Average Yearly Car Insurance Premium – Our goal is to help you make severally financial decisions and provide us a comparison of comparisons and provide services for free. If a market companies we make money from advertising and the products are visible on page links and / or other payments where suppliers go to their site if you get any product, a refund. You will not pay any additional money for our service use.

We proud of the equipment and information we provide and as opposed to the option to search in our databases, no matter whether we have commercial relationships with the suppliers of these products.

Average Yearly Car Insurance Premium

Labels ‘Sponsored’, ‘Hot Deals’ and ‘Featured Products’ refers to products where the supplier has paid for more prominently.

How Much Does Pet Insurance Cost? (july 2025)

‘Sorting order’ refers to the initial sorting and specific products are not a way of meant better than others. You can easily change the selection of products of products from display on the page.

Terms, Terms, Exceptions, Limits and Websites can apply to apply in any insurance products displayed on the website. These Terms, Circumstances, Exceptions, Limits and Sublimite can affect the benefits and covers and covers are displayed under insurance products displayed on the website. View a statement of relevant products for further information before you make decisions about an insurance product and determine the supplier website. This means, if you get updated now, your renewal prize can be about 9% higher than premium of last year. For example, in a £ 600 policy that means you can afford about $ 54 more than $ 54. In an 800 -dollar policy, you can now pay over $ 72 more for your renewal.

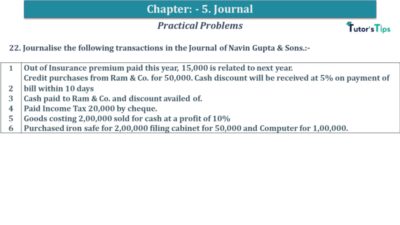

Author experts have angered thousands of data to illustrate how your Premium can be different, depending on how you riding a preigner, your age and where you live.

The average car insurance cost was for a wide cover between July 2024 – a year ago (Q3 2023) £ 561 to 9% are almost gathering the intruding this data in 2012. You can see the steep growth in the card in the chart.

Cheapest Family Car Insurance

Real life data collected by car insurance shows sacrifices that prices in November 2024 a few percent lower than the beginning of the year. Although the prices are higher than a year ago, for the moment, the prices appear to be the most and started to go. When the drivers is the growing rate it is important it is important that the prices of the premium has now started being steady.

Partially it is to soften the price pressure. However, the industry is still for a high cost – for example repair costs are 2 billion dollars for Q3 2024, that is 26% higher than Q3 2023.

And even though the price is soft, families still have problems. Director of general insurance policies Abir director Mervin Skit says:

“Although our last statistics that is signed the second quarterly-drop on the average motor insurance, we know that industry is an important expense stress and cover the cover is an emphasis on the money.

How Much Does It Really Cost You To Buy And Own A Car?

An additional factor to stabilize car insurance costs that many large insurance company is now new layers of broad auto insurance, which secures low coverage for lower expenditure. For example, we are now looking at the new “necessary” level of admiral on comparative sites. It is important to note that these new plans can miss the features such as windscreen and the car coverage. Read more about all this.

In favor of those who are desperant in assumption of EV, that electrical cars are 5% more expensive to repair and 14% more to repair (which means high costs of courteses).

It is important to understand that the autof insurance costs changes a lot in car and car in the car. Your age, vehicle and location may affect the price you paid up to 500% or more. So how can you use your car – their hair and wages with courier are more than £ 4, 000 per year for their reward and reward vehicle.

The real average price of the actual average price paid by drivers for extensive auto insurance in the UK is here is here:

Average Car Insurance Rates By Age And State

Is it how much money you have to pay for your car insurance? Not necessarily. For starters reflect the above figures just one type of car insurance – complete. Although it is ‘best’ cover, other types (third parties and third parties and third parties, fire and theft) can spend more.

Direct lines of most important car insurance suppliers, Allianz, Aviva, Xaa and Admiral showed the average target for our cheap coverage for our sample Driver, which is about 4% above the first quarter. During the last few weeks did not move prizes. You can read more about that test in our article about comparing cheaply auto insurance.

And the cost of auto insurance is widely changed from person to person, for example up to $ 350 to $ 2, 000 or more for a broad coverage. Young drivers insurance premiums are usually higher, more than £ 1, 000, who have poor Riding history (eg IC Failed and ET-FALLY) and / or Premium for them.

To understand how much you need to pay for auto insurance, we studied the UK Broad-Auto coverage of some of the top 10 auto insurance companies in the UK. First, we saw the prices of a middle-aged a middle age after a highernship of a young driver – the adventure falls between 20 and 50, then raised for drivers.

How Much Is Car Insurance Per Month?

We also have tested for cheap wide for cheap cover for 5 Popular Car models: Voxhal Corsa, Forta Corsa, Forta Kashkai, Audi A3, KIA Sports. Use this information to help identify and find out a good deal when you need to look for your cheap policy.

To see how the Driver’s Age Affects Widespead Car Insurance Costs, we have collected quotes for a Ford Fiester, the most popular Car in the UK Droughwferent Ages for a Male Driver. The rates are usually reduced in adults to the age of 60. In our research, the premiums are taken with 45% between 20 and 55, 55, then 55 to 75 years by 60%. The price is higher for younger and older drivers because insurance companies understand the higher risks understand the whole Risik events within this age.

Adolescans’s rates for adolescents are easily £ 1, 000 to £ 2, 000 or more in a year. Adolessescent Drivers are the most risky ERA group, and therefore the experienced driver 2x for 3x for what will pay for the driver for the car insurance.

Generally drivers in the 20 of 20 pays for insurance than more experienced drivers. We could see that the 20 -Jar -old drivers were quoted approximately $ 850; 25 -Year -old drivers must pay £ 720 or less than 15% for the same broad turn. Higher premises are theoretically equal because young drivers are more likely to be accidentally. Young drivers are not only less experience, but they are known to be that I is involved in risk of behavior and presents higher risk for insurance companies.

Home Insurance Rates By State For 2025

As a group pay their 30’s drivers less for car insurance than their 20s. In fact, the average cheap quote in our research £ 639 for 35 years that was £ 80 less than the 25 -jar -ear-of the price. Everything else is equal, the cost of auto insurance should be reduced to about 60 years. Drivers between 30 and 60 are usually more experienced and lessly harnessed to be crashes, which results in less premium. New drivers across the age of 30 in the UK will pay more than 30 years old, but the same must be paid less than an inexperienced young driver.

Although Preemprees are reduced to both male and female drivers in the high age, has shown our study that insurance premium to start to tround drivers in their 60s. This is because the insurers think drivers will be more accidents when they grow old. In fact, from the age of 65 to 75 we found that a driver can expect their premiums to increase with about 50%.

The vehicles of groups of lower insurance are usually cheaper to insure. For example, popular cheap cars

Average yearly home insurance premium, average car insurance cost yearly, average yearly health insurance premium, average yearly car insurance costs, car insurance yearly premium, average yearly home insurance, average car insurance premium, insurance yearly premium, health insurance yearly premium, yearly insurance premium home, average yearly car insurance, average yearly homeowners insurance