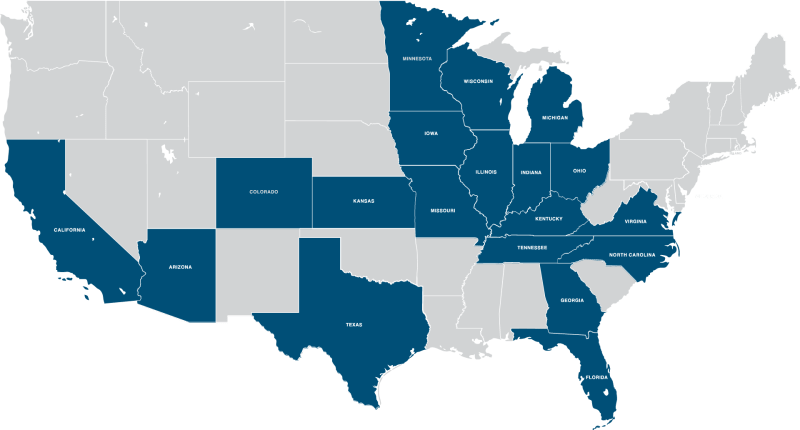

Car Insurance Florida Vs Arizona – In the United States, minimum car insurance requirements vary by state. Understanding the minimum car insurance requirements for each state is crucial for drivers, insurers, and policyholders. Each state sets rules on the type and amount of coverage the driver must carry. This guide provides an overview of mandatory auto insurance coverage in all 50 states.

Minimum auto insurance refers to the minimum coverage required by law in its state to drivers. This usually includes liability insurance, covering personal injury and property damage caused by the driver, but may also include other types of coverage under state law.

Car Insurance Florida Vs Arizona

Previous policy types were called 25/50/25, and the following format is mentioned.

Cost Effective Cars

Need (Medical Costs 4,500/$500; Disability and Income Loss 1 Year Monthly $900/$25 per Monthly; $25 per Day for funeral, funeral, burial or cremation costs $2,000; Rehabilitation $4,500 $4,500; Survivor Benefits; 1 Year of Income and $25 Daily Loss $25

Required ($50,000 per person, $2,000 per month, up to three years, loss of income, $25 a year, necessary expenses, $2,000,000 death benefit)

No car insurance is required, although you have to pay an uninsured $500 uninsured motor vehicle fare without coverage.

Liability insurance is a key component of auto insurance policy and is usually required by most state laws. It consists of two main coverage areas:

The Cost Of Living In The Sun Belt

Liability insurance is essential as it helps protect drivers from significant financial losses caused by accidents, so that they can be safely covered in the event of misfortune.

Personal Injury Protection (PIP) is a type of auto insurance coverage that helps pay for medical expenses, in some cases, wages and other losses, regardless of who is at fault in the accident. This coverage is often required in trouble-free countries and may include a range of benefits to support policyholders. Key components of PIP coverage include:

PIP coverage can be particularly valuable because it ensures that policyholders and their passengers are treated immediately without waiting to determine the failure in the accident.

Uninsured Driver Coverage (UM) is designed to protect drivers and their passengers, in the event of an accident, involving drivers with uninsured or underinsured drivers. It ensures that you are hit by someone who lacks adequate coverage and you are still able to pay for the cost of the event.

Mileage And Car Insurance Rates Study

UM coverage is crucial because it provides a safety net to ensure that accident victims of motorists without insurance or underinsured do not bear a huge financial burden.

When you have an accident with a driver, the insurer’s coverage is not sufficient to compensate for the loss caused by the loss, the purpose is to provide additional protection. This coverage fills the gap between policy restrictions for dial drivers and the total cost of accidents. UIM coverage is crucial because it ensures that you don’t have financial burdens due to the lack of adequate insurance from another driver.

UIM coverage is a financial guarantee, and you can rest assured that even if other drivers cannot carry enough insurance, even if other drivers are covered.

Medical Payment Insurance (MEDPAY) is an optional auto insurance add-on that helps you and your passengers incur medical expenses in the event of an accident, no matter who is at fault. This type of coverage is particularly beneficial as it provides immediate financial relief to a variety of medically-related expenses, especially if you are at fault. Key aspects of MEDPAY coverage include:

How Much Does Full Coverage Car Insurance Cost?

Medpay is particularly valuable for policyholders who want additional protection, beyond the services provided by their health insurance, ensuring more comprehensive coverage after an accident.

The fault system adopted by the state profoundly affects its minimum auto insurance requirements. Understanding how insurance requirements differ in terms of failure, failure-free and choosing a failure-free state is critical to understanding the wider insurance landscape throughout the United States.

In a state of fault (or infringement), the driver responsible for the accident is liable for all damages caused, and the minimum automobile insurance law usually requires a higher coverage of liability. This ensures that the at-fault driver can adequately compensate the injured party for medical expenses, property damage and any other losses. Therefore, drivers in fault status must hold policies that include liability for physical injury and liability for property damage, usually with designated minimum limits.

