Car Insurance Massachusetts – The car shopping season is up for us! Car insurance is essential for any driver, but surrounds policy complications, attention options, and payments can feel like passing an unknown way. When you come to buy a policy, understanding the basics of car insurance is important for protecting yourself and your car. Below are some important tips for choosing the right policy for affordable prices.

Massachusetts status also requires you to buy two additional cover – Personal Wound Protection (PIP) and Driver’s attention (SU).

Car Insurance Massachusetts

Now that you are well aware of the basic types of attention, you are ready to commit to your particular vehicle insurance needs. Bay State drivers are required to have four types of car insurance, at least the minimum required by law, and to the highest level if you choose to do so – this is a good starting point in deciding on vaccines .

3rd Look 2023: Market Share Update Of The Ma Private Passenger Marketplace

Keep in mind, if you buy your first car insurance policy, you can expect to pay more than a driver who has had insurance for many years. And while driver experience can be an important price factor when buying car insurance, remember that it is not the only reason.

It cannot be denied that inflation has a significant impact on the insurance industry, and owning a car is more expensive for drivers across the country as a car insurance payment.

Although these insurance costs continue to increase, you may be wondering how you can reduce your payment. The good news is you have options – these are the best ways to reduce your rate:

Car insurance is an important part of car ownership responsible, providing financial protection and peace of mind if there is an unexpected accident or situation. By understanding the different types of attention, factors affecting payments, and tips for choosing the right policy, drivers can boldly move around the car insurance. Remember, the best policy is the one that takes the balance between full attention and ability, ensuring that you are adequately protected no matter how the open road takes. For a car insurance quote on the shower, please complete the form below. We will contact you to discuss options and discounts.

Cheap Massachusetts Auto Insurance In 2025 (top 10 Companies)

You already have a policy? Load your insurance policy easily so we can explore and compare the actual apple-to-apple options.

Need help or do you have questions? Our agents are happy to help. Call to discuss your insurance needs.

** Please note that you will only be provided with a quote. The comment will not be bound or effectively automatically.

When you send us a copy of your policy, our team has the opportunity to get a picture of your current insurance, discounts, and add operators to your current insurance policy.

Average Cost Of Car Insurance In Massachusetts In 2025

Insurance companies send you a copy of your insurance policy annually and if any changes to your policy have been made during the year. However, if you cannot get your policy, your insurance company or insurance agent should be able to send you two copies by email, fax or mail.

As soon as we receive your upload policy one of our team members starts reviewing your policy. We will then contact you to discuss your vaccination options. Each insurance company has different writing guides and offers different covers and standards. Improve when we try our best to quote and information if it can still be necessary to get more information from you to prepare the most accurate rate.

Sera za bima wakati mwingine zitatajwa kama ukurasa wa chaguzi za chanjo au ukurasa wa azimio la chanjo. Below are samples of different types of insurance policies (click to see a large scene) Find cheap car insurance options in Massachusetts. This guide cuts the cheap service providers, city standards, and tips for reducing the profiles of all drivers, as well as young and DUI drivers. Pata Chanjo Bora Kwa Mahitaji Yako Leo.

Explore and compare standards by more than 50 insurance companies, including development, travelers, SEN, and across the country, to get better car insurance contracts.

Cape Cod Uninsured Underinsured Motorist Attorney

Kupata Bima Ya Gari Ya Be Bei Nafuu Huko Massachusetts Inaweza Kuwa Changamoto, Haswa Kutokana na Sababu Tofauti Zinazoathiri Viwango Vya Malipo. This guide explores the cheapest car insurance options available in Massachusetts, analyzing the driver’s profile, attention types, and insurance providers. If you are a young, older driver, or someone with poor driving records, this copy will help you move around car insurance hardness at Bay State.

Massachusetts is one of the most expensive provinces for car insurance, with an average annual payment of $ 1, 399, less than the national average of $ 1, 543. The state than Dhima Ya Jeraha La Milwi Wa Mali, Ulinzi Wa Jeraha la Kibinafs (Pip), na canjo ya dereva.

