Car Insurance Comparison In Uk – Comparison of insurance providers can be difficult and time-consuming. So we have done the hard work for you. When you get a quote, we will compare the best temporary insurance quotes. When comparing temporary insurance providers, multiple factors must be considered, such as surplus, maximum coverage, coverage, customer satisfaction and review. Although there are many differences between different insurance companies, the most important factor for most customers is price.

Getting the cheapest temporary car insurance can be a challenge, so we’ve simplified you here. We have shopped, compared prices to all the great competitors out there, and have results in the name of transparency:

Car Insurance Comparison In Uk

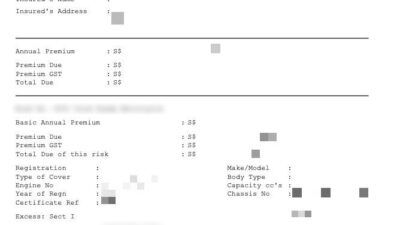

As you can see from the infographic above, they are the cheapest one-day car insurance providers. Our daily insurance starts at a lower price than any of our competitors. While this suggests you may get the cheapest price, of course, each risk is different, but every offer is different, which should be an indication, not a guarantee. If you get a quote, it only takes 30 seconds, and this is the best way to know how much temporary car insurance you are actually spending.

Insurance Comparison Uk Hi-res Stock Photography And Images

Remember, price is not everything! While it is great to get the cheapest price, you also need to make sure you get the best conditions and coverage. You can read all information about our terms and documents here. I played a lot in April. According to the name, the increased bills, expensive grocery stores and fatigue in overall life feels like “terrible April”. But if you are a driver, there is a silver lining on the horizon – car insurance will eventually be able to guide the right direction.

When we attacked in early 2024, auto insurance became a real pain, and we had another thing, it squeezed the already stretched family budget. Chocolate is also rose! But now there is hope, as the latest record-breaking car insurance premiums have finally begun to drop.

Here is the title: The average car insurance premium in the UK is £777. It’s not cheap, but it’s certainly better than the nearly 1,000,000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000

These are not just country data showing falls – so far, our own customer data shows positive signs. More than half (56%) of customers view

A Great 5 Star Review From One Of Our Customers! Visit Quotezone.co.uk To Compare Insurance Quotes For Car, Home, Van And Many More!”

Recovery this year offers – at least 5% cheaper than in 2024. Only 10% of pain hiking 25% or more.

Let’s do our best until the end of 2023, when the average car insurance premium reached £995. It’s a record-breaking premium that is indeed stuck.

Fast forward and premiums are about 164 pounds, or about 17% compared to March 2024. Since the beginning of last year, chaotic supply chains and rising repair costs have risen during tough inflation periods.

We still haven’t returned to the prices we saw before the pandemic, but the trend has been lowered and is very popular.

Buying A Car Is A Significant Financial…

Good news, if you just tighten it on the steering wheel: the young driver finally has a break. People between the ages of 17 and 20 will notice some of the biggest drop in premiums. Here’s what to look at:

Of course, these prices are still high compared to older drivers, but that’s the lowest, and it’s almost two years old.

If your offer is higher than expected, you are not alone. Not everyone benefits from the fall – there is still some huge pressure to keep the price going.

Industry load. The average claim rose 13% to £4,900, while repair costs hit a record £7.7 billion – an increase of £1.5 billion from 2023.

Understanding Car Insurance For New Drivers

Modern vehicles are more complex, which means they are more expensive to repair. As electric cars become more frequent, the cost is even higher. While premiums usually drop, everyone is different.

A way to make your quality hard work – especially when renovating. Here are some tips to help with trimming costs:

If you need to make a request, make sure it is still affordable. You can also see too much protection that can stop you from surplus if you need a claim.

Experienced drivers in politics can sometimes reduce your premiums. Make sure anyone owns a car and drives at most, avoiding pre-examination is the holder of the policy.

Uk Insurance Prices Continue To Fall Despite Traffic Returning

Agents, like in Howden, can help you find the best value for your driver’s special needs, and even find policies and businesses that you won’t be online.

We definitely hope so. After months of fate and melancholy cost, it’s refreshing to see car insurance in the right direction. Whether you are a new driver or have been on the road for decades, your next renovation may be a bit more painful than the last one. In 2024, auto insurance is more expensive than ever. So it is more important than ever to find the cheapest car insurance for you. Insurance in the UK is mandatory. No one should not use public roads without insurance. If you can pay a lot of fines. In some cases, you may even lose your car. The only time you may not have car insurance is to declare it as road driving.

This means it is not used and therefore may not be available. There are a wide variety of car insurance companies from the cheapest to the cheapest. The price range for minimum car insurance is between £281 and £333 per year. Various factors affect the quotes everyone will get. It is important to compare insurance offers from different companies before deciding on one.

The biggest advantage of cheap car insurance is saving money. One of the factors that affects your insurance price is the insurance provider. Another factor that affects the cost of your insurance is the insurance group to which your car belongs. The car model affects the insurance you pay for it. There are different types of cars, depending on which group they belong to, and their insurance costs vary. The cheapest car insurance will be the car insurance issued for cars belonging to the lower group. This means that insurance companies will spend less on insurance. Cars in lower groups should be less risky than this situation and are cheaper. High-rise cars spend more on insurance. This is because they are considered high risk, and they can also have expensive spare parts, and replacing them is expensive. Many factors determine the group A that belongs to. For example, damage, replacement parts, repair costs, repair time, new car price, capacity, braking and safety. There are only three basic levels of auto insurance coverage. The first is comprehensive insurance, which is the highest insurance available to a car. Protect all types of damage and protect drivers and second and third parties. The average cost of fully comprehensive insurance is £555. The second category is third parties, fire and theft. These policies only provide coverage for third parties involved in the accident. Third person, fire and theft. It can also protect your car if theft or fire is damaged. Third person, fire and theft. On average, it costs about £841. The third basic insurance level you can get for your car is third-party coverage. This is the minimum legal requirement you have to drive on public roads and is usually the most expensive species, especially for new drivers. The third-party cover provides coverage for others affected by the accident and its cars and property. The average cost of coverage for third parties is about £1, £157. The three best national companies that offer quality services and cheap car insurance include AXA, Direct Line and LV =. The actual price you pay varies depending on your location, type of car, driving history, etc. Of all three, the cheapest is AXA (SwiftCover), and the average offer costs as much as £ 281. This is about 18% cheaper than the direct line (privilege), which costs an average of around £ 299 and more than 30% cheaper than LV = with an average range of £ 333. In addition to AXA, LV = and Direct Line, there are seven other insurance providers known for their cheap and excellent service.

Average Cost Of Car Insurance Uk (2025)

SwiftCover was founded in 2005. SwiftCover was originally a virtual insurer and wanted to provide customer insurance with good value. Swiftcover is reportedly the first UK company to allow its customers to print car insurance certificates instead of