Car Insurance Cost – Young drivers are affected by the highest car insurance ever, with almost 3 pounds of 3,000 pounds in the information.

Confused. The company compares the price. The average of 17 to 20 years has seen more than 1,000 pounds in the same period of last year.

Car Insurance Cost

Steve Duks, Executive -Chief of Confused.com Tell Radio 4 today: “The frequency of demand in the past two years since the big epidemic. But also have expenses

The Week Observed, August 20, 2021

“The cost of the second hand car is higher than it used to be the expense of the hand expenses. -And all of this is sending to consumers. “

The second car price – the first vehicle for the new driver – driving – has fluctuated from a couple of months at COVID, the demand for secondhand cars when the production of new vehicles decreased due to the shortage of the world. Computers and other materials that are needed for production

In March 2022, the increased price in the secondhand car market 31%according to the National Statistical Office Since then, they returned quickly.

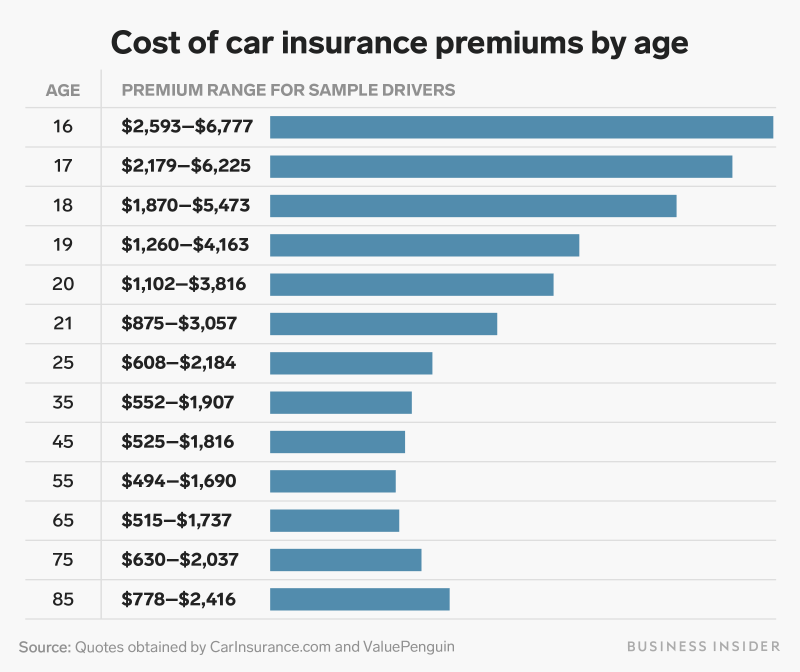

But the younger driver who confronts the sharp leaps for 17 years -an award increases to the average of £ 1, 423 to 2, 877. For the 18 -year -old driver, the average price of the policy. To £ 3, 162

What Is The Average Auto Insurance Cost Per Month?

The data will be calculated on average of the first fifth quotation that is more confusing than the actual price according to the policy.

Duke said that there is a way to reduce the award “where they can share driving with an older driver with more experience and adding this person to a driver with a very important effect and decreased in many prices. A hundred pounds that are worth looking at, “he said.

Duke also suggests that a younger driver is using the use of Telematics or “pay as a drive”, in which their behavior on the streets together with basic insurance provider or the driver insurance from time to time.

But he said that at the price increases for boys aged 17 to 20 years, many young drivers will analyze whether they will receive luxury to drive or not.

Where To Get Cheap Vermont Car Insurance

“The industry should be careful not to push the younger driver to other form of transportation, and this is a real risk when the price is very high,” he said.

The British Insurance Association (ABI) said that while car insurance may be expensive. But there are ways to reduce costs

He added that it is important for the driver to not drive without protection and showing people who struggled with the cost of talking to their insurance companies.

However, ABI said that the insurance is always at risk and the information shows that the average cost and frequency of claims will increase for young drivers, which may affect the prize.

The Rising Cost Of Uk Car Insurance

According to the analysis of ABI of 28 million, the driver’s insurance policy increased between July and September. On average, £ 561 an average increased 29% compared to the same time by 2022.

The association said that the numbers depend on the price of the customer paid by protection and is not something that referred to.

Including contact number if you are happy to talk to reporters. You can also contact the following methods:

If you are reading this page and don’t see the form, you will have to visit the mobile phone website to send your questions or opinions or you can send an email and email to Hasyousay@.co.uk Including your name and place with any delivery.

Average Cost Of Car Insurance Per Province

100,000 eggs have been stolen from grocery stores in the United States while bird flu increases for 6 days and Canada.

