Best First Time Car Insurance – Being a driver for the first time is an exciting experience, but it is also a great responsibility. You should always be alert and careful, and you have to make sure you keep your vehicle, your passengers and others on the road.

Of course, accidents can happen, no matter how careful you are. The best way to stay protected is to have a car insurance. A policy will save you that you have to pay disorbitant fees if something is unfortunate when it is behind the wheel.

Best First Time Car Insurance

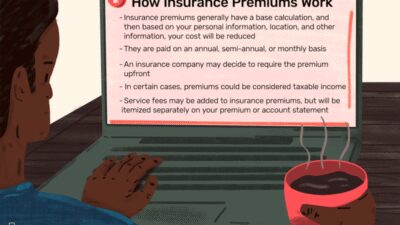

Getting a car insurance for drivers for the first time is simple; Simply contact a car insurance supplier, secure your data, discuss the coverage you need and sign the letters. So you will have to pay a premium every month (or at any frequency you have agreed with your agent) to get your benefits. However, before you do this, it is a good idea to buy the options. Get budgets from different companies, including providing KTs, and see which one has the greatest meaning based on your budget and needs.

How To Get The Best Car Insurance Rates: Comprehensive Guide

If you do not have your own vehicle (for example if you drive a parent’s car or share a vehicle with another), you may not need to get a special insurance policy and you will only need to update the existing plan attached to the vehicle to add you as one of your users.

When applying for car insurance, the supplier will request some details about you, your vehicle (including your use) and your driving history. You may ask an agent you need before you meet so you have everything ready.

It is important to keep in mind how a new driver, your car insurance budget can be slightly higher for the same coverage offered to a more experienced driver. Because you do not have much driving experience, insurance companies are risking to cover you, so they usually make up with higher premiums. But don’t worry, these have to sit over time.

Car insurance is required under Canadian law and two basic types are required in each policy: Liability insurance and insurance of accidental damage.

Car Insurance Victoria

Insurance of liability covers losses it can cause in other vehicles, as in the event of an accident leading to damage or death, this includes medical or legal payments to others, but usually does not cover the cost of repairs. Securing accidental damage protects against paying your medical expenses or loss of income if you enter a car accident.

Another optional coverage is good for having in addition to basic concepts, such as providing collision or covering personal effects. You can also get a full car insurance plan to cover all your bases.

All drivers for the first time need to get the car insurance for your vehicle as a way to protect yourself and others from damage. Remember to prioritize this step before you are behind the wheel.

Enterprise World, is a business magazine, a platform for all business master’s minds to share their successful stories and gaps they found to become stars at night now in the business world.

Comprehensive Car Insurance Victoria Quotes

We use cookie to improve your experience and we also collect some information using Google Analytics. By clicking “OK”, accept this. You can know more about our use of cookies. For drivers for the first time in Ireland, getting car insurance can be one of the biggest challenges when starting the road. Insurance premiums for new drivers and new managers are usually greater due to the limited experience of steering and the highest perceived risk. However, understanding how the driver’s insurance works for the first time, what factors affect prices and how to find the best deals can help you get a competitive premium without sacrificing coverage.

At Dolmen our car insurance team talks with new drivers every day. We understand your disappointments and how difficult it is to find covered. Many young people are looking for Google looking for “free car insurance for new drivers”. Generally this will not come to that destination. There are many factors to keep in mind when looking for a roof. To help you, in this guide, we will cover:

The first time driver is a type of car insurance policy specifically created for people who have recently received their student permission or full driving license. Since new drivers have little or no story driving, insurers believe they are a higher risk, which results in higher premiums.

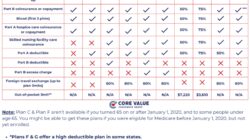

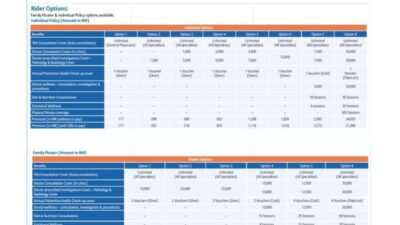

When choosing car insurance as a driver for the first time, it is essential to understand the different types of coverage available:

Top Five Cars For First Time Buyers #infographic

Many drivers for the first time choose third parties, fires and robberies while balancing the possibility of use and protection. However, if you can handle it, full coverage is often the best option.

