Car Flood Insurance Malaysia – In flash floods that have been conducted in the past few months in Malaysia, self -flood insurance includes themselves as a common topic. But exactly what it is and you really need it?

As we all know, motorcycle insurance is very important for each car owner in Malaysia. It provides a financial protection and some peace of mind when you encounter unwanted conditions in your car such as road accident. Stress after the accident is shortened – at least about your financial situation – knowing that you have this shield.

Car Flood Insurance Malaysia

Except for the three forms of main and comprehensive motorbike insurance, secondary parties and theft, there are also different forms of insurance that you can do to protect more. An example is to include floods. It helps include flood -related improvements to become more expensive due to the severity and complications of the flood system of your vehicle.

We’ve Got Your Back With An Easy-to-follow, Step-by-step Guide To Help You Make Your Claims Seamlessly. Should You Require Support On Your Insurance Policy Or Claims, Kindly Call 03-2170 8282 Or Email

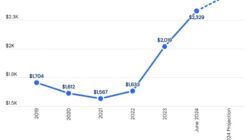

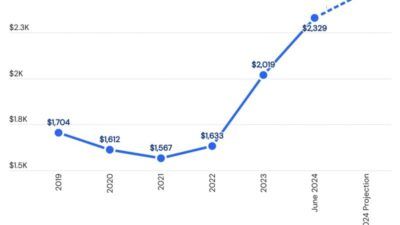

Malaysia has a colorful history when it comes to floods like floods in 2014 declares the lives of 25 people and destroys more than two thousand houses. Last year, the flood attacked the Klang valley wasting a few hundred houses and more vehicles. Of all this mind, worry that only 18% of cars have floods in Malaysia.

The problem against the exploitation of flood insurance for their vehicles around the common points against insurance in general. Excessive costs and what is considered unnecessary to accompany a tight thinking about “it doesn’t happen to me” or “I can avoid the steps to avoid it”. This old battle between customers and insurance companies is a great concern and in many ways, this thought is worse.

If we talk about costs, rescue prices are damaged floods or Axia RM20, 000. The price of the job includes 300 RM, especially when comparing the flood possibility here.

This is more likely to be available for people living more popularly such as Selangor, Pahang and Klang Valley. We encourage you to search for flood insurance today, in the period that is not Kemonane, where it is easy to forget danger. Hindsight is the name of the game and regret is really an emotion that you do not need emotional situations like natural tragedy.

Cars Submerged At Farrer Road Condo During Heavy Rain, Owners Seen Bailing Water Out

If you are looking for some help in flood insurance in your insurance programs, you can always hit us and we will find you! As always, keep safe with sugar! Since RM155K, will you have 2024 zeekr x reasonable or still for BYD Stot 3?

KLIMS: 2025 Kia Sportage Preview in Malaysia with the starting price RM149K: CKD Comed and next year

KLIM: 2025 Nissan Kicks launched electronically in Malaysia, lower than Honda HRV E: HEV and Corolla Cross HEV. Buying value?

Living in a tropical climate country with dismissal. When we have access to the day of the whole year, there is also notorious rainfall in Malaysia, sometimes explaining flash floods that are not at risk of damage.

Does Car Insurance Cover Flood Damage?

There is no fact that it is important to ensure that our vehicles are well protected and protected from floods and other natural disasters.

While some of us know about this reality, and have bought more protection against floods and natural disasters through our insurance engine, and there is no protection of their cars from floods and floods and Others have more natural disasters.

So, if your car is not protected from natural disasters, Etiqa here to save their comprehensive private car insurance day, this brings the scope for:

Above all of the above, ETIQA’s car insurance also provides additional insurance such as Oto 360 personal accident insurance, windshield insurance, cash reduction, new backup fees, and most importantly Is insurance from damage due to time and disturbance.

59% Of Malaysian Motorist Have No Flood Protection

If you have an increase in your car coverage, Etiqa has your car that is insured or harmful to floods, air service or any natural disaster for that problem.

Therefore, in addition and comprehensive car insurance, it can be said that healing and withdrawing a flood or natural disaster, thanks to Etiqa.

If part of your car insurance changes, the process is always frequent and traditional. Car owners should communicate, …

The first Malaysian insurance and Takul range for EV Home Charger are currently being provided at ETIQA. Available as a free addition for …

Flood Damage Coverage For Car Insurance In Malaysia

A simple guide on how to choose and buy your car insurance online in Malaysia. If you have a car in Malaysia or anywhere for this item, … like Western countries, there are four times in Malaysia. But instead of spring, summer, fall and winter, we in Malaysia have time in dengue fever, time in the cloud, the time of durian and the weather of the flood.

It may be funny, but sadly it is true. And now, we are perfect in the flood. The exact term is in the monsoon, but for most Malaysians, it means ‘rain and floods’.

It is a fact that in Malaysia, floods are what we can expect almost each year. That is why in this article, we will talk about the scope of flood insurance for your home and car.

The first thing we do with this article is very simple, to explain to you the exact way of flood insurance for insurance.

Insurance Association Announces Rm500 Subsidy For Flood-damaged Vehicles

And grateful, the meaning is as straight as possible, because the scope of flood insurance is very important to your property, if your home or your car is equipped with floods.

If your property is protected by flood insurance, insurance will pay you any losses due to floods.

This point is where most people do not act to get accurate insurance. For example, in a DOSM survey of residents affected by floods, in January 2022, less than 5% of people were affected by a car form, insurance.

Okay, so now we understand that flood protection insurance means your property, if your home or car, protects any damage caused by floods.

Carinsure Year End Promo

In general, the basic house insurance policy includes protection from fire, lightning and explosion. This means that flood protection is not included in your basic home insurance policy.

However, due to the fact that the bank also wants to protect their own interests, capable of your basic home insurance policy will include a flooded location.

Because if the flood causes your house to collapse, the bank cannot come or auction your home if your home is destroyed. So, for your home, it is better to contact your bank and receive all the details of your home insurance policy.

Now for cars, the answer is quite simple. In your basic car insurance policy, you are protected from losses or damage to your car due to accident, property damage and third -party losses, and third -party losses, and Third -party loss

Car Insurance Additional Benefits

If you want to protect your car from flood -related damage, you must add a special risk range, which can protect your loss or damage due to floods, storms, storms and onions. Other natural movements.

We explain that for both the family and cars, the common flood protection hobby is not included in your basic default insurance policy.

Where this part, we will consider the cost for you to add to the scope of flood protection in your basic insurance policy.

As mentioned above, the range of flood -proof insurance does not come as an independent of car insurance. So if you want to add to your car insurance protection, you need to add to special risks including your basic car insurance policy.

Is Your Car Properly Insured? Chapter 2

Adding special dangerous packages usually costs from 0.2% to 0.5% of the insured. For example, if the car is guaranteed for 50 RM, 000, the additional insurance cost for special risks includes 250 RM.

However, for houses, it is more complicated than that. If you contact your bank and make sure that your home insurance policy does not include flood protection insurance, it will be destroyed the amount you spend.

Okay, the first thing you need to know about home insurance policy is three types of basic housing insurance, which;

Basic fire policy