Best Auto Insurance Companies Jd Power – The new survey reveals that communication is critical to insurance companies as customers lose confidence in their efforts. The new survey reveals that communication is critical to insurance companies as customers lose confidence in their efforts. Kwangmuja/Getty Images

Eleen leads the Falcenburg-Hal Autos team. U.S. She has widely written about the auto industry for News & World Report, Cargurus, Trucks.com, Automotive Map and American City Business Journals. Alumna of the State University of New York in Eleen Pennsylvania State University and Buffalo. The authors Page Eiline Phalkenburg-Hal

Best Auto Insurance Companies Jd Power

Based on the facts, the reporter is directly verified and verified by the reporter, or is reported and verified from knowledgeable sources.

List Of Car Insurance Companies

J.D. Power 2021 U.S.

Now in its 22nd year, the U.S. Auto insurance study analyzes customer satisfaction in five areas: billing process and policy information; Suits; Interaction; Policy submission; And the price.

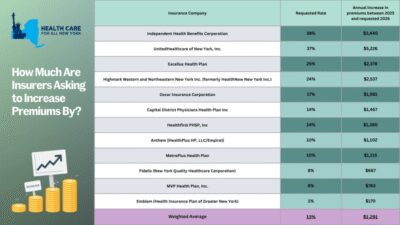

On a scale of 1, 000-points, the total customer satisfaction is at 835 to 2021, which has not been improved from one year to another year after 2017 after 2017. One of the largest holdbacks in communication, the satisfaction fell 12 points a year.

“In this year’s study, what we see in this year, insurers will lose a mark on the exchange of effective communication to their customers, but the insurers will deliver it with their actions,” J.D. Senior consultant Robert Lazziak for insurance intelligence at Power.

Porsche Named Most Appealing Premium Brand By J.d. Power

Based on scores, J.D. Power U.S. Top auto insurance provider in 11 geographical areas. All the winners have a score much higher than the national average.

Wavansia, State Farm and American family were the top honors for the second consecutive year in California, New York and the southwest respectively. Southeast Farm Bureau Insurance – Tennessee and Texas’s Texas Farm Bureau topped the 10th year in their areas respectively. Amika Mutual in the New England region wins the ninth consecutive year.

J.D. According to the Power’s Survey results, the following are the U.S. According to the Top-Rated Auto Insurance Companies in the area:

To be ahead, insurance companies have to change their submission. Of those surveyed, 34 percent of respondents are willing to try utility -based insurance. Currently, 16 percent of customers use tech, with double volume five years ago.

Your Car Insurance Discounts Guide

Increased premiums can also lead customers to find a new insurance company. Forty -five percent of the respondents say they will change to save $ 300 or less. Fifty -seven percent recently switched to that amount.

Author Eleen Leads Falcenburg-Hal Autos team. U.S. She has widely written about the auto industry for News & World Report, Cargurus, Trucks.com, Automotive Map and American City Business Journals. Alumna of the State University of New York in Eleen Pennsylvania State University and Buffalo. The authors Page Eiline Phalkenburg-Hal

Eleen leads the Falcenburg-Hal Autos team. U.S. She has widely written about the auto industry for News & World Report, Cargurus, Trucks.com, Automotive Map and American City Business Journals. Alumna of the State University of New York in Eleen Pennsylvania State University and Buffalo. Eleen leads the Falcenburg-Hal Autos team. U.S. Read her widely about the auto industry for the news & … Morej.d. Power and Associates Reports: Auto Insurance Customer Saturation reaches All-Time Hi, which is satisfied with policy submissions

Westlake Village, Calif.

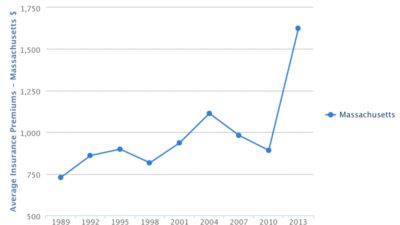

The Evolution Of Auto Insurance Customer Satisfaction

This study measures customer satisfaction with auto insurance companies in five factors: interaction; Price; Policy submission; Billing and payment; And suits. The total satisfaction with auto insurance companies has increased by 804 (1, 000-points scale), up 14 points since 2011. The highest levels of satisfaction in 2012 have been the highest since the study began in 2000.

The satisfaction of all factors in 2012 will increase with significant improvements in policy submissions (+30 points) and interaction (+19 points). Satisfaction with price does not necessarily change since 2011.

