Car Insurance Average Rates By State – By Billal Rahman is an immigration reporter based in London, the United Kingdom, specializes in border immigration and security policy. He has discovered accusations of misconduct among the border agents under investigation and exposed claims of abuse in the ice detention centers in the US. He has covered the British postal scandal and the conflict between Israel and Hamas. Originally from Glasgow, he studied journalism in Edinburgh and then worked for STV News before moving to London in 2022. He can contact Billal ATB.rahman@. Billal Rahman writers page

According to the facts, the reporter observed and verified firsthand, or informed and verified of knowledgeable sources.

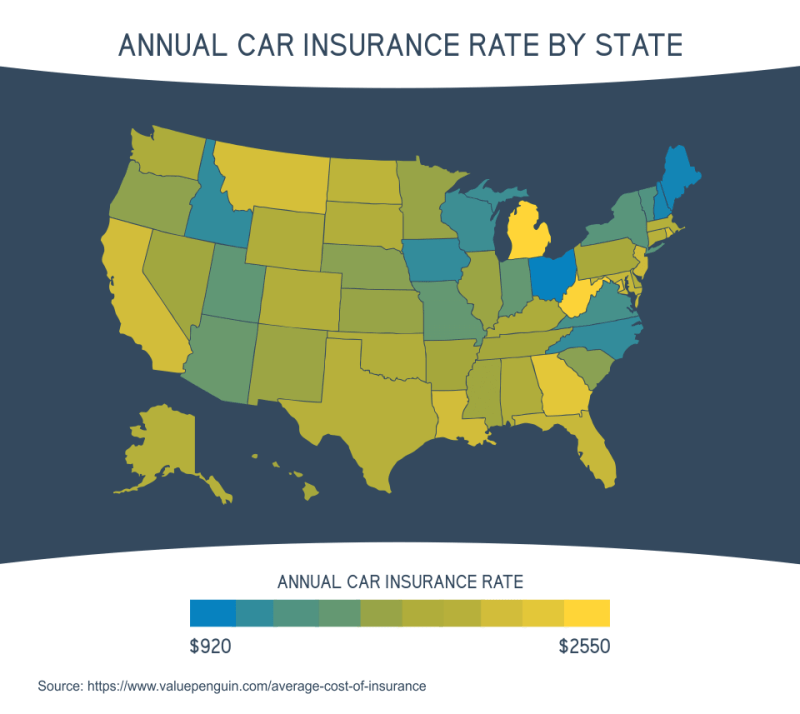

Car Insurance Average Rates By State

While some states offer more affordable rates due to favorable conditions such as population density and less accidents, others face significantly higher premiums.

Cheapest Full Coverage Auto Insurance In 2025 (9 Most Affordable Companies)

As the cost of car insurance continues to increase in general, drivers must be aware of these state differences per state to help them select the best available rates.

He has created this map to show the states with the highest car insurance rates, using data collected by Bankrate.

Bankrate used the quadrant information services to analyze the August 2024 rates for all postal codes and operators throughout the country.

The rates are weighted, according to population density in each geographical region, which reflects the different risk factors and demography that influence insurance premiums in different geographical areas.

Guess The 10 States With The Highest Average Car Insurance Rates 🇺🇸🚗 Follow Us To Find Out The Top 5 States! Methodology Moneygeek Analyzed Millions Of Car Insurance Quotes To Find The

New York leads the road, with an average cost of $ 3, 697 for full coverage car insurance. The State has high urban populations and dense traffic, which increases the probability of accidents and claims.

The aftermath of a car collision in Manhattan on March 5, 2021. Where he lives can significantly affect the costs of car insurance. The aftermath of a car collision in Manhattan on March 5, 2021. Where he lives can significantly affect the costs of car insurance. Angela Weiss/AFP through Getty Images

“Drivers in high density states such as New York generally pay more for car insurance than drivers in a low density state such as Idaho.

“This is due to variations in the frequency and seriousness of accidents, higher repair costs and a more expensive medical treatment. The most congested roads lead to higher accident rates.

Auto Insurance In Fl: Top 5 Smart Choices For 2024

“We are seeing a more serious accident trend throughout the country. The most risky driving behaviors, such as speeding and distracted driving, cause more serious impact accidents, resulting in greater deaths and serious injuries.

“The cost of car insurance reflects the expected losses paid to the insured. When losses increase, insurance premiums will also increase.

“For the AGGREGADA INDUSTRY OF US CEASURE INSURANCE, THE LOSSES INCURED OF OPERATORS increased 53% from 2020 to 2022 due to the growing frequency and severity of accidents.”

The report identified Louisiana as the second most expensive state for car insurance, with an average annual premium of $ 3, 646.

Car Insurance Rates On The Rise; Ct Average Premiums 14th Highest In U.s. — Connecticut By The Numbers

Florida is closely followed at $ 3, 451. Completing the first five are red and snowy with $ 3, 259 and $ 3, 074, respectively.

Variation in rates in all states can be attributed to several factors. Population density plays an important role; The states with higher urban populations tend to have more traffic accidents, which increases the cost of claims.

In addition, states with high driver rates without insurance force insurance companies to cover more risks. Climate -related problems are another crucial factor; The states prone to hurricanes, floods or other natural disasters often see higher insurance rates due to the greater probability of claims.

