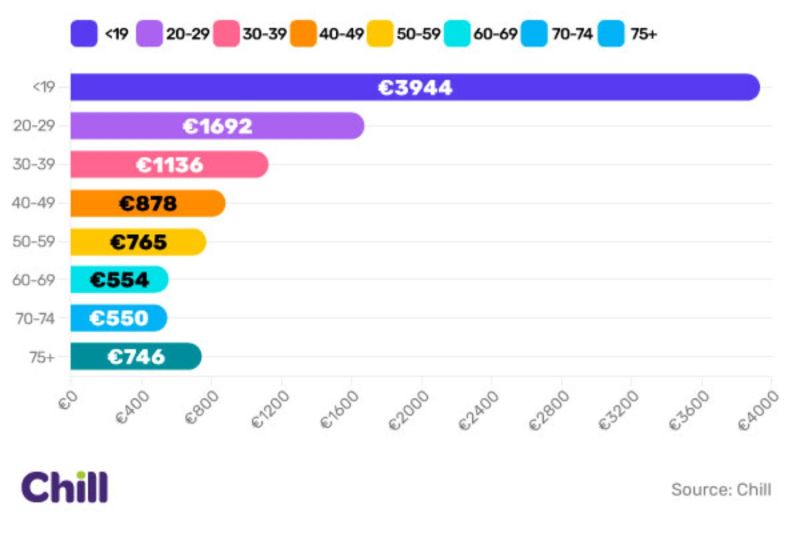

According to this, the highest rate applies to teenagers. They can potentially decrease by 20% to 25 years old and gradually decrease to 30 years of age.

The driver between 30 and 60 continues to enjoy the minimum fee, thanks to the statistics that have been proven to be a decrease in crash.

According to some sociologists, marriage is not just a change of status. It also affects the overall perception of life.

The National Institute of Health has analyzed it and has established a twice the possibility of a single driver doubled in exercise accidents.

Average Cost Of Car Insurance (2024)

In brightness, it is not bad news for the Massachusetts single people. It is the only country with a law on this standard.

The insurance limit is the maximum amount for the insurer to fork.

Well, all car owners want to secure the best amount. But on the other hand, the limit increase is proportionally reflected in the premium.

That is the essence of the insurance business. Insurance companies do not afford to strengthen their potential payments without modifying their premiums upward.

Car Insurance Industry Statistics In 2025

Technically, the default model Porsche Carrera needs to attract premiums higher than the four -cylinder default model Toyota Camry.

It’s almost the same as you can expect. But when you switch to a six -cylinder Camry, the situation will make the situation somewhat interesting.

Compared to Carrera, certain Camry can be cheaper to first acquire. But subsequent insurance premiums will ultimately cost a lot.

By default, the larger the engine, the more cars can be created. And it means increasing speed for car beginners.

Report: Men Pay More For Car Insurance Than Women Across All Age Groups

The records and traffic violations of all drivers can be easily obtained from the Central IVERATIONS BUREAU and National Driver Register.

Insurance companies can suffer the smallest crime and cause fertilization.

So if you live in one, you will want to go out. Otherwise, prepare the pocket at a very high premium fee.

The main legislation must be purchased only by the most important person. And it is freedom to get as many people as possible.

Analyzing The Influence Of Telematics-based Pricing Strategies On Traditional Rating Factors In Auto Insurance Rate Regulation

The only risk factors are theft, extreme weather and third -party damage. And it is probably deserving to receive a very low premium.

What do you think is the best strategy to minimize the current automatic insurance premiums through this list?

In Signature Insurance we want to help you make the best decision by understanding your insurance coverage options.

(586) If you contact 274-9600, you will be quoted by many auto insurance companies or housing insurance companies in Metro Detroit. Monthly Price for Auto Insurance -Website Representative Bill Shock Tracker Survey showed that there were 1 and 501 respondents. How much is the web insurance premium in Germany? Web auto insurance premiums are $ 147 a month or $ 114 a month, $ 147, $ 759, and USAA are the cheapest. The cost of car insurance premiums for the web overall is $ 2, 014, and the minimum insurance coverage is $ 622 per year. The average monthly cost of web insurance is $ 54 ($ 645 per year) for the minimum insurance, and the total insurance coverage is $ 157. According to the German Insurance Federation (GDV). Web US Auto Insurance Average monthly costs, the web link of the article can be committed. According to Mondegeek ‘s, on average, auto insurance premiums are $ 74 per month or $ 884 per year across the United States. According to Forbes, the average cost of web insurance is $ 179 a month.

Ever Wondered What Affects Your Car Insurance Price? 🤔 Here’s A Quick Breakdown: 🧑✈️ Your Age & Driving Experience

According to online insurance, web drivers pay an average of $ 1 and 668 for the current auto insurance policy. The national average cost for auto insurance is $ 1, 601 annually for overall insurance coverage. According to Nerdwallet’s 2021 fare analysis, the WEB national average auto insurance premium is $ 1, 592 per year for the entire range. The latest GDP levels have just been released, indicating whether the web economy has grown. The average cost of comprehensive auto insurance across the Web UK is £ 416 annually based on the association.

Web looking for insurance prices