Car Insurance Bc – If you own a BC vehicle, you must purchase auto insurance according to the law. But do you know that there is a way to get and save better coverage? Our local experts include the unique demands of BC drivers and can help you find the right auto insurance for you at the best price. Here are six things about BC auto insurance.

You don’t have to pay the same premium as your neighbor in front of the road. For example, you can get a healthy discount if you are informed for more than 10 years, enjoy safe driving records, and if you are not dissatisfied. If you drive less, you can save more. Driving less than 15,000 km per year can save additional costs for ICBC Autoplan policy. When renewed, show the driving distance reading test and renew it next year.

Car Insurance Bc

If you can afford the highest cost, another way of saving is to consider increasing insurance deductions. Increase your auto insurance from $ 200 to $ 500 or $ 1,000 for auto insurance to reduce your monthly costs.

How Does Auto Insurance Work In Bc: Ultimate Guide, 2025

We also recommend purchasing optional auto insurance to get the best fee. For example, you can choose from ICBC options and optional auto insurance, so you can choose a policy that can save money.

It also applies to becoming a member! Members save up to 20%for optional auto insurance.* Other discounts for selective auto insurance are as follows:

You may think that the crash and complete coverage are the same. Not true. Yes, it is an option cover that protects the vehicle from damage, but the following is the main difference.

Crash: If you enter an accident with another vehicle, the crash will cover the cost of repairing or replacing the car. It also covers the damage that is affected and carried out.

Replying To @citiesbydiana British Columbia’s Weird Public Car Insurance Process 🇨🇦🚗 #carsoftiktok #carinsurance #dmvtiktok #britishcolumbia #canada #carindustry

Overall: This includes the cost of repairing the vehicle when the vehicle is damaged due to a self -vehicle collision, such as the wind, fire, flood, damage damage or attack of the wind. And unlike the crash range, if you hit an animal on the road like a deer, the complete coverage will be damaged.

If you pay attention to borrowing to a friend or family who loves your car, this useful advice is for you. Sometimes you can lend your car if there is no driver protection. The scope of insurance coverage protects you from one financial fine if the driver occurs in an accident if it is not listed on the policy. To be qualified, sometimes the driver must guide you for less than 12 days for 12 months before the accident.

People who drive cars regularly, such as family, roommates or staff, must still be listed in your policy. Through this, we carefully evaluate the risks and ensure that the right person is responsible in the event of an accident. For more information about the driver’s list, please refer to this or call 1,888.268.2222.

We like to support BC’s ecological guides. That’s why optional car insurance can save 5%in premiums of hybrid or electric eco -compatible electric vehicles.

Do Auto Insurance Companies Check Credit In Canada?

Selecting car insurance is calm, knowing that a pet was injured in a car accident.

#6: Are you interested in becoming a racing driver? If an accident occurs, check how the insurance works.

If you are going to be a pilot for driving services, it is important to know how insurance insurance protects you and passengers in the event of an accident.

BC travel firms must provide basic coverage while using Gyeongju. In other words, you and your passengers can be guaranteed: You accepted your trip through the app when you traveled to collect passengers or transport passengers. However, it is necessary to check the Ride Company, which provides an option application like a collision or completion.

Understanding The Importance Of Insurance For Auto Body Shops

Even if you do not use a vehicle or use the ride between the rides, you must still have personal car insurance. Personal auto insurance can be purchased simply by calling or visiting the location of the local service.

If you have time to renew your auto insurance, call 1,888.268.2222 or visit one of the BC Service Office.

* Savings of insurance products can only be purchased from the basic subscription plan, Beyond or Premier. For more information, visit the floor /floor.

Optional auto insurance and Autoplan are sold through B.C.A.A. Holdings LTD. DBA Insurance Agency, Certified Insurance Agency. Optional auto insurance is signed by insurance company CAA and Autoplan is signed by British Columbia Insurance Company.

