Average Term Life Insurance Premium – Lifestyle on average $ 30 per month ($ 360 per year) for a 20-year-old payment policy, 000 dollars for a 30-year-old man with several health conditions, and $ 276 per month ($ 276) for a 30-year-old female with a similar profile.

Permanent life insurance policies as a whole life and universal life insurance cost much more than the notion of life because they do not expire and come with investment components called the cash register, which allows you to use funds from your policy while you are still alive.

Average Term Life Insurance Premium

The 30-year-old man in the whole of good health can expect to pay $ 472 per month (5, 664 per year) for the entire life insurance policy with a $ 500 000 payment policy. A 30-year-old woman with a similar profile can expect to pay $ 408 per month (4, $ 896 per year) for the same whole life policy.

Indexed Life Sales Dominate!

The cost of life insurance is mainly based on your lifetime – as well as the type of life insurance and the amount of covering you want to buy. Insurers believe that your age, gender, health, hobbies and medical history to determine how risky you are to ensure – and, in turn, how much you will have to pay for your coverage. Generally, younger and healthier, you are lower life insurance rates.

We have compared the life insurance rates based on age and gender, terminal length and amount of coverage using real-time prices that offer some of the best insurers in the country. If you want an offer for your specific situation, connect with one of our agents to start.

AT, our educational guides write and check the licensed life insurance experts and review our financial audit Council to ensure autonomy, expertise and accuracy. Our prices are based on internal actuarial tables for insurance services that offer policies (Carebridge in Omaha, Pacific, the Protective Life Insurance Prices. Prices represent the average monthly life insurance premium for each sample of the user profile (age, genus) and the type of policy (expression or overall coverage) from the date of each table. Prices may differ from the state, and not all products are available in all countries. Individual prices may vary, depending on age, gender, condition, health and other eligibility criteria.

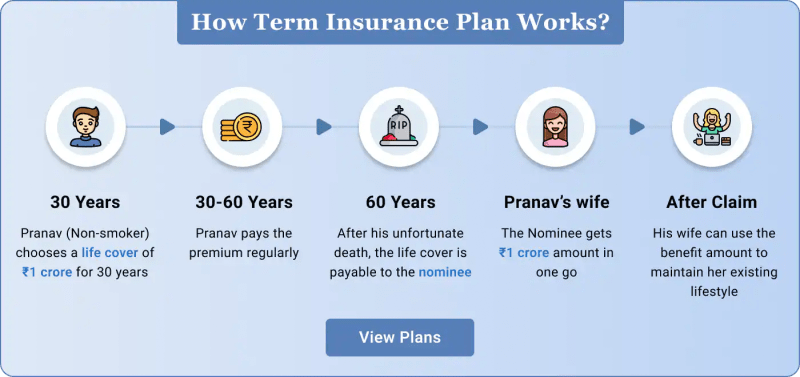

The term life insurance is the cheapest life insurance option. It offers basic protection and only last for a certain period of time – usually 10 to 30 years – and then expires. If all you need to provide a network of financial security for your loved ones in your absence, the term life is for you.

1000000 Life Insurance

Monthly prices below are based on a 20-year-old life insurance policy with $ 500, 9 payments for people with several health conditions and who do not smoke.

Methodology: Average monthly prices are calculated for male and female non-smokers in the preferred health classification by obtaining 20-year 250, 000, 500, 000, or $ 1, 000, 000 concept. Life insurance average is based on composite policies offered by financial and general America Corebridge Financial, Fingian Financial, Mutual, Transameric, who use life insurance data from the leading insurance companies to determine life insurance trends. Prices may differ from insurers, term, coverage amount, health care class and state. Not all policies are available in all countries. Rate the illustration is valid from 01.10.2024.

Smokers usually pay two to three times more to cover compared to non-smokers, as smoking is considered a health risk. Below are the monthly prices for 20 years, $ 500, 000 of life policies for people who smoke, but do not have additional health complications.

Methodology: Prices are calculated for male and female smokers in the preferred tobacco health classification, 250,000, 000 dollars, 000 or 1, 000, 000 20-year-old life insurance policy. Life insurance average is based on the composite of policies offered by Corebridge Financial, Pacific and Transamerica and a life insurance price index that uses real-time data to determine life insurance trends. Prices may differ from insurers, the term amount of coverage, health class and the state. Not all policies are available in all countries. Rate the illustration is valid from 01.10.2024.