At the other extreme of the spectrum, Idaho has the lowest annual average premium at $ 1, 104. The lowest population density of the state and less accident claims help keep the fees low.

Average Car Insurance Rates In Arizona By County

“The frequency is affected by the density of vehicles (urbanization), driving behavior and other factors. Gravity is affected by factors such as repair costs, medical costs, litigation costs and damage awards, the prevalence of insurance fraud and other factors.

“Idaho is a relatively less populated state, which leads to a lower density of the vehicle on its roads. In addition, it has historically been less prone to losses of natural hazards, generally faces lower litigation costs and has been less affected by insurance fraud.”

Vermont continues with $ 1, 385 on average for full coverage annually, while Ohio reaches $ 1, 497. Maine and Hawaii have average premiums of $ 1, 505 and $ 1, 543, respectively.

These states benefit from a combination of factors, including less accidents, lower repair costs and less natural disasters compared to the most expensive states.

How Much Does Tesla Insurance Cost?

Do you have a story that should be covering? Do you have any questions about this story? CONTACT LIVENEWS@

About the writer Billal Rahman is an immigration reporter with headquarters in London, the United Kingdom, specializes in border immigration and security policy. He has discovered accusations of misconduct among the border agents under investigation and exposed claims of abuse in the ice detention centers in the US. He has covered the British postal scandal and the conflict between Israel and Hamas. Originally from Glasgow, he studied journalism in Edinburgh and then worked for STV News before moving to London in 2022. He can contact Billal ATB.rahman@. Billal Rahman writers page

Billal Rahman is an immigration reporter based in London, the United Kingdom, specializes in border immigration and security policy. He has discovered accusations of misconduct among the border agents under investigation and exposed claims of abuse in the ice detention centers in the US. He has covered the British postal scandal and the conflict between Israel and Hamas. Originally from Glasgow, he studied journalism in Edinburgh and then worked for STV News before moving to London in 2022. He can contact Billal ATB.rahman@. Billal Rahman is an immigration reporter based in London, the United Kingdom, specializes in border immigration and security policy. He has … Reading more in the state of New York, the average annual cost for full coverage car insurance is $ 2, 996. This is more expensive than any other state in the United States, and makes New York one of the three unique states in the country where the annual cost exceeds $ 2, 500, together with Louisiana ($ 2, 864 annual) and Florida ($ 2, 762 annual). From Alan’s Factory Outlet comes this infographic that classifies the 50 US states depending on their average car insurance cars. It also includes information on monthly and annual costs for total coverage and minimal coverage car insurance.

On Annual Basis for Full Coverage, Car Insurance is the Most Expensive In New York ($ 2, 996 Annually), Louisian ($ 2, 190 Annually), Colorado ($ 2, 019 Annually), Pennsylvania ($ 2, 002 annually), Georgia ($ 1, 985 annually) and Delaware ($ 1, 963 annually). While car insurance rates are the most expensive in these ten states, Maine can claim to have the cheapest average rates.

Cheapest Nebraska Car Insurance Rates In 2025 (top 10 Companies)

In Maine, the average annual cost for full coverage car insurance is $ 876.00, which makes Maine the only state that has this cost is less than $ 1,000 on average. For minimal coverage car insurance in Maine, drivers can expect to pay an average of $ 227 annually. Other states with cheaper car insurance rates than others (annually for total coverage) include vermont ($ 1,000 annually), Idaho ($ 1, 065 annually), New Hampshire ($ 1, 182 annually) and Ohio ($ 1, 200 annually).

With the annual side costs, some of the monthly rates for full coverage car insurance in the United States can also be alarming, including New York ($ 249.67 per month), Louisiana ($ 238.67 per month), Florida ($ 230.17 per month) and snowfall ($ 202.17).

According to the research and data of the team in Alan’s Factory Outlet, these were the only four states within their classifications where the average monthly full -coverage car insurance cost exceeded $ 200.

We care about your privacy, we use cookies on our website to provide the most relevant experience remembering your preferences and repeated visits. By clicking on “Accept”, you accept the use of all cookies.

Average Cost Of Car Insurance

This website uses cookies to improve your experience while navigating the website. Of these, the cookies that are classified as necessary are stored in their browser, since they are essential for the operation of the basic functionalities of the website. We also use third -party cookies that help us analyze and understand how this website uses. These cookies will be stored in your browser only with your consent. You also have the option of choosing not to participate in these cookies. But the option to get out of these cookies can affect your navigation experience.

The necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security characteristics of the website, anonymously.

Established by the consent complement of GDPR cookies, this cookie is used to register the user’s consent for cookies in the “announcement” category.

This cookie is established by the Cookies GDPR consent complement. Cookie is used to store user’s consent for cookies in the “analysis” category.

Average Car Insurance Rates As Of November 2024

The cookie is established by the consent of GDPR cookies to record the user’s consent for cookies in the “functional” category.

This cookie is established by the Cookies GDPR consent complement. He

Average car insurance rates oregon, average car insurance rates texas, average car insurance monthly rates, average insurance rates by car, average illinois car insurance rates, average maryland car insurance rates, average car insurance rates ohio, average car insurance rates massachusetts, average car insurance rates colorado, average arizona car insurance rates, average boat insurance rates, florida average car insurance rates