Car Insurance Comparison Us – At the end of April, Progressive began using Autootquote Explorer for car insurance comparative tools. The insurer presented a brand for the name last year and it is now used to describe its price comparison device.

You may argue that there is also a difference in the product itself, at least when it comes to how it is presented. It is one thing to see how the progressive exchange rate is against others; Giving buyers the opportunity to compare the car insurance ratio from different companies is different. What’s more, the trademark application describes the Autoquote Explorer as follows: “Price comparison services, namely, which provides a comparative ratio from various companies for assets and casualties, with a network application.”

Car Insurance Comparison Us

The process starts by getting a quote in Progressive. The buyer is then introduced to two options – buying the policy or choosing to use AutoQuen Explorer to compare the ratio against others.

Best St. Paul, Mn Car Insurance In 2025

When the Autoquote Explorer option is selected, the progressive buyer refers to progressive.insurance.com, which offers a screen where more information is asked for more information such as the annual mileage, the age of the first license and the operating years. In the next step, the data “intelligence” and quotes are presented.

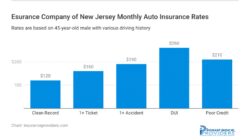

As you can see, the exchange rate of Progressive is presented next to the exchange rate from tourists, which is cheaper. The service, which is powered by Quinstreet, allows the buyer to even compare the two roofs side by side.

I finished the process with tourists, which demanded more information to get their exchange rate that ended by being more expensive than Progressive’s, and ~ 50% more than the original $ 481 exchange rate.

Liberty Insurance’s undertakings go out of the market for pet health insurance where a company protects the book to Old Republic.

Car Insurance Rip Off!?

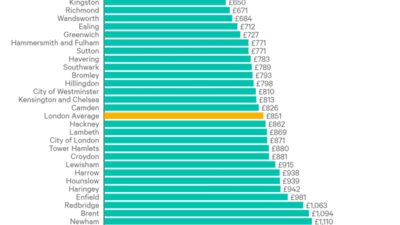

We use cookies to make sure we give you the best experience on our website. If you continue to use this site, we will assume that you are happy with it. When you decide how much to charge you for car insurance, the insurers analyze every inch of your personal information to work out how much risk you are involved in traffic collision. Studies have shown that your job can significantly change your insurance ratio. Insurance companies believe that some professions are more risk than others. However, there is no connection between being at risk and causing more accidents, so this way of identifying risks is controversial, so to speak.

In order to find out which professions are at high risk of car insurance companies and are therefore most charged with being guaranteed, car rental experts took the 100 most common job titles in the UK and submitted them to insurance offers while they did not change any other information about the car.

To create our car insurance offers, we used data from the National Statistics (UNS) office, BBC and statista to bring the UK’s average driver. They usually run Volkswagen Golf, travel 7, 600 miles a year, have comprehensive car insurance and no previous claims for accidents in their name.

We then entered this information on the UK’s largest website compared to a website 100 times and changed only a role every time. This then showed us which professions are most charged with ensuring exactly the same car in the UK as the price difference between them.

Compare Car Insurance Quotes: Fast, Free, Simple

Being a driver in hospitality business means that your car insurance is the most expensive of the 100 most common job roles in the UK. Insurance companies, according to previous research, consider professions where the driver of the car is on the way for a long time as a high risk, because they are more likely to be in an accident. Drivers would be charged at a minimum of £ 479.80 a year to be insured at 1.5 liter Volkswagen Golf.

However, it is not possible to say the same for chefs, hairdressers, employees and fitness workers, which consist of the rest of the top 5 list. Most would not regard their professions as relatively risky, but still the guarantee of the same car would cost them a minimum of £ 381.15. This is compared to a firefighter and a police officer, who would be charged £ 350.57 and £ 337.87.

Employees who are in the lower part of the list are usually financial and insurance, along with those who are wholesale and retail. It comes as no surprise to see that a mechanic would be charged at least of our top 100 list for its car insurance, as logic is that if insured are very interested in cars, they are more likely to take care of their car and be more vigilant on the road.

Back in December 2012, the EU introduced new rules that meant that car insurance companies could no longer discriminate against men by charging them more than women for securing the same car. This was despite the fact that women are in fewer accidents, so they cost car insurance companies less money to secure than men.

32 Compare Car Insurance Quotes Royalty-free Images, Stock Photos & Pictures

To find out if there is still gender errors in car insurance, each profession classified into several industries such as education, construction and retail, etc. We then compared the average cost of car insurance for 1.5L Volkswagen Golf in each of these industries with figures from the National Statistics (UNS) office that show us gender exchange in each industry.

Our research shows that on average, it now costs women more to secure their car than men about 15.33 pounds a year.

At the time when the UK and the world are dealing with an unknown economic situation, there are some employees of the industry who have been hit. This is because many hotels, pubs and restaurants in the country block the foreseeable future. Insurance is mixed with the situation, unfair in our opinion, by charging the Bar’s employees and the chefs of premiums on their car insurance compared to other professions.