Buy Third Party Car Insurance Online Malaysia – Before purchasing car insurance, it is the best to understand the terms and main words of the car insurance policy. This is it to help you choose the best policy when you need to apply the insurance needs later.

There are 3 types of car insurance policies available in Malaysia: comprehensive insurance, (2) Third insurance, fire and (3) third-manufacturer insurance.

Buy Third Party Car Insurance Online Malaysia

This type of policy provides the most extensive insurance. It provides blocking loss or damage to their property damage or damage or damage to third-under complaints or third-party or damage to third parties or a third party or a third party.

Motor Vehicle & Car Insurance Malaysia (quote Online)

This policy reduces loss or loss of loss or loss of damage or loss of damage or damage or loss of a third party or damage or loss of a third party or loss of a third party or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage or loss of damage.

Third-law insurance is the most basic policy because it offers insurance for third parties. This includes the property of you caused by you and the loss of the life of third -80 life.

Say you have an accident that harms your car and you are guilty, you have to pay your car repair cost.

First, understand that your insurance includes only some incidents that can be with your car. Therefore, the insured quotes the person, refers to events that your insurance will pay and pay compensation. It is important that you can know what is involved in your insurance to avoid any confusion during your request.

Car & Motorcycle Insurance Renewal Malaysia

For example, if you purchase extensive insurance, you need to understand your insurance programs. Unlike the main insurance scope, you should also know about additional benefits to your policy. For example, Talkfull Malaysia provides free personal accident insurance for drivers and passengers in the case of death or all disability due to car accident.

It can be with your car. Even events that are not involved in your insurance too. This means that if someone does not pay your insurance for your car, you cannot request your insurance company against your insurance company.

For example, your insurance does not provide insurance if your car is damaged with floods. However, if you want your insurance company to cover the loss, you have to buy a special cover as an alternate cover. To enjoy the scope of this insurance, you will have to pay more different insurance premiums between insurance companies.

Another incident in which your car is not included if your car damaged by a strike, riot or civil expectations. However, if you can enjoy the scope of an additional cover to an attack, riots and civil demands.

No-claim Discount (ncd): A Comprehensive Guide

Insurance time reflects the effective date of your insurance policy. In this insurance period, you can apply your insurance policy requirements for events that your insurance insurance is.

The usual time of cover is one year. It must be renewed annual car insurance to enjoy your insurance.

Summary is insured as much as the maximum of your car is insured. According to Malaysian General, the basis of evaluating the accurate value of a car is the basis of its loss. For example, if your car insurance sum insured in the rate of your car market at the time of extension at 45 RM

However, you can also choose an agreed price because money is insured for your car. If you choose any agreement value, the compensation you will receive in the case of your car is a complete loss that will be a price agreement at the time of increasing your insurance. Money whether your car market decreases.

Best Car Insurance 2024 For Malaysians

You can check your car market value for free at Micherrofo and read more about the car market value and the value of the value in our previous article.

The more amount is the first amount you have to pay for each insurance needs, even if the event is not your error.

ਹਾਲਾਂਕਿ, ਬੇਲੋੜੀ ਅੱਗ ਬੁਝਾਉਣ, ਚੋਰੀ, ਚੋਰੀ, ਚੋਰੀ, ਚੋਰੀ, ਚੋਰੀ, ਚੋਰੀ, ਚੋਰੀ ਜਾਂ ਸਰੀਰ ਦੀਆਂ ਸੱਟਾਂ ਦੇ ਕਾਰਨ ਹੋਏ ਨੁਕਸਾਨ ਜਾਂ ਨੁਕਸਾਨ ਤੇ ਲਾਗੂ ਨਹੀਂ ਹੁੰਦੀ. You must check your policy list to find the more amount to pay.

If you have a constant your vehicle insurance for 12 months and you will or someone else will give your driver during your policy.

E-hailing Insurance Guide En

For your information, your NCD ratio will increase from 55% each year for personal cars. However, if you do insurance conditions where you are at least give you all your NCD.

In addition, because NCD is your personal authority, you can really transfer the NCD from your new car.

Optional or additional insurance reflects additional insurance provided by your insurance company by your insurance company. If you want to buy more covers, you have to pay additional premium.

For example, if you want to buy windshield, you have to pay 15% of the insured person for your windshield. For example, if the insured amount for your windshield is 1 RM, 000, then additional insurance premiums only 150 RMs only 150 RM With this optional insurance, if your windshield chip or break, your insurance will pay for your windshield or for a change for your windshield.

Vehicle Insurance Market Size To Hit Usd 1,796.61 Billion By 2034

Your name personal name you received the name of this. In addition to protecting you, your insurance also protects the driver nominated in your insurance policy.

For your information, you have not been named your driver at the time of your car accident? Therefore, if you run your car to drive your car, it is best to give their name in your insurance policy.

Add two drivers with the first name (including automatically. If you want to add a third or more drivers, you have a driver with an additional name 10 RM.

To increase your insurance for any person who allows your driver for your insurance, you do not need to name only in your policy because anyone who is authorized to drive is automatically protected. Some insurance companies such as Malaysia Takhley Malaysia, Rewards Lakhs and Laulpacks provide all free insurance drivers.

Generali Car Insurance

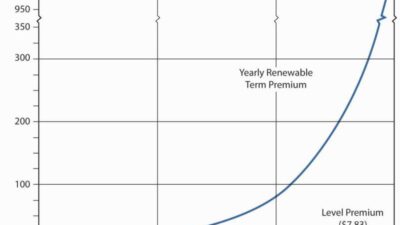

Final Premium: Pay your insurance company to activate your insurance policy. The final calculation of insurance premium is as follows:

Final Premium = Total Premium (After NCD, if any) + Additional Insurance (if any) + service tax (6%)

Insurance authentication is a change or supplement to the insurance policy that changes the rules or scope of the initial policy. Another authentication for your current insurance policy usually add or edit insurance to insurance or modify insurance.

We hope that by sharing our car can help your car better better. As you know, it is important that you understand your insurance policy terms and conditions of your insurance policy so you know what is involved in your insurance and not involved. Then you can decide that you need to get any optional insurance based on the assessment of your risk.

Car & Motor Insurance Comparison Malaysia

You should also compare insurance companies because insurance companies can provide various insurance and insurance premiums. To complete the car insurance to complete your budget, use it to compare 15 free insurance quotes. Access to get your free car insurance quote online. Car insurance serves thousands of people in the whole country. The Liberty insurance company is considered one of the best car insurance providers for many reasons. We have reviewed the complaints in its comprehensive plans, extra insurance options and different articles.

We will end this three-cent series with third-time insurance options, fire and stealing (TPFT). Karinia insurance from TPFT are two different plans – the basic scheme and auto 365 TPFT prefirst premier plans. Let’s know more about them.

The basic TPFT Protection of Kurityia provides the requirements of the third-side requirements and helps a car for the car to $ 200 for accidents. In addition, the policy owners are also eligible for the claims of limited damage.

Auto 35 third parties, the premiere of TPT insamor, a wide range of premierests of premieres and theft are with essentials to protect their vehicles and others. The plan has an additional benefit of the plan compared to the basic TPFT plan.

How To Renew Etiqa Car Insurance At Jpj Self-service Kiosks (step-by-step Guide)

As a reliable car insurance brand since 1978, Patience has a large support network for the service of customers in Malaysia. Compared to other brands are the main benefits of the selection of the electricity insurance.

Free automatic support in 24 hours