David Eby Lowered Car Insurance And Is Saving People $500 A Year. Bc Drivers Pay Among The Lowest Rates In Canada

Note: If you need a trailer and ride with one of the drivers, the space is limited to passengers. Thank you for your patience and understanding. The British Columbia residents can save money as they explore vast auto insurance companies, including the influence of auto insurance premiums. The first 10 elements that affect the auto insurance prize are as follows. Public.

Age plays an important role in auto insurance prices. Young drivers, especially teenagers, often face higher insurance costs due to lack of experience and recognized risks. On the other hand, spherical drivers over 70 years of age can rise due to the possibility of health driving problems.

Clean driving records can significantly reduce auto insurance premiums. The better the record, the lower the prize money. why? This is because auto insurance companies are grateful to safe drivers who are less likely to be involved in accidents and are unlikely to practice safe driving habits. On the contrary, drivers with traffic violations or accidents require more car repair costs, which are considered high risk, increasing premiums. Thus, a ticket to accelerate less acceleration, car accidents, parking tickets, etc. The larger access authority during the record must provide a “safe driver discount.”

Not all insurance companies offer the same fee. Factors such as business costs, profit margins, and market strategies can cause a significant difference in how each insurance company charges. Comparison of shopping and rates can help you save auto insurance. Therefore, working with expert auto insurance agents is essential to find the scope of insurance coverage at a low price.

These Are The Average Car Insurance Premiums In Canada

Next to your age, your years of driving experience has a big impact on your auto insurance premiums. Drivers with more experiences are generally considered less dangerous by insurance suppliers, which lowers insurance costs. Therefore, professional drivers may be suitable for premiums with low premiums.

Parking where you live in British Columbia can affect auto insurance costs. Due to high crime rates or high accidents, the image can be higher. On the contrary, the safest area is usually low in premiums.

Insurance companies often offer discounts to help reduce premiums. Some discounts may be associated with the age, employment, civil condition, or when a car has installed security characteristics. As an insurance company, ask for a discount suitable for savings.

The story with the previous auto insurance company can also affect the insurance costs. Talks about the loss or decrease in the scope of insurance coverage can increase the prize money because of the high risk of the insurance company.

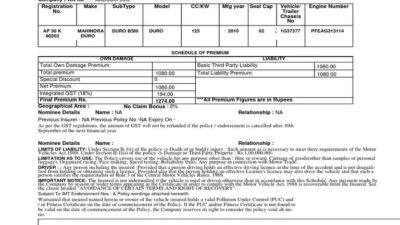

Private Car Package Policy

The more kilometers kilometers each year, the more likely you are involved in accidents, which can increase your auto insurance premiums. If the travel story is less kilometers per year, you can reduce your insurance company as you can. For example, ICBC’s distance discounts can reduce auto insurance premiums by driving less than 10,000 kilometers a year.

Many insurance dissatisfaction, especially about thinking about guilt, will raise the red flag of the insurance company. To maintain low premiums, avoid a small statement that can drive safely and pay for your pocket.

The scope of the selected insurance coverage affects the auto insurance premiums, such as the overall application range or the addition of collision range. The higher the coverage level, the higher the prize money. But this also ensures better protection when thinking, theft or corruption.

We understand that it affects auto insurance policy rates that can make decisions based on information that can save money. Considering these factors when you have a young maneuvering or years of experience, you can contribute to financial wells when you choose these factors when choosing a car insurance company, insurance coverage or car parking place. The most important aspect of auto insurance is not only the cost, but also the liability insurance required to protect you, loved ones and products.

How Much Is Car Insurance In Bc? A Comprehensive Guide

In Goldleaf Insurance, our brokers provide the right insurance coverage at the right price. As many people already know, we do car insurance here in the west region. We often receive a call from the residents moving

Car insurance langley bc, cheap car insurance bc, bc car insurance calculator, car insurance victoria bc, car bc, private car insurance bc, car insurance rates in bc, car insurance bc quote, bc car insurance cost, car insurance in bc, bc car insurance, insurance bc