“Although the satisfaction of the price has been stable since 2011, auto insurance companies have made great progress in all other sectors,” JD. Jeremy Bowler, Senior Director of Insurance Practice at Power and Associates, said. “In the area of policy submission, many insurance companies prefer the packaging of production and discounts and offering in their ads.”

The study found that 20 percent of customers had experienced an insurance-starting rate increase since 2011, 63 percent of these customers enjoy an increase of $ 50 or more. The satisfaction among customers who increase premiums at least $ 50 are experiencing an increase of less than $ 50 compared to $ 735, 797.

Ranked: The Most Reliable Car Brands In 2025

“Insurance companies appear to be able to meet their service expectations or that the modest rate growth is well tolerated, providing the rate adjustment amounts to less than $ 50. However, large rate adjustments may inspire customers to consider shopping for customers, especially with their insurance company.” “One Method Auto Insurance Companies who can use auto insurance companies to reduce the disappointment of rising rates, have to pre -reform the rate change before the restoration notice, and participate in negotiations with consumers regarding their choices.”

Discussing the rate increase with customers and providing options can have a positive impact on satisfaction. The rate increase in auto insurance customers, 56 percent of the recovery notice is not communicated before the restoration notice, whose satisfaction is 746. On the contrary, the satisfaction of the customers who have been informed before the rate increase and negotiated with their insurance company.

Social media comments on the subject of individual auto insurance rate hikes indicate a strong desire to change insurance companies or start the shopping process. In addition, many people ask if they have experienced similar results with a particular insurance company or whether they completely recommend another insurance company.

“Our research shows that most of the customers who shop for insurance will eventually change. However, as they are unhappy with the service they received, all three of them are shopping until they find a new insurance company. “Initiative to customers in advance and discussing options can help reduce depression and shopping for insurance.”

Car Value By Vin Number

California region: Wavanesa is the highest in the Award-Award insurance companies in the California region with the highest score of 823, followed by the Automobile Club of Southern California (807) and State Farm (806).

West Region: State Farm (837) is one of the highest award-all-in-the-one award-award-performing insurance company in the West Region.

Central Region: The Texas Farm Bureau (857) is the highest ranked place in the award-qualifying insurance companies, followed by State Farm (832) and Geeko (830).

Southeast: Tennessee (828) is the highest in the award-qualifying insurance companies in the Farm Bureau Insurance-Southeast region, followed by North Carolina Farm Bureau (823) and State Farm (821).

U.s. Mortgage Servicer Satisfaction Study Award Information

North Central Region: Auto-owned insurance and state form (at 828 at 828) in the North Central Award-Award-Awarded insurance companies, followed by Ery Insurance (823).

Northeast: Amica Mutual (867) is the highest in the northeastern region, followed by the New York Central Mutual (811) and Geeko (793).

Mid-Atlantic Region: Erie Insurance (834) is the highest in award-qualifying insurance companies in the mid-Atlantic region, followed by State Farm (813).

Customer satisfaction changes in the Southeast region from an average of 814 to 784 in the northeastern region. The Southeast Region is interactions, billing and payment, policy offerings and suits, while the West Region is especially well in the price.

The Cheapest And Best Insurance For New Drivers In 2025

To see the service channel behaviors that transfer to the auto insurance market, as well as the management discussion that examines the impact they have on customer satisfaction, please click here.

2012 U.S. Auto insurance study depends on about 35, 000 responses from auto insurance customers. The study is between March and May 2012.

[1] J.D. Research conducted by Power’s user Insight and Strategy Group includes information collected online from June 2011 to June 2012.

Westlake Village, Headquarters in California, J.D. The quality and satisfaction dimensions of the company depend on the responses of millions of consumers annually. For more information about car reviews and ratings, car insurance, health insurance, cell phone ratings and more, please visit JDPower.com. J.D. Power and Associates Business Unit of McGra-Hill Companies.

Getting It Right: Why Is Claims Satisfaction So High?

McGrow-Hill announced on September 12, 2011, the intention of separating as two public companies: McGra-Hill Financial, Content and Famous Provider of Analytics

Best auto insurance companies arizona, jd power best insurance companies, best auto insurance companies maryland, jd power ratings home insurance companies, best auto insurance companies georgia, jd power auto insurance, best car insurance companies jd power, rate auto insurance companies jd powers, jd power ratings insurance companies, best auto insurance companies indiana, best auto insurance companies ohio, best home insurance companies jd power