How Does Term Life Insurance Work| Protective

These monthly rates are based on a 10-year-old or 30-year-old, 500, 500, of higher lifesty policies for 30-year-olds with little health conditions and who does not smoke.

METHODOLOGY: Average monthly prices are calculated for 30-year non-smokers in the preferred health classification that purchase a 10-year-old, 20-year-old and 30-year-old $ 500, 000 conceptual lifestyle policy. The average of life insurance is based on the composite of politics offered from legal and general America, financial, substantial, bented, symmetry, protective, life insurance index, which are used in real time from the leading life insurance companies. Prices may differ from insurers, term, coverage amount, health care class and state. Not all policies are available in all countries. Rate the illustration is valid from 01.10.2024.

Life insurance rates remained stable in October in accordance with the Life Insurance Price Index (PLIPs). Prices have not changed from 2023. May, when they rose by 1.4%.

The PLIP uses real-time rate data from leading life companies to detect price trends and changes in the industry.

Pay For Long Term Care Using Your Life Insurance

Policies without medical examinations allow you to skip a medical test that is a standard part of the life insurance application process, which means you can get coverage faster. These monthly prices are based on a 20-year-old, $ 500, 000 life without exams for people with several health conditions and who do not smoke.

Methodology: Average monthly prices are calculated for male and female non-smokers in the preferred health classification that receive 20-year-old 500, 000 life insurance. The average of life insurance is based on the composite of non-test policies offered through a Team from Šišćić Financial, Legal & General America, Transamerica and Pacific Life. Prices may vary from insurers, outputs, amounts of coverage, health class and a life insurance price index that uses real-time data from leading life insurance companies. Not all policies are available in all countries. The issuance of the concept of life insurance policy without a medical exam is subject to product availability and your eligibility, and may depend on your true answers to the health questionnaire. Rate the illustration is valid from 01.10.2024.

The whole life insurance does not expire and comes with a cash saving component that allows you to borrow money while you are still alive. It is significant more expensive than terms, but can be valuable in certain scenarios – for example, if you want to top up your planning or investment portfolio or if you have allies that require lifelong care.

METHODOLOGY: Full life insurance rates are calculated for male and female non-smokers in the preferred plus health classification that receive 250,000 or 1, 000, 000 lifestyle are fully paid in the age of 100 to the masses offered. Individual rates will be different because specific circumstances will affect the rate of each customer. Rate illustration is valid from 10/01/24.

Life Insurance Rates: $500k Term Policies Start At $300/yr

Methodology: Approximate monthly rates are calculated in the preferred classification of smoking health, based on a million dollars of all life insurance paid in 100 to 100 offered through mass. Individual prices may differ from insurers, the amount of coverage, health class and the state. Not all policies are available in all countries. Rate the illustration is valid from 01.10.2024.

Life insurance quotes are estimates how much your life insurance premiums will cost monthly or annually. You can get allegations online, free, with just a few information – or you can call us at 1-800-608-2192 to connect to the agent and start. Life insurance rates are the ultimate cost of your premiums, which insurance company secures only after they assess your application.

Katherine Murbach is a licensed agent for life insurance and former life insurance editor and associate and sales associate of the antenna. Prior to that, she wrote about life and disability insurance for 1752. Financial and advised more than 1.5, 500 clients about their life insurance policies as a sales associate.

Antonio is a former director of cooperation with the cooperation content, which helped the leadership of the editorial team for life and annuities in. Before that, he was a senior director of the contents on Bankrat and credit cards.com, as well as the main writer covering personal finances on the CNET.

What Is The Average Cost Of Life Insurance In India?

Patrick Hanzel, CFP®, is a certified financial plan and a former advanced planning manager. Its expertise is presented in Lifehacker, consumer affairs, magazine, advance global and fatherly. Without life and all lives are two most common life insurance policies – providing payments to tax loved ones if you die. Expression of life insurance is simpler and cheaper and can be appropriate if you generally need