Car Insurance For Driving To Malaysia – Home »6 Things Consider the New Driver Before Taking Auto Insurance at M’Sia 6 Things New Driver in M’Sia

Navigate off -road as a new driver with a mix of excitement and responsibility. Among the important considerations when walking in the driver’s seat understand the automatic insurance nuances. From surfing mandatory conditions to finding comprehensive scope, traveling to the correct insurance policy can be annoying and important for new drivers.

Car Insurance For Driving To Malaysia

Here is a guide by giving light to extraordinary consideration and important opinions that new Malaysia drivers should know if car insurance is purchased.

Insurance For Car

Insurance will play an important role in taking care of your car and ensuring financial protection when accidental. In Malaysia, car insurance was ordered under the Transport Road Act 1987.

While denying all body parts or body protection is the minimum requirement, highly recommended for new drivers to take care of wider risk.

As a new driver, you can handle higher insurance premiums due to seeing higher risks related to less experience. Many reasons have contributed to premium determination, including:

Malaysia insurers offer NCD as a reward for intermediates that keep a driving record clean and avoid claiming during policy.

The Motorist Guide On How To Handle A Car Breakdown On Plus Highway Malaysia

This discount can reduce premiums for hours, which are important for new drivers to wear safe driving habits and avoid accidents. Therefore, make it a priority to follow traffic rules to keep your NCD from the first year.

Although add-ons often have additional premiums, financial rescue can be provided to incidents that are not covered by core policies. If buying more scope, remember to identify different protective options offered by advocates. This includes but not limited to:

Before signing your insurance policy, completely review and understand the terms and conditions. Consider attention to the following aspects:

If you feel too or are not sure about navigating the insurance scene at any point, do not hesitate to seek help. Consultation discovers driver drivers, family members, friends or insurance agents who can provide personal advice based on your specific number of driving needs and profiles.

Malaysia New Digital Road Tax And Driving Licence Format

By following these instructions, you can navigate the insurance scene with confidence and make decisions to protect yourself and your cars.

One of Malaysia’s largest insurance websites, offers rules from over 10 brands. Visit now to get your free social quote! Them, Malaysian driver colleagues! Congratulations on finding that new driving license list in Malaysia! Now that you’re ready to hit the road, it’s time to talk about an important piece of puzzle driving – car insurance. On this blog, we plunge into the car insurance world for the new Malaysian driver. So let’s hang out and we’ll navigate ins and from getting the right scope for your trip to Malaysian roads. Care slang understanding certainly:

First thing first, clean the air with some jargon insurance. “NCD” does not stand for a new CAFE City; This is your discount claim. Actually, it’s a reward for safe driving – you are longer to go without making a claim, the more saved. “OD” and “TP” may sound like acronym from a secret society, but in real qualities of protection: self-injury and third parties. Now we will get nitty-grown what Malaysian drivers should think about when diving into a car insurance game.

Money things, right? Before you start scrolling through insurance options, think about your budget. Malaysian drivers are especially new newcomers, they should be wise with their ringgit. The protection of swings and prices is important. Do not opt for cheaper; Make sure it includes your needs. Compare quotes, think about the extra value, and choose an award that does not scream your wallet.

Worry More If Driving Classes Are Too Cheap, Say Instructors

Let’s talk to no discount on admission yet. It’s like finding a secret treasure in the soul of insurance. For each year you do not make a claim, your rate of NCD grows. So if you are a safe driver, protect the NCD as this is the latest piece of Durian in the market. This can lead to significant discounts on your premium, and who doesn’t like a good discount, right?

Own Damage (OD) and Third Party (TP) – is like chosen between Satay and Nazi Lemak. Cover the defects in your own car, while TP has injuries to the car to others. As a new driver, think of a complete package that includes both. You didn’t know when you accidentally turned a family’s car at the time of Raya Festival. It’s better to be safe than sorry, right?

As with how KICAP (Soya Sapue) develops the taste of your Goren NASI, increasing your insurance coverage. Consider choices such as strip protection, flood protection, or even special advantages such as car taking services. It’s like adapting your insurance to suit your steering style and needs.

