Bca Insurance Bengkel Rekanan – BCA Auto Insurance is one of the most important brands in insurance. Here is a Partner Seminar on How to Ask BCA Auto Insurance.

Insurance is indeed an important thing. In fact, we must have insurance before we decide to get an investment, as insurance will protect us from various economic problems that may be faced in the future. Whether caused by disasters or self-challenges, insurance protects us from all kinds of economic risks. One thing that is usually used as an insurance protection object is a car. When looking for auto insurance, you have to find a company that actually pays insurance claims. You can choose BCA Auto Insurance because of the benefits he gives. The following is correct!

Bca Insurance Bengkel Rekanan

BCA Insurance is a company established on December 1, 1988 using the name PT Ganesha Ciptadanamas. The name was changed to Transpacific General Insurance in 2006, and in 2010 the company was taken over by the BCA and BCA Finance pension funds and renamed its name to Central Sejahtera Insurance.

Bengkel8selindo (@bengkel8selindo) / X

On December 23, 2013, the matter changed the name of BCA Insurance with 75% of the company. The company offers products such as vehicle insurance, transportation, engineering, currency, fire protection, personal accidents and micro.

The company focuses on achieving future business growth through management and employees. This is further reinforced by the fact that human resources and systems can operate more confidently and effectively. The company has also always expanded its service sector by opening marketing offices across Indonesia and working to improve services in order to provide the best service for its customers.

You have to know the types of auto insurance in your insurance company so that you can choose faster and optimize them more based on the protection provided. You can get two types of car insurance, as follows.

This insurance will protect the car from various risks, often referred to as comprehensive or overall insurance, which will pay claims for various types of losses, ranging from mild damage to serious damage, and even losses. This insurance is only different from the total loss paid for the claim by the small blister insurance, but the cost of the vehicle is certainly more expensive than the total loss insurance alone.

Bri Insurance Bayar Klaim Asuransi Kebakaran Rp920,05 Juta

This car insurance means that claims can only be filed if the total loss is lost. In auto insurance, the total loss is the occurrence or more of theft damage. If the car damage is less than that amount, you will not be able to receive compensation. This 75% figure is taken from the possibility of cars that can no longer be used. Although his clients have a small range, the cost is cheaper.

All risk insurance is certainly more expensive than the total loss, especially if you want to add protection. If your car is expensive, even if it’s small damage, it’s a lot of expenses, then you’d better choose all risk insurance.

This insurance is also ideal for those who have a car rental business or car course because these parties have a greater risk of mild damage. The type of insurance you choose is also affected by the frequency of use, because the more you use the car, the more likely you are to have an accident, especially if you often walk through a communication path. You can choose from all risk insurance.

If your car is more common, you can choose to lose full insurance as you have to keep focusing on the level of crime. There are areas where there are really high levels of crime, and if you live in such an area, it is better to choose only total loss insurance. You can also determine which insurance is right for you by comparing two insurances, types, or companies.

Bengkel Body Repair Dan Cat Mobil Honda Pradana

The main guarantee you will receive is compensation for the total loss, and part of the loss to the full insurance of the car. And the total loss is only insurance will compensate for the loss totaling more than 75% of the vehicle price. Expansion can also be guaranteed if there are earthquakes, riots, terrorism, hurricanes, third-party legal liability, storms, volcanic eruptions, strikes, destructive, hail, tsunamis, floods, floods and landslides, etc.

Every insurance has its advantages, and BCA Auto Insurance is no exception. Here are some of the advantages of BCA car insurance.

Auto insurance will provide considerable damages for losses, losses or thefts in accordance with the amount of premium paid in accordance with the policy so that economic losses in the event can be minimized.

Cars provided by insurance will also be more maintenance-free than minor damage, and when resold, it will be more expensive than cars without insurance.

Portal Perbandingan Asuransi Online Terbaik

The company is part of one of the best insurance companies in Indonesia and has to follow some requirements to apply for insurance. The following is the file.

