Car Insurance Delaware – Tonya Sisler has been a technical insurance writer for more than five years. She uses her extensive insurance and financial knowledge to write rich articles to answer readers’ best questions. Her mission is to provide readers with timely, accurate information that enables them to identify their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywriting…

Daniel Walker received his Bachelor of Administration in 2005 and has operated his FCI institution for more than 15 years (BBB A+). He is licensed as an insurance agent who writes property and casualty insurance, including family, life, automobile, umbrella and fire insurance for residence. He has also appeared on sites such as Reviews.com and Safeco. Make sure our content is accurate…

Car Insurance Delaware

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparative shopping should be easy. We work with top insurance providers. This will not affect our content. Our opinions are our own.

Ebt Car Insurance Discount Delaware ($27/mo) + Cheap Card Holder Benefits Near Me For Low Income Snap Recipients

Editorial Guidelines: We are free online resources for anyone interested in learning about auto insurance. Our goal is to be an objective third-party resource related to auto insurance. We update our website regularly and all content is reviewed by auto insurance experts.

Delaware was stuffed into a very small space, the second smallest state in the United States, with 1,949 square miles of real estate, and only three counties can drive. Still, residents of the First State are still favorable in getting the best residents around (Beaches, Philadelphia Hamburg and the White House).

With various attractions near home, Delawareans often drive to different states – sometimes, to work, and more often for entertainment. Now that the holiday is over, you can start planning your holiday for the best deals.

Between all the fun and work, you should also consider getting the right car insurance coverage to protect you from any type of accident when driving in or out of state.

13 Surprising Car Insurance Cancellation Laws To Know

We understand that you don’t have the time to do in-depth research on the web or otherwise know which insurance companies will serve you.

That’s why we’re writing this guide to be a one-stop solution for all research related to auto insurance.

We’ll cover what type of coverage, what is the premium rate for different profiles, which companies are the best companies in Delaware, the laws you need to follow to avoid violations, and so on.

If you prefer, you can start comparing shopping by entering your postal code in our free online tool.

Goodguys 1st Grundy Insurance Mid-atlantic Nationals Presented By R&m Performance

We will start with the most critical information, the type of coverage you may need and the average insurance rate in your state.

Although you can get quotes from any insurance company by calling or online, you don’t know if these rates are comparable to the state average. Also, some insurance agents may try to push the basic coverage of your sales, but is that enough for you?

Every state has its quirks that are unique and difficult for outsiders to understand. For the Delava people, it’s their love for low-marked license plates, and they’re ready to pay for the roof for those coveted plates.

In 2018, a stunning $410,000 plate auction in Delaware for the staggering $410,000 plate auction. Yes, you read the correct amount. For the Delava people, a license plate with a numeric number is a status symbol, which began a long time ago.

Delaware Car Insurance

When it comes to automotive culture, the method of residents in Delaware is practical and uses cars as the primary mode of transportation.

Before we dig deep into the minimum coverage requirements set by the state, let us know why these laws are enacted.

During the day you drive, you will be hit by a motorist without any drawbacks. Now, if you have to bear all the costs of medical injuries and car damage, is it fair to you?

One study puts the average amount of car accident claims solutions from $14,000 to $28,000, with a total of about $31,000 in serious accidents.

Is Delaware A No-fault State? Understanding Auto Accident Laws

Every driver has no resources to pay for damages caused in the accident. That’s why the state requires people to buy auto insurance so that you can pay a relatively small monthly fee to pay for the accident.

Delaware is a negligent state, which means insurance companies determine the failure of the accident resolution claim. Each state requires motorists to purchase liability coverage for compulsory payments for third-party damages in the accident.

As mentioned earlier, the mandatory liability for personal injury and property damage will cover the costs of your injured passengers and pedestrians.

In Delaware, your basic liability insurance policy covers third-party personal injury costs at $25,000 per person and a total limit of $50,000 per accident. For property damage, your policy will pay $10,000 per accident.

Cheapest Car Insurance For New Drivers

Despite being a fault state, Delaware requires all motorists to purchase personal injury protection or PIP to cover your medical expenses and lose wages when injured in an accident, regardless of the drawbacks.

Please note that if law enforcement officers ask you to present a certificate of insurance, they must be able to display a valid insurance identification card. Delaware also allows drivers to display digital copies of their insurance cards on their phones or any portable electronic device.

The state minimum coverage can help you meet legal requirements for driving a car; however, policy restrictions are not enough if you are involved in a major accident.

A monthly recurring expense budget makes you consider at least once how much you spend on your percentage of your income.

Cheap Car Insurance In Delaware: 2025 Rates And Companies

In 2014, 3.02% of Delaware’s revenue was on auto insurance premiums, a slight increase from the percentage spent in 2012.

Delaware has a higher premium to income ratio than the premium percentages in the District of Columbia, Maryland and Virginia. Even in New Jersey, the premium percentage of income in 2014 was 2.76%.

Some of the reasons that make Delaware expensive for car insurance is the high density of population in the state and the increase in the number of uninsured drivers.

Another important factor that can lead to premiums is the average repair cost in your state.

Delaware Public Media

Delaware ranks eighth in the U.S. for average auto repair costs, with parts and labor force of $387.74.

Delaware’s full coverage average premium is $1,240.57, which includes liability, collision and full coverage. It is recommended that you collide and cover full coverage in your policy, as you may need these at some point in time.

You may hit an object while driving, such as a telephone pole, mailbox, another car, or any other valuable object, and you will be paid for the repair of the object. If you have collision insurance, your insurance company will pay for this.

When your car is damaged by uncontrollable circumstances, such as fires, vandalism, hurricanes, etc. Such events are hard to imagine, so full coverage will help, so adding this option is a good idea.

Car Insurance For High-risk Drivers In Delaware

In addition to the basic coverage stipulated by law, motorists may also consider purchasing medical compensation and insurance coverage for uninsured/insured drivers through their policies.

This table illustrates the loss rate for different coverage options in Delaware. The loss rate is the percentage of premiums that an insurer settles or pays in a claim. If the loss rate is 80% and the premium obtained is $100, the insurer has already spent $80 in claim.

Insurance companies tend to profit from premiums by charging higher rates than they charge for when they settle through their claims. For medical compensation, Delaware insurance companies seem to be in financial trouble because they pay much more in their claims than they get through premiums.

PIP is mandatory in Delaware and it covers your medical expenses, so why buy a medical salary?

Delaware Division Of Motor Vehicles

You must evaluate whether you need a medical salary, as the PIP covers your medical expenses and lost salary. You can increase your PIP limit or purchase a medical salary, depending on which option is more cost-effective for you.

A notable feature of medical compensation is that it covers you and your family even if you are in another car or walking somewhere.

You can also consider other add-ons and riders covering specific situations. For example, if your car is under repair after a claim, you may need to rent a car to meet your daily needs. Rent compensation covers rental vehicle or public transportation fares.

Buying car insurance is mandatory, so you can’t escape a fixed monthly premium.

What To Do After A Hit-and-run In Delaware

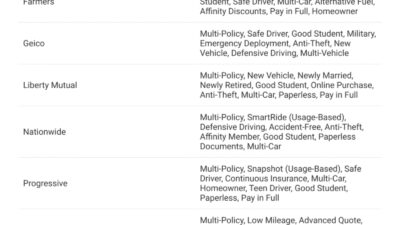

However, insurers do offer drivers the option to get discounts with use-based insurance, also known as paid drive insurance.

Using telematics technology, you can track your driving mode and get rewarded at the end of a specified period. Usage-based programs are designed to ensure safety on the road and increase premium rates