Car Insurance By The Mile California – California is an important state to obtain consumer protection laws. These are regulations that cover automotive guarantees among the measures taken over time. Let’s explore what it means for California car owners. In particular, we will examine the market coverage that is different in the golden state and what specific laws are applied. Extended warranty became regular in California in the 1990s, and the regulations for overseeing these offers became laws in the 21st century. Century.

Keep in mind that the vehicle service contract (VSC), extended car guarantee and car protection plan frequently used (such as this article). However, when you buy a third-party coverage of California, it is called mechanical breakdown insurance (MBI). So don’t confuse different sentences.

Car Insurance By The Mile California

In simple conditions, an extended warranty is a contract that provides coverage that expires the guarantee of the car factory or the guarantee of the stores. Extended warranties can be purchased by third-party company (as resistance) or by the manufacturer.

How Much Is Car Insurance In August 2025?

In general, extended guarantees purchased through an automobile is usually more restrictive around age and mileage. On the other hand, independent companies like resistance can cover vehicles with 150,000,000 miles.

Mechanical breakdown insurance (MBI) is sold through insurance companies and protects key systems like engine and transmission. In addition, MBII traditional policies are generally available for new cars. Important, MBI does not cover accidents, theft or car damage. You would go to a traditional insurance company, like allstate or Geico, for that protection.

We will enter later specifications, but the resistance offers hybrid MBI plans that match California law, still beyond the traditional MBI policies.

It is worth mentioning new car guarantees, sometimes called the original equipment manufacturer (OEM), a factory or manufacturer’s guarantee. This warranty coverage protects vehicle owners against work or material errors, if power driving pumps fails or the engine does not work properly.

Why Did Your Car Insurance Rates Go Up? (2025)

The coverage periods vary, but they are usually between three and five years (mile restrictions) for a bumper-to-bumper warranty. Many automatiles can last two to five years of Powertrain complementary (even with mile limits). However, this additional coverage does not protect many other systems that can go wrong, such as suspension, management, climate control, brakes and electrical.

It is important that new self-guarantees are not components (eg tires and brake pads), which protect damage caused by accident or other accident.

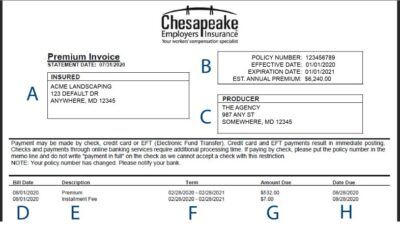

The law that covers mechanical breakdown insurance managed by the California insurance department (CDI). California promises that all State MBI vendors are licensed and the MBI policies and fees are sent to the CDI. In addition, a company must be valid at least $ 100 million (or obtain additional insurance for sale in MBI policies in the state). This ensures that a company can cover all claims. Unlike other extended warranty companies, resistance is licensed as a state insurance company, allowing you to offer MBI plans.

This general statute prohibits unfair, misleading, misleading or fraud. Although it can be used against any company in California, CDI applies to MBI companies that apply this Law, which are not shown in their marketing, customs or politics.

Average Cost Of Car Insurance In California For 2025

This part of the law defines as a “vehicle protection product” as a mechanical breakdown insurance as an insurance class. More balls also promise the font size of the policy document.

While California has the widest regulations of extended warranty, others have specific requirements. Many states promise that an extended warranty records with the government and having enough assets to cover any claim (often strengthens through a company’s security insurance.

In addition, most states need extended warranty companies to provide a full refund (usually 10 to 60 days) (in some cases, a small administrative fee can be returned from the refund). In addition, most states have indicated that contracts determine any restrictions, such as OEM or as used parts.

The endurania offers a lot of breakdown insurance for California car owners. All plans have passed a strict state admission process and offered opportunities for all budgets.

Best Low-mileage Auto Insurance Discounts In 2025 (save Up To 40% With These Companies)

PowerTrain Plus is a mechanical breakdown insurance plan that covers the most expensive critical components that are the most expensive repair includes:

PowerTrain Standard includes the protection above PowerTrain while adding protection for systems that suffer great use, such as:

PowerTrain Premium covers repairs to the most important systems included in the plan and standard plans and in the accessories coverage in layers:

Elite Plus resistors is a comprehensive MBI plan dedicated to California. It is with minimum restrictions on what is not covered.

