Car Insurance Learner Driver – Adding a student driver to insurance is a significant cost assessment. On average, it costs 1, 704 a year to add a 17-year-old student to an existing policy based on September 2025.

The choice of vehicle has a significant impact on insurance premiums, making certain cars cheaper for new drivers. By choosing the first car, smaller engines usually mean lower insurance premiums. Volkswagen up! 1.0L sees £ 1, 300 premium increases, while Ford Fiesta 1.0L costs 1, 500 adds to insurance. The location also plays an important role. Urban drivers face higher premiums, and London is on average 2, 100 additional costs compared to 1, 400 rural areas. This difference reflects different risk levels in areas.

Car Insurance Learner Driver

There are several insurance roads for students. Increasing them to existing policies is originally, but provides constant coverage. Short -term insurance provides flexibility in occasional practice, while annual insurance is suitable for regular students. Choosing one of the safest cars for new drivers can help reduce these insurance premiums.

Learner Driver Insurance On Parent’s Car

The UK law will be authorized by at least a third -party deck for students. The basic document contains a valid temporary license, an address certificate and supervisor qualification. Supervisors must be over 21 years old and have three years of driving experience.

International licenses need additional documentation, including valid permits and evidence of residence in the UK. Diseases require DVLA reporting and may affect insurance conditions. General conditions, such as diabetes or vision problems, need reporting on a proper blanket.

After passing the exam, moving to new driving insurance becomes crucial. Intelligent technology rewards us through our secure driving sensory application by offering competitive prices without outsourcing or gauges.

Provides customized premiums based on your location and guarantees that you will get a fair and competitive price, no matter where you are.

Does Your Child Need Learner’s Permit Insurance?

Urban areas cost 30-40% more than rural areas. London premiums on average 2, 100 pounds, while rural areas on average 1, 400 lower accidents and crime.

Neede You need a temporary license, current address certificate and full information for the supervisor license. Your supervisor must be more than 21 and have more than 3 years of driving experience.

Short -term insurance for random training costs £ 20.09 a day. Regular students save more than annual policies for £ 1, 500 years through telematics.

Yes, if you add to your current policy. Student requirements affect the bonus. Think about the individual practices of the student to protect the bonus request.

Car Insurance New Drivers

Small engines less than 1.0 liters offer the lowest insurance premiums. VW up! On average 1, 300 insurance, compared to 1, 500 Ford Fiesta. As a rule, the lower the costs, the costs decrease.

Organize insurance before driving. The cover can start the same day with appropriate documentation. Driving without valid insurance can lead to penalties and penalties.

Students need at least a third party cover. Comprehensive insurance is recommended as it protects both the student and the vehicle of all types of damage.

Insurance usually covers a particular vehicle. Additional cars need special settings for deck or politicians. You must check the policy conditions before driving the vehicle.

Car Insurance For Learner Drivers

Transfer to the new driving insurance dedicated to as soon as you pass the test. A good learning voucher can reduce your original insurance premiums and make you cheaper on the road.

Thelematics can reduce insurance costs by 20-30% for safe drivers. Intelligent technology monitors driving without imposing restrictions and rewards good driving methods.

If you are looking for a car insurance loan, you are covered. New drivers can save with the Wisht application. Our site is aimed at young drivers who are usually classified to try to get the best possible colleague of your cash insurance. Fill in your information to get a quick offer that has also been sent to you through E -So so you can return to it later. You also have the opportunity to discard your calls so as not to be fooled by sales calls.

Black box insurance black is a special black box on your vehicle to track and track your vehicle. Installed in a black box, you will be notified if you are wrong to improve your driving skills by keeping yourself and other road users safe. For example, if you continue to break the boundaries set on your black box by acceleration, the risk of increasing insurance premiums or insurance rejection. Black boxes are usually at least 12 months.

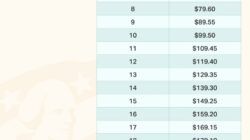

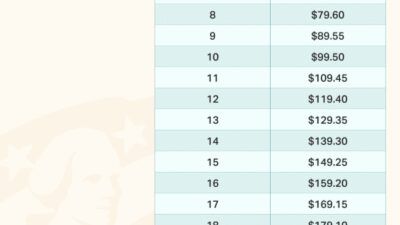

How Much Would It Cost To Add A Learner Driver On Your Car Insurance?

Learning a driver’s driver can sometimes take months to pass the test, so as a friends or older car, it makes sense to get as much training as you can run with lessons and help you get the experience you need to pass the test first. Especially with temporary licenses, it allows you to lag more often behind the bike that just taking lessons and the number of lessons you need, saving even more money in the long run.

Called driving insurance to get insurance as a named driver for your parents can be a great way to start learning to drive or build your experience until you get your own car. As a cheaper alternative to pay for your insurance, you will be added as a designated driver of your parents or grandparents that save money that can be used to save your new car. Your parents without shell discounts can also be safe if you have a black box that is equipped for use only while driving. If you want to learn how to drive with another adult family member who is not a qualified teacher, make sure you take and understand the student’s driver’s insurance.

Student driver insurance is a short -term, temporary insurance form that you can take to cover you while driving with an unskilled driving instructor. Many insurance providers provide this type of cover for students, and some insurance is very flexible, allowing you to take insurance for any hour for five months. If you take out an insurance for a few months and pass the test early, most companies pay extra payment.

Of course, there are circumstances such as an outsider ban or a night time ban. You exercise must be a complete and separate annual insurance cover, and some companies do not convince students using valuable or high performance. There is also additional, which is the amount you have to pay for repairs in the event of an accident

Prices For Cars, Insurance, And Fuel Are Making It More Expensive For People To Learn To Drive, Claims Heritage Car Insurance

Insurance of the student’s driver ends as soon as I get the test, so do not try to drive home unless you have organized an appropriate action.

Anyone who drives A, whether they were or whether they belong to something else and have a full license or insurance for temporary permission. If you drive without proper insurance, you may be forbidden to drive, get up to eight penalties and be given an unlimited penalty before passing the test

By law, all those operated on public roads in the UK must be insured. If you use a driving vocational school or a qualified instructor to teach you to drive them, you can be sure that they have the right insurance. A qualified instructor shows the green brand of his windshield, while the director of the specialist shows the pink brand. These are the only people who charge you for driving lessons. If anyone else requests payment, he or she will violate the law and may be reported to the Agency for Drivers and Vehicles (DVSA).

If a friend or family member teaches you to drive or take you for driving training, there are certain laws that are particularly applied to them:

Learner Driver Insurance Faqs

If you run without proper supervision, as shown above, you can get a significant penalty and six points under the license.

You and your supervisor may assume that it is good to allow you to drive them, but they need to check the insurance supplier to make sure they are fully covered to oversee the student driver. If not, they can add you to their insurance or you can take a temporary or student driving insurance just to cover the training. You can arrange this in a session, such as an hour or day, or take a long time to cover you for up to three months.

If you have your own, you must have annual insurance. Make sure this will cover you in oversight training. You can find that fully comprehensive insurance is a better option for a third -party insurance because many younger drivers choose a third party, assuming it is a cheaper option. This leads to more demands for these policies, which can really make them more expensive.

Learning to drive can be an expensive business and some costs you just can’t avoid. Applying a temporary license will require the start of payment even if you receive a slight reduction if