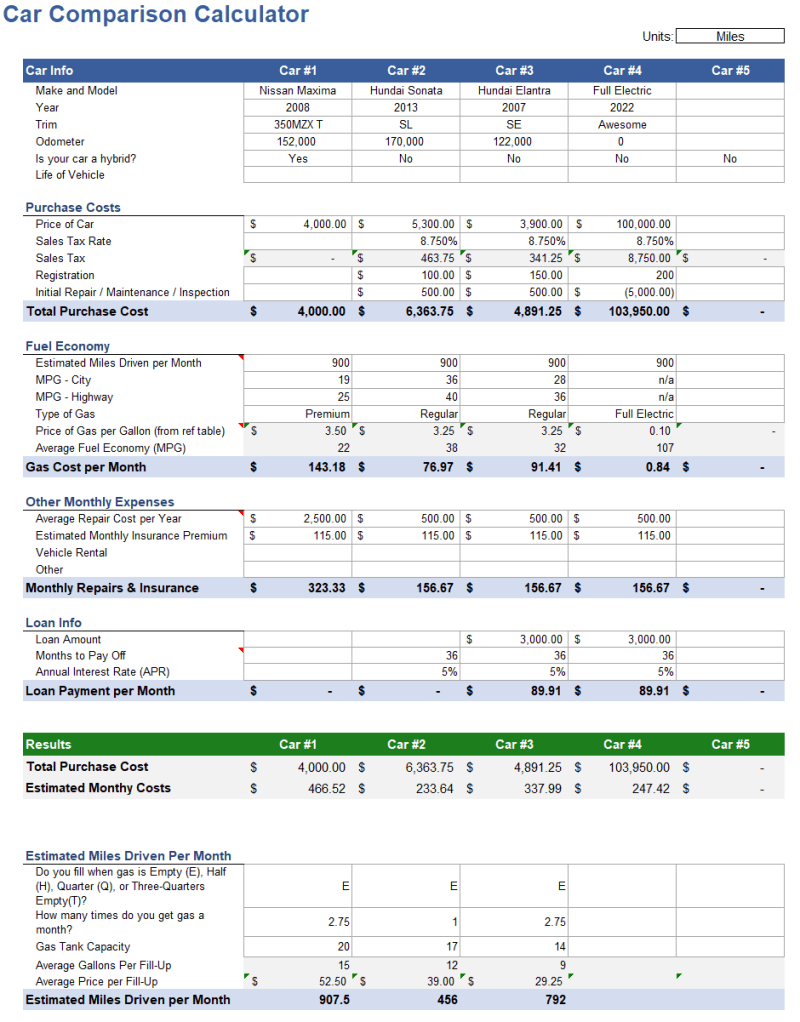

Car Insurance Comparison Shopping Answer Key – Are you looking for car finance calculator or compare cars? In Excel, the car comparison calculator helps how much you are paying for your current car and how to finish the future car. You can also use this car tool to decide or rent a car. Connect your car loan payments to calculate your monthly car finance.

Buying a new or used car comes always with many questions. Has a different car buying? Is a used car or new car financially better? How do I know if I can buy a different car?

Car Insurance Comparison Shopping Answer Key

This car calculator spreadsheet helps answer these questions so that you can trust your decision to buy or buy a car. This spreadsheet allows you to compare many vehicles. Price, mileage, debt information, and repair costs for estimating overall cost and monthly care.

Best Car Insurance In Malaysia 2025

Resignation Discount: We do not guarantee this spreadsheet or content of this page to the contents of its special financial situation. You should look for the board for financial decisions.

Customize the model with those cars you want to compare. You can compare your current car and / or many different cars.

To make the maximum of this spreadsheet, try to enter your data as much as possible. If you are uncertain of the answer, many features can be found on Google, just look for the brand, model and year. For other areas you can’t find the correct answer, it may be necessary to guess. Try different values to see how the input affects the results.

If you don’t know how much mile / kilometer is “kilometer and kilometer in the” consequence of “kilometers” in the “consequence of” kilometers “in the” consequence of the fuel “kilometer” in the “consequence of” kilm / km. This part of the spreadsheet is optional and designed to help estimate the value for corresponding cell. This subcole includes entry as well as its normal quantity (half full, empty, etc.) as well as car tank capacity. If you are interested in tracking your long-term gas, check the mileage record of our Mileage record gas.

Average Cost Of Car Insurance (2024)

This spreadsheet compatant factor is designed to facilitate completion of assets with the estimated monthly cost of property. There are some questions to consider:

Some of the main factors affecting this type of decision (other than just a new look) can be found at the cost of gas, maintenance expenses and expenses. Another personally in person or how long you expect a car. You may be forced to make a new car to fit your growing family, but your current vehicle’s price can still be important that can help you learn much about your current vehicle expenses. If you want to calculate the special loan features with the purchase of the car, see our car loan calculator.