In the digital age, the information is in your finger. Don’t just settle for the first announcement on pop insurance on your screen. Dig deep, review, and ask your kids (friends) about their insurance experience. Malaysians like to share their opinions, especially when it comes to things like insurance and departure.

Kia Panel Car Insurance Malaysia

Think you tied off the road with a flat tire – nightmare, right? Get insurance plans that offer road aid. It’s like your own hole crew, ready to help you when your car decides to play drama. Malaysian roads are unaware, so having a backup plan is always a good idea.

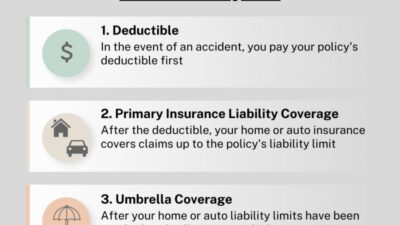

Overdoing is the amount you pay when you make a claim. It seems like Sambal most beautiful – a little can be consumed. Evaluate your risk permission and select an overdue amount by leaving your budget in flames. Finding the right balance to ensure you can still enjoy your taric tarik without worrying about unexpected costs.

All right, new Malaysia driver, you are now armed with knowledge to solve the car insurance game. Remember, not just about obedience to the law; It’s about protecting yourself and your ride. So get out, check Malaysia roads, and move safely! Let your NCD grow, your award stays fair, and your trip is smooth as a good steam Kuih. Drive safe, lah!

Now that we are not auto insurance unrats, it’s time to make this knowledge. In, we will set your needs and benefits, making us natural choices for your driving trip. Choosing means choosing a spouse focused on transparency, personal solutions, and peace of mind.

Generali Car Insurance

Your new understanding of the full scope is ready? For more details, insurance quotations, customized plans, or create a purchase, visit our website now https: ///. Power on your drive – where your safety and satisfaction take the driver’s seat. In Malaysia, car insurance is more than a measure of salvation – this is the law. But with many providers and policies, finding the right can be challenged. Here’s a simplified guide to navigate your choices.

Malaysian car insurance usually falls into three categories: third parties, third parties, fire and thieves (TKFT), and complete.

The third part has damage you injured on other cars, property, or people in an accident, but do not hide your own car. TPFT includes the same, more scope for fire or steal your car. The complete assurance offers the most topics, including injuries to your car, theft, fire, and third-party properties.

Think of your car age, your driving habits, and financial conditions. Whether you have a new or excellent car condition, complete cover is a smart choice. But if your car is older or commonly used frequently, the third party or TPFT protection may be sufficient.

Your Ultimate Guide To Car Insurance In Malaysia

Always think about your ability to bring unexpected costs. If an important recovery can be challenged, complete cover, though the best, may deserve it.

IDV is your car’s market value, which determines the maximum amount of claim when there is general loss, theft, or more damage. Make sure it shows the real value of your car, as stated IDV can result in insufficient costs, while exempt value means higher premiums.

No discount of claim (NCD) is a discount on your premium per year claim, starting 25% of the five years in Malaysia. A clean driving record translates to lower awards.

The carrier’s claim process should be easy, straightforward, and transparent. You want a provider of insurance to offer good customer support, 24/7 road assistance, clear instructions on how to file a claim, and easy claim claim.

A Singaporean’s Guide To Driving In Malaysia

Think of valid add-ons such as air cover, legal responsibility, and flood protection, especially if you live in flood regions.

In addition, many insurers offer free add-ons such as free road aids, withdrawal services, and personal accidents to develop your overall scope, giving you peace of mind.

Take time to determine the quality of conquest, evaluate your unique needs, while comparing quotes and reading customer reviews from different providers. By doing your homework, you will find a plan not only to fit your budget but also give you complete protection and peace of mind.

You can get quotes from over 7 different insurance companies to touch you and just cover with a few clicks. What a Mercedes

Renew Road Tax & Insurance Online

Car insurance for bad driving records, car insurance for bad driving record, insurance coverage for driving someone else's car, driving to malaysia, car insurance for bad driving history, car insurance for driving abroad, car insurance quotes for bad driving records, driving from singapore to malaysia, best car insurance for bad driving record, cheap car insurance for bad driving records, cheap car insurance for bad driving record, car insurance driving to mexico