Car Insurance In California – California is known for its strict car insurance laws, the goal of which is to protect drivers and passengers on the road. Each state has minimal car insurance requirements. These minimum requirements can significantly affect any claim presented as a result of a car accident. In this blog, we will closely analyze the laws and regulations governing car insurance in the gold state, as well as some tips on the needs of California’s insurance cars.

First, it is important to understand that California is guilty. This means that the river, which is responsible for a car accident, is responsible for paying the cost associated with the accident. These expenses could be things like medical invoices due to physical injuries. In addition, the damage to the property suffered by the victims of the accident. The victim in a car accident can file a insurance claim for the other driver’s insurance, or sometimes.

Car Insurance In California

Each state will have its own laws in terms of minimum car insurance. If you live outside California, it is important to keep in mind that the minimum of your car insurance will probably be different.

California’s Low Cost Auto Insurance

Another aspect of California’s car insurance laws is that all drivers have the ability to carry car coverage without insurance. This coverage will pay your damages and injuries if you are involved in a driver who has no insurance driver. The minimum threshold for coverage of motorists without insurance is $ 15,000 per person and $ 30,000 per accident.

In addition to the few California car insurance laws covered above, there is optional coverage that drivers can buy in California. These include the following.

California conflict coverage will pay for your vehicle in the event of a car accident.

Complete coverage in California will cover the damage caused by uncoated events such as theft, vandalism or natural disasters.

Car Insurance California (@carinsurancecalifornia) • Instagram Photos And Videos

It is important to understand that if he is in a car accident and hurting another person, these minimum California car insurance may not be enough to cover the overall scope of damage to a serious accident. Because of this, it is strongly recommended that you do not only buy the minimum insurance requirements. If the minimum of your insurance does not cover the cost of injuries and damage, the other part may request the costs not covered by insurance.

When it comes to finding the best car insurance in California, it is important to buy and compare contributions from different insurance companies. Be sure to consider not only the price of California’s insurance coverage, but also the reputation and financial stability of the company.

There are several ways in which you can reduce your insurance premiums in California. All insurance companies will not offer discounts. But, be sure to see if any of the following programs will help reduce your interest rate.

When taking a defense management course, it is likely that you can save money on your premiums. Usually, these courses are online and relatively easy to complete.

California Car Insurance Laws & Requirements (updated 2023)

If you have enough guides to your family in the same insurance plan, you may be able to get a multiple download discount on your premiums.

If you can prove that you have a good credit history and pay your bills, some companies will find a lower risk for your premiums and offer a small discount.

This can be obvious. A good management history means less risk for your insurance company. There are several companies that will “reward” it for a good management history while keeping their rates to a minimum.

The California Vehicle Department will suspend the registration of any vehicle for which the required insurance test has not been taken and that the vehicle cannot be driven or parked on public roads until an insurance coupon is obtained.

Best Car Insurance In California For 2025 [check Out These 10 Companies]

If you had a car accident in California, you may be wondering what your next steps are. If you have been injured as a driver, passenger or pedestrian, you have options. You have been involved in compensation for your compensation, including medical invoices, lost income, property losses and emotional anger.

Depending on the confident coverage you have decided to go, you may be able to claim a claim against your own insurance policy.

If you had an accident and you can try “guilt” against another driver, you can claim a claim against your insurance.

If you are involved in a car accident and injured, it is particularly recommended to hire a car lawyer. The majority of accident cars are working on a percentage of emergency, so it will not generally have an initial cost.

California Moves To Curb Discriminatory Auto Insurance Pricing Using Job And Education Level That Charges

If you have been involved in a car accident in Los Angeles, do not hesitate to contact a high -quality lawyer as a car accident in Los Angeles. B The B Law Group is an experienced car team in Los Angeles who can help guarantee their legal rights and receive the compensation they deserve.

In B | B Legal Group, our goal is simple: maintain and protect the legal rights of the southern California people. Our team has been awarded lawyers has experience in the fields of personal injury, labor law and skills and it is our mission to provide our customers with the best legal representation.

