Car Insurance Comparison California – Wawanessa has the cost of the cheapest car insurance in California, with an average monthly cost of $ 80. It is $ 9,59 a year, or $ 878 less than the average cost of trackage coubagage coubageal.

The other friends for the best car insurance and the gallery in California is Geico, Asa, mercury, and public nationality. You must compare the price before buying coverage to find the most cheap company.

Car Insurance Comparison California

We analyze a car insurance premium offered by quadhrant information services for all zip code in all 50 countries, as well as all code Zips in Washington in Washington in Washington, D.C.

Information Needed For Car Insurance

The companies have determined to use all average speed, costs by postcode, and average for driver dries 30, 35, and 4.000 miles.

“Direb” SKS specified using the cost driving and the average rate of a single 30-year-old and credit score less than 578.

Some carriers can be represented by affilies or canigiah. The fees provided is the cost of sample. Your actual quotation can be different.

Our previetuol methods performing some factors, including Celebrities, costs, financial power and policy delivery. See methodological parts for more information.

Brace For Impact, California Drivers! Car Insurance Rates Set To Skyrocket. Here’s Why

America is a global credit rating institution with American financial power

Using the combination of internal and external speed data, we thought the premium fee of each insurance on the most expensive scale ($$$$).

Wulanma has some cheapest car insurance rating in California, but the average feet is lower after accident or driving violation. If attach your budget are your number priority, it’s a good choice.

Wawanesma is one of the CALIFORNIA MOTIONS INALS INALLIA (it’s a car insurance management only in California and Oregon). Level lower levels of average even if disaster or shelter. You can also find a cheap requirement in Wawanese with your policy with a steel driver.

Factors That Affect Your Car Insurance Rates In California

Wawanessa does not offer a gap insurance, so if you need a lender, you may need to consider other insurance companies. Wawanessa offers a road desred, a special tool designate and part-part of the shoe legs.

The cost of insurance paint facilities from the Wawanessa in California susndi $ 80 a month or $ 959 years of year, which is 48% cheaper than the statewide average.

Teico, even for risk drivers, causing average in California. In-Applications and convenience set before competitors.

Geiko is the best car insurance company in California thanks to the prices and wideous content. Geico has a low average level for California drivers with a poor credit or a recently shown driver at home.

Glendale, Burbank Insurance Rates Among The State’s Highest

I also like Geico Mobile app. This allows you to estimate that your vehicle can be required after accident. Although it is one of the largest insurance companies in the country, Geico has a customer complaint instead of hope.

Moderator Cars of Geico in California is $ 122 a month or $ 465 years, which is 20% cheaper than the average of the Statue.

USAA has some best car insurance tribes in California. Add to basic basic gangkro insurance, but probably enough for the most driver.

If you are a military activity or retired member or military family member, USAA have the best car insurance in California. Usena also offers a gap coverage. This is necessary if your car has a loan or lease.

Do You, Or Someone You Know, Need Affordable Car Insurance? Starting In 2025, You May Qualify For A State Of California Program Offering Lower Auto Insurance Rates! This Program Provides Affordable Liability

USA also has a good customer service with high-score score from useless to national insurance prisailix, they receive the average number of complaints against the industry.

Car insurance costs in the United States in California is about $ 125 a month or $ 502 years, which is less than the average reswy state.

Verbs offer more additional drivers and supports from key companies, but if your records have an accident or driving violation of the Customer Call in California.

Rampt is one of the car insurance company in California due to low average costs. If you are injured, DUI, or violation of the driving is not in your record, you can find a car insurance that falls in the medicine.

Why Did Your Car Insurance Rates Go Up? (2025)

Melkure offers several different discount options, including savings to enroll in automatic payment, pay for annual insurance bills, or list of idkure insurance options.

The cost of the race of the race of Ebluria in California $ 12 months or $ 520 years, is 17% cheaper than the average of the steak.

The National General is primarily known as non-standard insurance company, but offer insurance if you have never been injured and has not been previously experienced.

National General is a Top Cars Insurance Company, especially if you struggle to find the common public date coverage for a very average risk driver.

Dui Impact On Car Insurance In California

Reported from public nationals very easily. It means that has been a lot of rooms to increase the road stoke and exaggerated customizing rather than death. However, if you want a simple policy, this can be true for you.

Usually car insurance costs of national nationals are $ xx per month, xxx per year, which xx% is cheaper than average all the situation.

