Car Insurance Comparison Hk – What is third -party liability insurance (TPL)? Comparison of frequent questions insurance | Third -party insurance compared to comprehensive insurance affects the cases of high -end car insurance | Can car insurance be rejected? Common questions

As a car owner, car insurance is an essential cost. But how should you choose the right policy? What is the difference between third -party insurance and comprehensive insurance? How do insurance companies determine the premium? This time, will provide a detailed explanation of the scope of the third party insurance and comprehensive insurance, factors affecting the insurance premium and the reason for the refusal of insurance, helping you choose the right car insurance program.

Car Insurance Comparison Hk

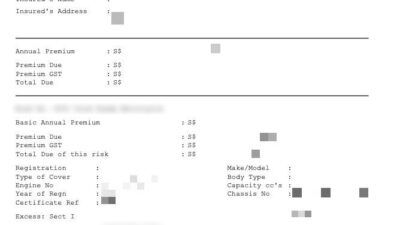

According to Section 4 of the Ordinance on Motor Vehicle Insurance (third -party risks) (Cap. 272), all vehicle owners must buy third -party insurance (TPL). This insurance includes “injuries or third -party death liability” and “third -party property damage”, protecting the contract owner from legal debts in the event of an accident that causes injury or death for third parties. The minimum amount of insurance is 100 million HKD.

Affordable Full Coverage Auto Insurance

Because third -party insurance only includes injury, death or property for third parties, the owner of the car must bear the entire car repair cost if they have an accident. Therefore, many car owners choose comprehensive insurance, providing broader protection, including insurance for their own car.

Young or inexperienced drivers are considered to be higher risk due to greater accidents. Therefore, insurance companies calculate the premium higher and may apply deductions.

Old cars are often less reliable and related to higher risks. Insurance companies often add surcharges for cars over 10 years old.

For comprehensive insurance, compensation is based on the value of the car market. Higher value cars increase insurance responsibility, leading to higher insurance premiums. Luxurious sports cars or vehicles require imported parts tend to have more expensive insurance.

The Electric Cars That Are Most Expensive To Insure

High -performance cars with greater power and engine speed, causing higher accident risks, making third -party insurance more expensive.

Some industries, such as construction workers, often drive into high -risk areas such as construction sites, leading to higher insurance premiums or policies than office workers.

A deduction is the amount that the contract owner pays before the insurance company includes the remaining requirements. Policies with higher deductions often have lower premiums.

Insurance companies consider a driver’s claim and the history of traffic violations when determining the premium. A clean record leads to lower insurance premiums.

Is Your Job Title Increasing Your Car Insurance Costs?

Drivers are not allowed to discount (NCD) without claims during the policy time with high -end discounts:

Insurance companies assess each driver’s personal circumstances when determining insurance and insurance premiums. If the applicant has a poor driving application or many claim history, they may be denied insurance. Some insurance companies also refuse young drivers or people with less than two years of driving experience to minimize risks. In such cases, even if the scope of insurance is granted, the contract owner may face extremely high insurance and deduction.

If a driver has previously been denied insurance or canceled their policies, it may be difficult to find another insurance company. To avoid this, drivers should maintain a clean driving profile by alert and avoid accidents.

For younger P-drivers, a good strategy is starting with third-party insurance and transferred to comprehensive insurance after holding a full license for two years to save insurance premiums. In addition, they can be added as a driver named after a more experienced driving policy (for example, parents) to reduce costs.

Moneyhero Offers End-to-end Car Insurance Purchase Journey In Hong Kong Through Strategic Partnership With Bolttech

In addition to considering high -end costs, policy owners should compare options and exclude insurance to find a plan that best suits their needs.

There are more than 20 years of experience in the car insurance industry, comparing quotes from more than 60 insurance companies in Hong Kong. Use our online quotation tool right now to receive free car insurance quotes!

The above information is only for reference. Not responsible for the accuracy and timeliness of information. For the scope of insurance, the method of compensation, the benefits and high levels of any specific insurance program, please refer to the relevant policies.

As a motorbike insurance broker company is licensed with more than 20 years of experience in insurance. The company tries to simplify insurance and choose the best insurance packages for customers to suit their budget and insurance needs.

Tips For Buying Home Insurance In Hong Kong, How To Choose The Best Coverage For Your Home?