However, the lease of a car is generally more expensive than buying and sometimes is more expensive than new buying, the cost of the car can compare a profitable quotation. Car les are usually a short-term solution and may have further damage, such as the contract or the beginning of the agreement) for example.

If you get a good use car, almost always will always be a better financial decision (less monthly and total cost). However, the spreadsheet does not show the effect of buying the new one and is used for a period of 10 to 30 years, the total price of the purchase and long-term finance will usually be too much for a new vehicle. If you are thinking of buying new, do not understand maintenance costs. If you can avoid buying Lemon, you can take advantage with routine care expenses for a few years, where you can find registration of your vehicles.

Car Comparison Calculator For Excel

The new vs. or may be important to consider the current car’s current, how long it will take you to buy your next vide. Perhaps your current car lasts 10 years, or perhaps only another year. The car used can not live as new.

Adjustable Rate Mortgage Calculator (ARG

ਆਟੋਮੋਬਾਈਲ ਲੋਨ ਕੈਲਕੁਲੇਟਰ ਲਿਓਨ ਲੋਨ ਕੈਲਕੁਲੇਟਰ ਮੁੱ ore ਲਾ ਲੋਨ ਕੈਲਕੁਲੇਟਰ ਕੈਲਕੁਲੇਟਰ ਸਿਰਫ ਵਿਆਜ ਕੈਲਕੁਲੇਟਰ ਕੈਲਕੁਲੇਟਰ ਸਧਾਰਨ ਵਿਆਜ ਕੈਲਕੁਲੇਟਰ ਸਧਾਰਨ ਵਿਆਜ ਕੈਲਕੁਲੇਟਰ ਸਧਾਰਣ ਵਿਆਜ ਕੈਲਕੁਲੇਟਰ

Reading Snowball’s ball 401 by annuity calculator

4 Types Of Insurance Policies And Coverage You Need

The context of the advertiser who appear on this site that are competing to more. These compensations are and where these compensations appear on this site and can affect it, but we are not affected by the classification compensation. We do not include all companies or offers available on the market.

There are many or all products from our partners who make for us. So we make money. But our editorial consistency ensures that our product is not affected by classification compensation.

The main conclusion is fed by inward and is only based on the content of this article. Their review is done by Jack Coral, our research director. Author and editor adhere to the final responsibility for content.

In recent years car insurance has increased significantly, but it is often to buy this LED drivers for the victory of their current insurance provider’s victory? And when drivers buy car insurance, which factors are most important to them?

How To File A Car Insurance Claim

To find out that the driver is automobile insurance, such as the increase in rates continues, Motala has searched for 2000 Americans in insurance habits and priorities. Get complete search results to reading records.

Pearls’s money is three of three respondents who buy 2024 cars insurance preferences and trends annually.

Buying a new car insurance policy is the main way to find economics in car insurance. Money money recommends that the driver compares the passage of vehicle insurance at least once a year.

Thousands of anniversary was much more likely to represent an annual car insurance market from any generation to the annual car insurance market. Prices were compared to thousands of generations z, 24% of 24% of 24% of 24% of the 24% of the 24% of the generations of 24% of the generations of 24% of the generations of 24% of the generations of 24% of the generations of 24% of the generations.

Survey: Car Insurance Shopping Preferences And Trends

Thousand% of thousands of years, say they never buy car insurance, lowest percentage of any generation.

The drivers have procured the car insurance by buying the insurance wisdom by buying the insurer and insurer insurer by buying vehicle insurance. Fourteen per cent drivers purchased a new car insurance in March 2025 and the car insurance provider has changed more than only 4%. Both are approximately records.

Percentage of forty-respect for car insurance preferences and car insurance trends

However, some car insurance companies can offer loyalty waiver after many years, but it is important to compare its discount rate with others available in the market. Some auto insurance providers can also offer a unique discount to change them.

The 6 Best Car Insurance Providers In Ireland [2025 ]

Generation Z and Baby Broomers were less likely to change the car insurance company, although they have done so. The car insurance provider was exchanged for at least once a better rate of 60% of the Generation X and 63% differences between the interviovas.

When car insurance has two main most important factors when costs the car insurance according to 2024 car insurance preferences and trends.

Two-thirds of the intervioe gave the value of the premium expenditure as one of the two most important car insurance factors when the purchase or 60% quoted coverage options are. The reputation for customer service was selected as 31% of the respondents, the payment availability was selected 24% and the election speed option was selected by 20%.

There is no surprise that cost and coverage options are the most important factor to buyers. Car insurance charges have grown in recent years and can be considered a necessary meat for drivers. Options of Coverage Drivers are allowed