Car Insurance California Price – There was a time in the United States when driving was an activity in itself. Teens would cruise the main feature of their friends and dates. Families were to pack the car for Sunday styles in the countryside. But around the 1970s there was a shift. People began to look as more a tool than a hobby or a leisure activity.

Fast until today. For many people, driving is necessary as a means of getting to and from work, transporting family members and acting groceries and other necessities.

Car Insurance California Price

But from long commuters to gridlocked traffic to carbon footprint, there are not many positive things we associate with driving anymore. In fact, many califiners seem to suck – and drive less and less because of it.

California Insurance Quotes?

Many caliphonies report that they are driving less today than they did five years ago – but we wanted to learn more about why. It turns out, their causes are varied. This is what we learned.

No surprise here. Anyone run in California (especially during rush hour) has a story of being forced to share the road with an aggressive, roady or just bad driver.

In our survey, we found that 39.1% of Kalifornians drive less now than they did five years ago because of poor drivers. Of them,

⮕ Is traffic school worth it ⮕ How long is the traffic school? ⮕ How much does the traffic school cost? ⮕ DMV-approved traffic schools ⮕ Traffic School Campaign code

Best Car Insurance For 25-year-olds: 2025 Picks

The American Society of Civil Engineers (ASCE) collects annual “Report Cards” on American infrastructure, including roads, bridges, highways and more. In 2017, the last year that data was released, ASCE found that the country’s infrastructure was on average a D+ character, which means that the infrastructure conditions were “mostly below standard”, and showed “significant deterioration” and “strong risk of failure.”

In California, the roads make many drivers choose to stay outside them. 39% of California drivers say they drive less today than they did five years ago due to poor road conditions. Of them,

This is another matter that appears to be more important for men – 43.6% of them say they drive less due to bad roads, compared to only 35% of women.

Young people are also much more likely to drive less because of this problem – 47.3% of them, compared to only 33.2% of older drivers.

What The Bleep Is Going On With Texas Home Insurance?

California is known for its traffic. In fact, the state consistently ranks among the worst in the country for traffic and commuting times. According to the exaggeration, 87% of California’s urban highways experience regular traffic overload – almost twice the national average of 47%.

So it should come as no surprise that more than half of the state drivers – 54.9% – say they drive less now than they did five years ago because of traffic. Of these

Men and women were quite likely to stop driving due to traffic, but young people are much more affected by this than older drivers – 60.2% of young drivers say traffic has made them drive less, compared to 49.5% of older drivers.

We know that passenger cars and gas production are some of the best contributors to carbon emissions in developed countries. But what we learn is that many drivers in California are willing to change their driving habits to reduce the environmental impact.

Putting A Price Tag On The Risk Posed By Ridesharing Drivers

Surprisingly, the environmental impact is more important for younger drivers than the elderly. As many as 50% of young drivers said they have adjusted their driving habits to reduce the environmental impact, compared to only 34.75% of older drivers.

AI-driven and autonomous (or “self-driving”) vehicles have made some scary headlines in recent years-especially when involved in crashes. The reality, however, is that more and more of these cars are on roads and companies such as delivery and Rideshare services are looking for ways to incorporate self-driving vehicles into their fleets.

Our study shows that California drivers are nervous about this-27% of them have reduced driving compared to five years ago because they are concerned about the increase in AI-powered and autonomous vehicles. We also found out that caliphonies who are concerned about self -driving vehicles are more likely to stop driving completely than just reducing the time spent on the roads.

Once again, men are much more likely to take this problem seriously. 34.4% of men said they are driving less due to the increase of autonomous and AI-powered vehicles, compared to only 20.5% of women.

Clearcover Car Insurance

It’s no secret that a dollar just doesn’t go as far as it once did. In the midst of increasing inflation, higher living costs and stagnant salaries, many califiners drive less to save money.

In total, 47.2% said they are driving less now than they did five years ago because of the cost of driving and owning a car.

High costs especially affect young people. 51.5% of young drivers said they drive less than five years ago due to the cost of driving, compared to 44.2% of older drivers.