Providing a range of insurance products, including car insurance, motorbike insurance, cross -border insurance between Hong Kong and mainland China, home insurance, travel insurance, domestic assistance insurance and voluntary health insurance. The group has been named “Best Car Insurance Broker” and “Outstanding Leadership Awards” by different media over the years.

What is the Table of CONTRAings for the Liability Insurance of the third party (TPL)? Comparison of frequent questions insurance | Third -party insurance compared to comprehensive insurance affects the cases of high -end car insurance | Can car insurance be rejected? Common questions about questions include a comprehensive plan including your car, as well as the damage you cause for cars or property of others. It also includes repair costs for car damage, accidents and medical costs, as well as third -party debts. Our motorbike insurance is designed to bring you peace of mind. Quote

Enjoy the free cash cash voucher of HKTVMALL is valued at up to 1000 Hong Kong dollars when you buy a motorbike insurance package directly on this site. T&TS applies.

Receiving your car is insured with Allianz and enjoying the 24 -hour free emergency support with 10%discount. This special offer is exclusively to buy on this website.

Comprehensive Auto Insurance

We especially customize the scope of free insurance for your own charger for comprehensive engine plans for your Tesla car and your electric car. Receive fast quotes for your electric vehicle insurance today!

Receiving insurance with HKMB HK across the border of the compulsory motor vehicle (traffic compulsory insurance) and additional insurance provides you with additional insurance and protection.

No discount requirements (NCD/NCB) are discounts for your car insurance premium that your insurance company can provide as a reward for not making a request against your policy. Normally, you earn a year of NCD/NCB for each year you do not require your car insurance.

If I insurance with Allianz, can I bring NCD/ NCB from the old insurance company?

Which Car Insurance Sites Help You Find Cheap Car Insurance?

If you are thinking of your car insurance with Allianz, you can bring your NCD/NCB from your old insurance company to reduce general costs for your insurance premium.

No, NCD/NCB cannot be transferred to others except your spouse, provided that your spouse is buying a new motorbike insurance program with Allianz. This is a one -time transfer and it cannot be reversed. After the transfer, your NCD for your current engine insurance policy will become 0%.

Car insurance exceeds the amount you need to contribute to the cost of your car repair if you make a request. To make car insurance more reasonable for everyone, we include an exceeding your policy.

There are many different types of redundancy depending on what your requirements are related, who are driving your car and the type of cover you have chosen. If your request is for many accidents or events, you or the driver will have to pay for each accident or event. You can find the amount of each excess that you will need to pay for your policy schedule.

Bmw Financial Services: Premier

Correct. The 24 -hour pull service is automatically embedded in our insurance programs, even if you only buy third -party insurance.

When giving you a extension, we will send you a car insurance notice at least fourteen (14) days before your extension. Make sure you consider your extension notice, as the premium will change from year to year based on changes to the rating factors and repair costs or services. Please make sure your details are accurate and updated.

You can cancel the policy at any time in seven (7) days of notice and (provided that no requirements arise during the current insurance period), you will be returned to the insurance premium less than the insurance fee is calculated at the short interest rate of Allianz in this period of effective policy.

If you decide to sell the car and plan to buy a new car, you can cancel your current car insurance and get a refund of Pro-Rata when you buy a car insurance for your new car. However, if you do not have a plan to get a new car, you will need to contact your insurance company to cancel your policy.

Best Car Insurance Singapore

4. You change the use of your motor vehicle (for example, changing from domestic society and joy to business use)

5. For support during non -business hours, please call Allianz’s 24 -hour emergency hotline as prescribed in the policy schedule.

Can you provide a hard copy of the policy document because I need to send it to the transport department and hire a purchase company?

You will get via email an Allianz policy package including policy schedule and insurance certificate. Such electronic policy documents serve the same purpose as the copies of paper and you can use them for the aforementioned purpose.

Car Hire Insurance Usa & Canada: Daily And Annual Plans

Do I need to send any support documents when I buy a motorbike insurance package on the site?

You do not need to send any support documents at the time of purchase. However, before you confirm and pay for the plan, it is a requirement to read and agree with the terms and conditions and statements, as well as ensure all the information given in the form is true and complete to know.

Comparison car insurance quote, car insurance comparison website, car insurance massachusetts comparison, car insurance comparison rate, comparison car insurance site, nerdwallet car insurance comparison, car insurance comparison tools, free car insurance comparison, car insurance comparison calculator, car insurance california comparison, car insurance comparison colorado, company car insurance comparison