For the best value, compare the appointments of multiple insurers and consider talking to a runner like Dolmen Insurance to get the best price coverage.

Being insured as a driver for the first time in Ireland can be a challenge, but to understand how policies work and take measures to reduce costs can facilitate the process. To get the best car insurance dating, consider to choose your car, driving history and type of politics. Whether you are looking for third parties, fires and theft or full coverage, dolmen insurance can help you find the right policy for your needs.

Do you need expert driver insurance tips for the first time? Contact Dolmensuransthray to compare budgets and get the best coverage at the best price.

Car Insurance Calculator: Estimate Your Costs

Choosing the best carination that politics in Ireland requires full attention to the levels of coverage, premiums and additional benefits. Whether a traditional gas or diesel vehicle is directed as if you change in an electric car, it is important to find the right insurer. Dolmen insurance corridors are distinguished as the main EV specific insurance provider in Ireland, with a team dedicated to assist owners of electric vehicles.

If you are looking for affordable and complete coverage, consider the insurance of Dolmen. Contact today to discuss car insurance options and explore the benefits of insurance roofing grouping. From mortgage protection to life insurance, housing insurance or car insurance we have covered.

UNRASANCE in Ireland: What do Irish companies know before the category is too late: Dolmen News, car insurance

Most Irish business owners buy insurance with a relief. Is a box marked to do …

7 Best Cars For First Time Drivers In 2020

Ireland car insurance questions answered. The advice of Dolmen insurance experts when it comes to car insurance, Irish … One thing is true: if you have a car, you need car insurance. Not only is the law in most states, but it can help you protect your funds if you are in an accident. However, navigating the details and from this diverse landscape can be many, especially if this is your first car. With many different types of available car insurance policies and a variety of factors that can affect your premium, finding the right adjustment for you can take time to track. Start your head with a guide on the car insurance basics.

Like other types of insurance, car insurance is a contract between you and an insurer you pay a roofing premium. In this case, insurance covers some of the costs if you enter an accident or your vehicle is damaged. Car insurance can cover medical expenses for you, your passengers and residents of any other vehicle involved. You can also cover the cost of damage to car damage and other properties.

The type of car insurance you need varies according to the laws of your status, the value of your vehicle and your personal preferences. Common types of coverage required include:

Providing responsibility covers the damage you can do to someone else or your property. This type of insurance is required by most countries and is typical less expensive than other types of policies.

The 10 Best F1 Cars Of All Time

If you are involved in an accident with an unsured (or insured) driver, non -insured motorcycle policies (UM) and Biker UIM policies) help cover their medical expenses.

These two policies are usually sold together, and if you can rent your car, your business or owner may be required. The collision pays car repairs if you are in an accident. Integral insurance pays for damage to your vehicle for various reasons from an accident, such as theft, fire, flood and animals. In both cases, you may have to pay a discount before getting coverage.

Pip helps pay for medical expenses for you and your passengers, whether you or the other driver have caused the accident. Some states have unsuccessful insurance laws (where both parties must submit a request, no matter who caused the accident) and require the insurance of PIP. This type of insurance also helps cover additional costs such as lost salaries, burial costs and replace injuries lost from damage, such as cleaning or daily care.

Although the average annual car insurance cost was $ 1, 633 in 2021 and is expected to be $ 1, 706 in 2022, the current amount you will pay depends on several factors. Where do you live, how old are you, how is your driving record, your credit score and what kind of car you have, everyone has an impact on the cost of insurance (except how much and what kind

Top Car Insurance Options With Affordable Rates Under $300

Cheapest car for first time insurance, cheapest first time car insurance, cheap car insurance first time buyer, cheap car insurance for first time, best car insurance quotes for first time drivers, best car insurance for first time buyer, best first car insurance, car insurance quotes first time driver, car insurance quote first time driver, best insurance for first time car buyers, first time car insurance quotes, best car insurance for first time