A barrier to driving so many caliphonies is facing is to find a place to keep a car. California has a large number of people living in apartments and cabins that do not have driveways or garages. Nearly a third of the state’s stations – 28.7% – said they are driving less today than they did five years ago because of problems that store their car. Of these

Ontario Motor Vehicle Industry Council On X: “thinking About Buying A Used Car? Here Are Some Top Tips To Help You Make A Smart Purchase! Your Next Car Should Be A Great

There has been a used car shortages in the United States for almost a year now. In recent months, new cars have also been in short supply. This affects califinated driving decision.

13.4% of drivers said they are driving less right now because they do not find a car in the current deficiency.

And since car prices skyrocketed, 15.3% said they are currently driving less because they just can’t afford a car. This was especially true for young drivers – 21.2% of them said they can’t afford a car right now, compared to 11.2% of older drivers.

By using Pollfish.com, we examined 1,000 current California residents in late July 2021. By Suzanne Blake is a reporter based in New York. Her focus reports on consumer and social trends, which ranges from retail to restaurants and beyond. She is educated at UNC Chapel Hill and joined in 2023. You can get in touch with Suzanne by sending e -post to s.blake@. Language: English authors side Suzanne Blake

Auto Insurance San Luis Obispo, Ca

Based on facts, either observed and verified from the first -hand of the reporter, or reported and verified from knowledgeable sources.

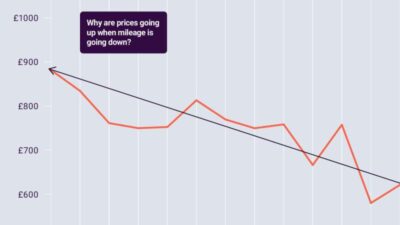

The latest consumer price index shows that car insurance has 20 percent over years. The wave in prices happened after years of gradual price exchange, with previous reports that found prices grew by 36 percent since 2020.

It is at the same time as debt steps for many Americans. While Americans hold around 1.75 trillions in student loans alone, they also have $ 1.05 trillion in credit card balances that have not been paid.

In an air photo, brand new Honda cars are shown at the Honda Marin’s sales place on February 6, 2024, in San Rafael, California. Car insurance prices have increased 20 percent lately … In an air film, brand new Honda cars are shown at the Honda Marin Marin sales venue February 6, 2024 in San Rafael, California. Car insurance prices have increased 20 per cent over the past year.

Price Controls Cause Insurance Shortage In California

In addition to inflation, Americans face sharp car insurance trips and may have to make difficult decisions to afford to be on the road.

Because car prices generally have skyrocketed, more Americans keep their current cars longer. This means that expensive repairs can be more likely, and the car insurance companies have adjusted prices accordingly.

“Insurance companies took decisive measures in 2023 to adjust prices with insurance loss trends,” said Betsy Stella, CEO of carrier management and business at Insurify, said

“Consumers will continue to feel the effect of increased premiums when their guidelines renew during the first part of 2024.”

Average Cost Of Car Insurance In August 2025

Bank rate found that the average cost of car insurance today in America was $ 2, 500 annually. This is in stark contrast just three years ago when the average hovered to $ 1, 700.

Back in 2020, when the pandemic saw Americans run with record low prices, car insurance companies could lower prices. But right after the roads opened again and people returned to their normal routines, the prices were run again, and now many are struggling to keep up with payments next to inflation.

“With the pandemic in the back mirror, Americans travel more, including by car,” Stephen told Henn, an economics professor at Sacred Heart University, to

A decrease in the supply chain and ongoing lack of labor has also pushed the insurance industry to implement price increases on customers, said Insurance Quotes.com analyst Michael Giusti.

How To Get An Anonymous Car Insurance Quote

. “When the supply chains collapsed, things like tile shortages led to fewer vehicles.

For several quarters, the insurance companies felt the financial effect, and now they pass it on to the consumer, Giusti said.

“None of it even mentions the higher medical costs they have