Before reviewing the cheapest insurance options, it is important to understand the minimum required by the rules in Massachusetts:

Several factors affect car insurance rates in Massachusetts, as well as age, running history, location, and the type of attention you choose. For example:

Fillable Online Application For Massachusetts Motor Vehicle Insurance Form Fax Email Print

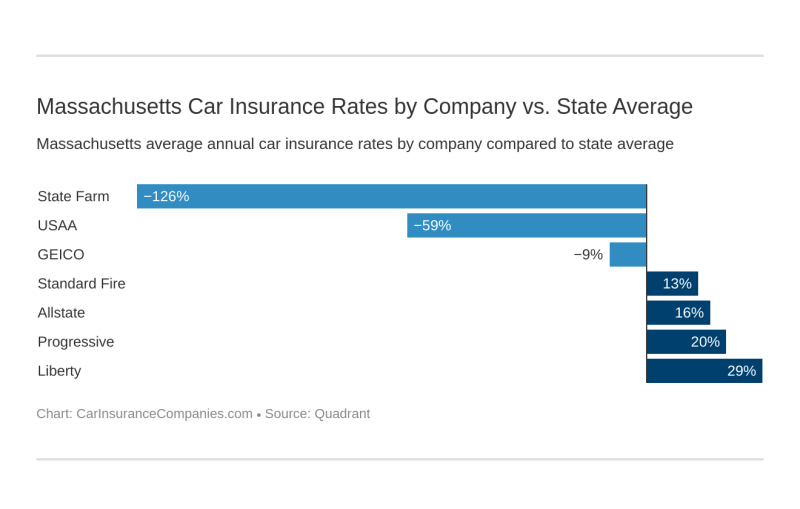

According to an analysis of a variety of sources, the following companies offer the cheapest standards for car insurance in Massachusetts:

Geico offers the lowest levels in the population in Massachusetts regularly. With an average payment of $ 861 for low attention and $ 1, 025 for full coverage, Geico is expensive for good drivers and those with a clean running record.

State Farm is another high option, especially for young drivers. It offers the cheapest price insurance for $ 1, 590 annually. This is also the cheapest option for those with DUI on their record, with much lower rates than other service providers.

USAA is a good choice for military families, providing an annual payment of $ 1, 115 on average for low coverage and $ 1, 335 for full coverage. However, it is only available for soldiers and their families.

Unbelievable Car Insurance Rates In Massachusetts

Insurance costs vary greatly depending on the driver’s age, driving history and other personal factors. Below is an analysis of cheap options for various driver profiles:

Young drivers often suffer from the highest insurance payments due to their inexperience. However, some companies offer competitive rates for this population:

The State Farm provides excellent rates for young drivers, with a full average payment of $ 1, 590 annually.

DUI may affect your insurance rates, but some companies offer the cheapest options for high -risk drivers:

Best Car Insurance In Massachusetts (2024)

Geyso is still the cheapest option for drivers and DUI, providing full coverage of an average of $ 1, 673.

For those seeking fundamental attention to meet the legal requirements of Massachusetts, the following service providers provide the lowest levels:

The proposed provides the most complete coverage for $ 913 annually, followed by security insurance by Geyso.

Your place within Massachusetts can significantly influence your insurance rates. Urban areas such as Boston and Springfield have high buzz due to higher traffic, higher accident rates, and more calls.

Massachusetts Auto Insurance

Brockton and Lynn are the most expensive cities for car insurance in Massachusetts, with average payments exceeding $ 2, 100 annually.

Even with the highest payment in Massachusetts, there are several strategies you can hire to reduce your car insurance costs:

Getting cheap car insurance in Massachusetts needs to understand a variety of issues that influence standards and know where to find the best deals. Geico, State Farm, and USAA are among the cheapest providers in the province, providing competitive rates in driver’s profiles and attention rates. By shopping around to take advantage of the discounts available, Massachusetts drivers can get the attention they need at a price that suits their budget.

In Massachusetts, the minimum coverage required includes $ 20, 000 per head and $ 40, 000 by accident for physical injury, $ 5, 000 for property damage, $ 20, 000 per person and $ 40, 000 accidentally for the attention of drivers, and $ 8, 000 for personalized injury protection (PIP).

How Much I Pay For Car Insurance For A Tesla

You can reduce your car insurance payments by buying nearby quotes, incorporating policies, increasing your commitment, and taking advantage of reductions such as safe running or protective course reductions.

The State Farm offers young drivers the cheapest rates, with a full average payment of $ 1, 590 annually.

Yes, DUI can increase your car insurance rates. However, Geico offers drivers and DUI the cheapest options, with full coverage rates of $ 1, 673 annually.

Financial Equipment Calculator: How much do I need to retire? How to invest when you feel you are behind a millennial retirement plan so that only work can work

Commercial Auto Insurance

Merika and Mexico Business Battle, Canada, and China: Automatic Schedule of Important Nnick Andr Development · 10 Mun Read · Feb 9 New Tax Measure: How it affects you in 2025 Nnick Andr · 7 Mun Read · Feb 7 Klover App Review app 2025: Operate is it worth using for money development? Nnick Andr · 8 min Read · January 24Americans have been paying a high price for everything due to inflation. Even insurance drivers pay more for their car insurance than it was years ago.

40% of insurance drivers demanded to afford car insurance. In several states, there is no way around these payments as car insurance is a requirement.

To ensure you can afford your policy,