According to J.D. Pratident autp ibhent autp crab is auto, wulanesa is the best car insurance company in California. The corporate ranks based on price, transparency and satisfaction of all. [1]

Individually and the merger is some of the other for the best and honest company in California. Because they offer the cheapest average price and the electric score J.D.

Cheapest Car Insurance Rates By State For 2025

Compared with parents’ partners, young adult drivers usually have high insurance prices. That’s because the lack of experience behind the wheel means they are more likely to get injured and admit from longer drivers.

Choose the best car insurance company for you not difficult. There are several factors, including:

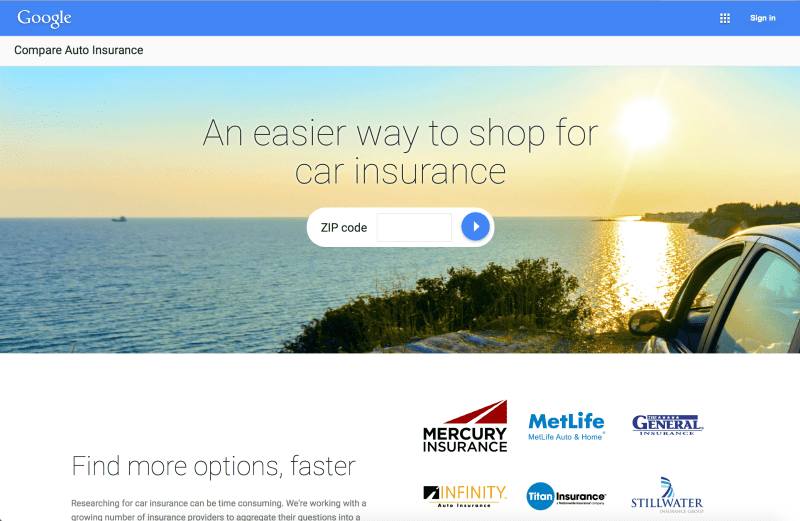

If you get ready for shopping as the assumptions, it can help you compare the choice and find the correct insurance signal that matches your needs with your needs.

?strip=all)

To share the accident or traffic ticket work more expensive cars and may be very difficult to find a car insurance if you are considered a high driver.

Why Are Car Insurance Rates Increasing In California And What Are Some Alternative Insurance Options?

Wawanessa is the cheapest car insurance company in California if there is an accident or driving violation on your notes. If you do not find the cover, consider the policy on the Camp, the high risk market is california.

Wawanessa is the cheapest car insurance company in California after a disability accident. The car insurance cost from Wahanesa after accident is $ 124 per month or $ 488 per year for execution accidents.

If you have DUI on your notes in California, the cheap car insurance company is Wawanesa. Fixed, car insurance from WESTANESA after the cost of drunk charges are drunk $ 146 a month or $ 748 a year.

The cheap car insurance after a speeding ticket in California is Wunuresa. Average, AWANANESA costs $ 117 a month or $ 399 a year for tickets.

Cheapest Car Insurance In California For July 2025

Some Seller Supplements of the state of condition based on their credit score. In the face, this is due to the driver with low credit score easier for claims, but in fact, they cannot be considered a driver. As a result, Californic recognition prevents concerning from rating based on their credit history.

Automated Wine Adjustment in your area destroy into about Dance, Population density, the amount of close accident, and other factors. This is the cheapest car insurance company in California 10 the most sophisticated city.

California requires that all people have vehicles in the country carry one of these types of cars:

The driver is choosing to carry out responsibility for responsibility must have an insurance level that is required in situations.

Car Insurance Rates Are Skyrocketing In California! 🚗💸 Expect A 54% Increase This Year In 2024, According To A Recent Study By The Insurance Website Insurify. As Of June, The Average Annual Cost For

The driver is other than the minimum of the responsibility of responsibility will be suspended by the situation. This means that you are not valid or your car park on the public road.

To provide the advantage of the flowers of flowers, california insurance requirements is very low. This means that if you are not responsible for the injury more than a four bender of the bender of the fours, they can’t provide sufficient meal.

Further, the country does not follow that it is carrying anything from basic physical injury or property coverage belonging to property property. This means that maintain the minimum level of noda not covering their vehicle damage and will not have protection against the uninsured or unbelievable driver.

As in 2019, 16.6% driver in Calerifornia street is not enough, so to protect yourself by performing the full coverage of more important.