Faisal Islam: ‘Prime Minister Iron Iron’ must be bent for the growth she wants 31 January 2025.

February 2, 2025, selling personal registration sheets: ‘I have a personal sheet of 220’ is seen as a more investment. Usually not used in the car, experts say that February 2, 2025, business.

January 29, 2025 Drivers at high speed, no ‘excuse’ to risk life

Relief For Millions Of Drivers As Insurance Costs Fall For First Time In Two Years

January 29, 2025, the selfish driver that made 164 miles per hour should stop saying that there are at least 24,000 drivers, accelerating more than 100 km / h in five years, showing police information, 29 January 2025, England.

January 22, 2025, consulting about MOT test every two years, Ni DFI is launching a consultation about changing the frequency of the motto test from one to two years, 22 January 2025, Ireland made Norte.

January 21, 2025, the Treasury intervention to protect the payment of car loans, the government involves good compensation for the incorrect sales scandal, which may cause the automotive industry to decrease 23 January 2025, the business of commercial car insurance. Various according to many factors about your business Your award is directly affected by the number of vehicles that your company has commercial value and others.

A small company pays an average average of $ 147 per month or $ 1, 762 per year for commercial car insurance, also known as commercial car insurance.

7 Things To Check Before Purchasing Car Rental Insurance — Rentalcover

Our numbers come from the average expense of the policy that the customer received from the main insurance provider. The median offers better estimates than your business may be paid because it does not include high and low prizes.

Receive commercial car insurance policies if you drive from and go to the workplace, transport customers or drivers who trust or the post office.

Among 37% small business customers, pay less than $ 100 per month for commercial car insurance and pay 26% between $ 100 and $ 200 per month.

Expenses vary according to small businesses depending on the number of cars that they have and the types of insurance coverage they choose.

Cost Of Landscaping Business Insurance

As your personal car insurance policy, your business insurance company calculates your commercial vehicle insurance according to various factors including:

Talk to the insurance agent that is licensed if you are not sure which coverage options to choose from and receive a free business insurance.

If you need a car insurance that is paid for a variety of damage, you must choose a higher limit for the occurrence and the scope that is added to your policy.

When choosing the limit, make sure that you comply with the state specifications for car insurance. Most states need commercial car insurance for companies with vehicles. You may be responsible for damage to property and protection of personal injuries. They cover damage that their vehicles can cause vehicles, qualifications and other people.

Visualizing Auto Insurance Rate By State In 2020

When buying a policy, you can choose a higher franchise to save money with your award. However, make sure that the franchise is something that you can easily pay. If you are not able to buy your insurance franchise, it will not be enabled to cover your claims.

The right amount depends on your business needs. You want to limit liability that covers car accidents that may occur without buying more than you want. Talk to the insurance agent that is licensed if you are not sure which limitations are suitable for your business. They can also help you find a way to get an affordable commercial car insurance.

The type of automatic coverage you buy has a huge impact on your automotive business. You can select automatic responsibility, comprehensive coverage and other types of physical damage.

Most of the laws in the state need automatic liability and protect you if you or your employees are guilty of your commercial vehicles. Automatic responsibility is your lower cost option and provides limited coverage to help.

Texas Cities With The Cheapest Car Insurance

If you choose a car insurance that covers your coverage will increase – but your insurance rate In addition to comprehensive things by covering automatic responsibilities, commercial car insurance covers theft and damage due to variotic climate or fire.

Additional certifications, such as coverage, drivers that do not limit medical payment or collision protection, can add your award. For the accurate quotation of car insurance, give details about your insurance needs.

You can also choose a contract with a contract that has a contract and not spending if you drive a rental car or employee for business purposes. While you are not damaged by your own vehicle, you can talk less for covering HNOA.

HNOA is important because even though your personal car insurance covers your work route. But there may be exceptions for defeat to work, such as the text you make is part of your work.

Annual Car Insurance: How Much Does Car Insurance Cost?

Your business type also affects the amount you will pay for commercial car insurance policies while using your vehicles. For example, a food truck is full of valuable equipment or trailers on the road, may have a higher rate. Like construction vehicles such as tilt trucks, which are frequently harmful workplaces

However, remember that the number of vehicles and value of their values have more impact on your prize than your industry.

Is an independent agency number 1 for insurance delivery for small businesses By filling out an easy online application from Easy, you can receive a free quotation for commercial car insurance and other insurance provider policies in the United States with the best classification.

When you find the right policy for your small business, you can start coverage in less than 24 hours and receive insurance certificates for your small businesses.

Why Insurance For 4runner Is Significantly Higher Than Others?

The insurance award vary according to the company’s policy.