If your case is not successful, you have the guarantee that you will not need to pay for anything. There are no hidden expenses, expenses or conditions, that is, our promise.

When an accident interrupts his life, the help of a local car lawyer in Los Angeles is not only beneficial but necessary. Navigation in complex legal land after a vehicle collision can be complicated. In general, it requires a special defender capable of testing negligence and securing compensation …

California Car Insurance Requirements In 2025 (see What Ca Law Requires)| Us Insurance Agents

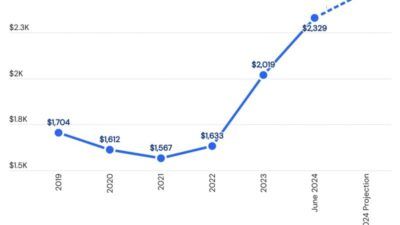

Victory in the case of bodily harm to California is an important milestone, which marks the end of a provocative journey full of legal complexities and emotional stress. However, victory is not the last step. Once you have won your case, there are many … We find that Wawanesa has cheaper car insurance rates in California, on average $ 80 per month. This is $ 959 per year, or $ 878 cheaper than the average cost of a complete political coverage in California.

Our other options for the best and cheapest car insurance in California are Geico, USAA, Hermes and the national general. You need to make sure you compare rates before buying coverage to find the cheapest company for you.

He has analyzed the rates of car insurance provided by the Quaternary Information Services for each Postal Code in the 50 Most Washington States, D.C. For full coverage policies, the following coverage limits were used:

Percentages for the general average, rates per postcode and cheapest companies determined the use of averages for individual drivers 30, 35 and 45.

How To Register A Car In California For 2025 (follow These 3 Steps)

Prices for “bad” management violations are set using average values for a single 30 -year male driver with a credit result below 578.

Some operators may be represented by subsidiaries or affiliates. The rates provided are cost costs. Your actual appointments may be different.

Our methodology with patents take into account many factors, including customer satisfaction, costs, economic power and policy offers. Please refer to the “Methodology” section for more details.

AM BEST is a World Credit Evaluation Organization that meets the financial power of insurance companies on a ++ scale (superior) (poor).

5 Ways To Reduce Your Car Insurance Premiums In California

Using a combination of internal and external prices data, we characterize the cost of the premiums of each insurance company on a less expensive scale ($) to the most expensive ($$$$).

Wawanesa has some of the cheapest car insurance rates in California and the mean rates are still low after an accident or driving rape. It is an excellent choice if you stick to a budget is your first priority.

Wawanesa is one of the cheapest car insurance companies in California (only sells car insurance in California and Oregon). Prices are lower than average, even after an accident or driving rape. You can also find cheap coverage with Wawanesa with a teenage guide in its policy.

Wawanesa does not provide vacuum insurance, so you are likely to consider another insurance company if your landlord or lender requires. Wawanesa offers road aid assistance, special equipment coverage and OEM pieces.

2025 Guide To California Garage And Dealers’ Insurance

The average Wawanese car insurance cost in California is $ 80 per month or $ 959 per year, which is 48% cheaper than the average of the state.

Geico has cheaper rates than the average in California, even for high -traffic drivers. The tools and comfort in the Geic application set it in front of competitors.

Geico is one of the best car insurance companies in California thanks to low prices and widespread availability. Geico has cheap average prices even for California drivers with poor credit or recently licensed drivers.

We also like Geico’s convenient mobile application, which allows you to appreciate what repairs on your vehicle can cost after an accident. Although it is one of the largest insurance companies in the country, Geico receives fewer complaints from its customers as expected.

0 Down Car Insurance

The average cost of insurance car industry in California is $ 122 per month or $ 1, 465 per year, which is 20% cheaper than the average of the state.

USAA has some of the best car insurance rates in California and some of the highest customer service qualifications of any company.