In a faultless state, instead, each driver’s insurance coverage is primarily responsible for his own losses, regardless of who caused the accident. Here, minimum insurance requirements focus more on PIP coverage than broad liability insurance. The PIP covers medical expenses, wage losses, and other injuries-related expenses for policyholders without negligence. As a result, mandatory minimum coverage for fault-free states usually includes PIP, sometimes under higher limits, while liability coverage may be less emphasized or required at lower quantity.

Report: Home Insurance Rates To Rise 8% In 2025, After A 20% Increase In The Last Two Years

For drivers who choose a fault-free state, minimum car insurance requirements may vary depending on the coverage they choose, whether fault-free or fault-based. Those who choose to fail-free insurance must meet the PIP coverage requirements of traditional trouble-free countries. However, if they choose a fault-based coverage, they must comply with liability insurance requirements similar to the fault status to ensure that if the accident is negligent, the loss can be covered.

Overall, whether the state follows a fault, no fault or chooses a fault-free system has a significant impact on the specific types and quantity of the specific types and quantities required by the law and the minimum range of automobile insurance, tailored to protect all parties involved in a car accident.

Understanding your state’s minimum car insurance requirements ensures that you are legally compliant with and are fully protected. Always consider buying additional coverage that exceeds the state’s minimum requirements to enhance your protection in unforeseen circumstances.

In Thompson law, we understand the importance of being fully insured. The minimum policy restrictions imposed by the state are usually not sufficient to cover the large amounts of expenses associated with serious accidents. For several compelling reasons, our attorneys recommend buying purchases that exceed the minimum policy limit:

Jerry’s Guide To Car Insurance In Florida For (august 2025)

By investing in minimum policy restrictions, you are taking positive steps to protect your financial situation and ensure you are fully protected and able to compensate for personal injury in the event of an accident. Our legal team at Thompson Law will be here to help you choose the best coverage to suit your needs and provide peace of mind on the go. Contact us now.

What to do after a car accident in Texas after a car accident, you must remain effective and follow certain steps to protect your rights. These steps not only ensure you are safe, but also help you

How does the personal injury claim process work? Suppose you or a loved one is injured in an accident due to someone else’s negligence, such as a motor vehicle crash, a workplace accident, or a slip. You may decide

When will I seek help from a car death lawyer after a car accident, you might ask yourself: “When will I need a car wreck lawyer?” Answer: It’s always worth contacting a car accident lawyer. from

15 States Facing An Imminent Insurance Crisis

How do insurance companies pay attention to injury claims? Navigating the world of insurance claims can feel overwhelming after a car accident, especially when it comes to personal injury. Learn how the Insurance Council values injury claims, not only

What to do if you get injured in a pedestrian accident in Texas, which can change lives and lead to physical injury, emotional distress, and financial burden. If you find yourself injured in a pedestrian accident in Texas, know the steps to take

Common injuries caused by pedestrian accident injuries involving vehicles in pedestrian accidents are a major public safety concern, often resulting in serious injuries due to the personal vulnerability of walking. When hit by a car

Thompson law does not charge any fees unless we reach a settlement for your case. We have invested over $1.9 billion in cash settlement in customers’ pockets. Contact us now for a free, no-obligation consultation to discuss your accident, answer your questions and learn about your legal choices.

The True Cost Of Auto Insurance In 2025

State law limits the time you have to file a claim after an injury accident, so call immediately.

Fort Worth, Texas 1500 North Main St., Suite 140, Fort Worth, TX 1500 76164 Phone: (817) 330-6811 McKinney, Texas 321 North Central Expressway Suite 305, McKinney, TX 75070 Phone: (214) 390-9737 Atlanta, Georgia 1201 Peachtree St NE, Suite 2200, Atlanta, GA 30361 Phone: (678) 981-9022

San Antonio, TX 9901 W I-10 Suite 1040 San Antonio, TX 78230 Phone: (210) 880-6020 Arlington, TX 1521 N. Cooper Street Suite 209 Arlington, TX 76011 Phone: (817) 873-1639)

El Segundo, CA 909 N Pacific Coast Hwy S, Piso 10 El Segundo, CA 90245 Phone: (310) 878-9450, if you are in the galaxy fold, consider expanding your phone or viewing in full screen to optimize your experience optimally.

Arizona Car Insurance Laws

Advertisers disclose that many of the quotes appearing on this website are from companies where Motley is compensated. This compensation may affect how and where products appear on the site (for example, including the order in which they appear), and which one may affect

Average arizona car insurance rates, best car insurance companies arizona, cheap arizona car insurance, cheapest arizona car insurance, best car insurance arizona, arizona insurance car, car insurance phoenix arizona, car insurance in tucson arizona, low cost car insurance arizona, arizona state minimum car insurance, arizona car insurance companies, lowest car insurance in arizona