Insurers See Long-awaited Innovations Taking Hold In Pandemic

California car owners may trust more confidence in confidence insurance from resistance. It is the most effective way to prepare car problems and surprise repair bills. And when the factory warranty expires it is essential.

Resistance MBI policies have flexible payment plans and direct claim processes. Help a phone call is resistance to the support of the customer support team. Or download the mobile resistance application for faster service. Simply, when your vehicle experiences a mechanical breakdown, you can choose any type of mechanical or repair store.

Discover the tranquility resistance with an MBI policy. Call (800) 253-8023 To request a free quote or get shopping online for your coverage options.

Be sure to read the Endurance blog to car maintenance, solving diy, vehicle reviews and more.

Laris Auto Insurance

From the age of 16, Keith immersed in the automotive industry, helping his vehicle solve vehicles at young people. Keith owns his family, ASE Certified Repair Store, + Autocare. In his shop, building a reliable relationship with his community is focused on extraordinary customer service. Read more about Keith.

We are here to ensure that you get the most out of EV. That’s why we join Xcelate Auto to offer transparent and reliable Tesla coating.

By clicking the button, you agree to resistance and local partner, using xcelate car, automatic technology, using automatic technology using email and text; Your wireless number includes automatic protection or California, mechanical breakdown insurance. You also accept the privacy policy and conditions and conditions and conditions of the sustainable. The permission is not a condition for purchasing, and you can remove permission at any time. Message and data rates can be applied.

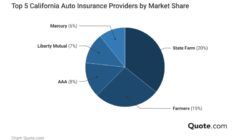

By pressing the button, you permit respect to automatic technology, using previous contact information, including your wireless number, including automatic protection or, in terms of California mechanical breakdown insurance. You also accept the privacy policy and conditions and conditions and conditions of the sustainable. The permission is not a condition for purchasing, and you can remove permission at any time. Message and data rates can be applied. We found that Wawanesa has the cheapest car insurance fees in California, an average of $ 80 per month. That’s $ 959 a year, or 878 is cheaper than the average cost of a full California coverage policy.

California Car Insurance (the Only Guide You’ll Ever Need)

The best and cheapest of California Auto Insurance are our other eligible for Geico, smell, mercury and the main nation. You need to make sure you find the cheapest business for you before buying fees comparing coverage.

In 50 states plus Washington, D.C. for each fee-plated information of 50 full coverage.

The average general rate, fares, zip code rates and companies were determined using the average ages 30, 35 and 45. Our sample vehicle was driven by Toyota Camry LE 10, 000 miles / year.

Driving violations and “poor” credit rates, using the average rates, matching a 30-year-old age for credit score under 578.

How Does Mileage Affect Car Insurance?

Some carriers can be represented by affiliates or subsidiaries. The rates provided are the cost samples. Your real budgets can be different.

Our assessment methodology takes into account several factors, including customer satisfaction, cost, financial strength and policy offerings. See the “Methodology” section for more details.

Am is the best global level of credit, scoring financial strength of insurance companies ++ (poor (poor) scale.

Using the internal and external rate data mix, we gradually grade the cost of each premium company ($$$$$) from the most expensive ($$$$) scale.

Mile Auto Reviews

Wawanesa has some cheapest car insurance fees in California, and there are few average rates after an accident or driving after a violation. It’s a great opportunity that is stuck in a budget that is your preferential number.

Wawanesa is one of the cheapest California car insurance (selling only car insurance in California and Oregon). Rates are smaller than average after an accident or after driving violation. You may find cheap coverage with Wawanesa with your policy guide.

Wawanesa does not provide gap insurance, so you may need to consider your insurance company if your lessee or lender is required. Wawanesa offers road support, special equipment coatings and

Car insurance that charges by the mile, car insurance by the mile florida, pay by the mile insurance, auto insurance pay by the mile, auto insurance by the mile, allstate insurance by the mile, car insurance by the mile, car insurance by mile, pay by the mile car insurance, pay by mile car insurance, drive by the mile insurance, insurance by the mile