After approving the above requirements, as a prospect, you will pay premiums according to the premiums on the insurance policy to be protected against the fees you pay.

You can easily purchase BCA car insurance offline or online. For offline purchases, you can go directly to the closest BCA insurance agent in the city, or contact them by phone, or go to your city’s BCainsurance branch.

If you want a more practical approach, you can buy it online through the official website. Before purchasing insurance, make sure you already know the correct product and policy type as needed. To convince yourself that this product is the right choice for you, you can ask customer service before making the final decision.

5 Alasan Kenapa Kamu Harus Pilih Mpm Insurance

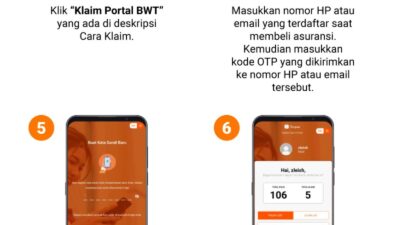

To pay for BCA car insurance, you can go directly to the branch office or the BCA insurance headquarters to go offline. If you want to pay online for more practical steps, you can also use the BCA Life Mobile Services app. This app you can download directly from the Google Play Store or the App Store.

There is a reason why you have to buy BCA insurance online. The following is a discussion of the reasons.

All activities will be conducted online, from status updates to checks. This will help you save time as you don’t need to visit the bank or meet with insurance agents.

Submitting insurance completed online will make it cheaper to have the expenses, as there are no allocations and infrastructure costs, so the insurance premiums will be lower.

15 Rekomendasi Asuransi Kendaraan Terbaik Saat Ini

Submitting online insurance gives you more freedom as a prospect to choose and compare existing insurance products. This method will help you gain a deeper understanding of various insurance products so you can choose the one that suits your needs.

Most car insurance app websites have a more attractive appearance and are more complete forms, so the submission process will be easier and you don’t have to provide documentation offline.

Submissions submitted online can give you a look at various reviews of the insurance products you want to purchase. Often, you will find people who have purchased this insurance before, and you can use this review as a reference to find the right insurance.

.png?strip=all)

The rules of BCA auto insurance must be followed when trying to file a claim. The following is a way to require relevant insurance.

Daftar Asuransi Mobil Dan Motor, Akan Diwajibkan Mulai Januari 2025

The insured must report the incident to the insurer’s claim department at least 3 days after the accident, between verbal and written.

Since this car insurance is part of cheap car insurance, some things are not covered due to the following.

Insurance will not bear losses, losses and expenses for motor vehicles and third parties due to the following circumstances.

A vehicle used to encourage or attract vehicles or other objects or to drive learning. Participate in exercises or activities involving highways, carnivals, parades, etc. Propose criminal acts and other things that are not included in the policy.

Tunas Toyota Bintaro Body Repair And Paint

Insurance will not bear any losses or expenses for motor vehicles or third parties’ legal liability arising from the following matters.

Riots, hurricanes, storms, tsunamis, riots, people’s power generation, fusion, active radio pollution, military forces, invasion, terrorism, destructive, nuclear reaction, nuclear reaction, robbery, robbery, revolution, rebellion, volcanic eruption, volcanic eruption, attack, ice cream, hail, ionization, flooding or other geographic or other geographic symptoms or Mott’s symptoms,

Insurance will not guarantee losses, losses and expenses for motor vehicles or third parties’ legal liability if the following happens.

Typically, BCA Auto Insurance provides partners workshops for customers. Here is a list of what you need to know.

Bcainsurance Mobile Apk Untuk Unduhan Android

To provide the best service, BCA Insurance provides a place where consumers can make complaints through various platforms below.

Here are some information we can share on BCA car insurance. This car insurance is indeed well-known as it is part of the BCA Bank, which is also a large bank in Indonesia.

Of course, there is no doubt about the credibility of this insurance, because we all know that BCA Bank is a well-known bank.