Car Insurance Options – There are different types of car insurance coverage and policies. The right car insurance coverage or policy you need is affected by several factors, including the car and the car’s use. By legal mandate, any citizen who runs is required car insurance. Car insurance coverings and policies provide financial protection against car theft and car damage from events such as traffic collisions, natural disasters and collisions with non-moving objects. A vehicle and driver must be equipped with the right car insurance policy to legally use public roads. People who are trapped with driving without insurance can be fined up to £ 300 and receive six points on their license. The vehicle can be seized or even crushed. The consequences may be more serious depending on the gravity of the accident, such as causing a collision that leaves another person injured.

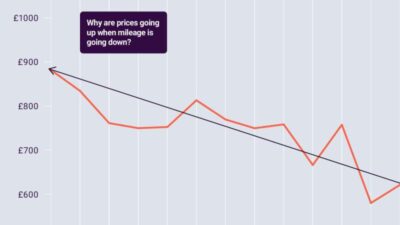

It is important to choose the best car insurance coverage because insurance was created to help a driver get back on their feet and essentially return them to the point they were before the unfortunate accident. Choosing the best car insurance coverage may depend on several factors, including where a driver lives, driving experience and the nature of the policyholder’s environment. One of the factors that can affect car insurance costs is the driver’s history. Different vehicles have different coverage costs. There are many characteristics of a vehicle that insurers look at before providing coverage. Since 2020, car insurance rates have fallen due to competition. On average, most people get the smallest requirements for car insurance coverage with a few additions. There are many car insurance policies provided by many insurance companies that are available for anyone to choose from. To use car insurance discounts, find out which discounts a provider or potential provider offers, and then request it. Sometimes the task may become overwhelming, which is why you need to be aware of your car insurance options and understand the various basic car insurance policies that are. Almost three most important basic car insurance levels are explained below:

Car Insurance Options

Generally, the level of coverage determines how much the insurance will cost. However, there are other types of car insurance coverage to take out. Note that a good car insurance policy consists of several types of coverage. The short -term car insurance is another type of car insurance that specifically provides coverage for shorter periods, especially popular shorter term policies includes temporary car insurance for 30 days.

Host Liquor Liability Insurance: Tips To Save On Coverage

Responsibility coverage in car insurance is the part of an insurance policy that provides financial compensation to a driver who causes damage to another or their property while using a car. Responsibility coverage in car insurance will only cover damage done for third parties and their property. If a driver is to swing into a curb that damages people and destroys property, liability coverage will take care of the affected, not the driver. The effectiveness of coverage depends on the limits originally set by policy. In some places with car insurance without fault, drivers affected by accidents must file a requirement for their insurance companies first, regardless of their fault. Places like this usually cause their drivers to buy personal injury protection coverage (PIP). PIP covers all accident -related medical expenses for the driver and passengers.

Responsibility coverage has two components: Body damage and material damage. Coverage of body injury liability will have payment limits for bodily damage to one or more persons involved in a car accident. It will handle medical bills and lost wages for people in another car if the accident is your fault. On the other hand, coverage of property damage just pays for property damage in an accident caused by you.

Comprehensive coverage for car insurance is considered as the default setting when you insure your car. It is the highest level of coverage available for cars. Comprehensive coverage for car insurance will provide financial protection for you and your car even when you caused the accident. If a third party is involved, they and their property or car will also be covered. If your car is affected by arson or theft, the cost of repair can also be covered by extensive coverage. Choosing this option is not a legal requirement as responsibility coverage. Excellent extensive coverage should include a degradation cover, windshield cover, legal protection law, courtesy of car cover and false coverage among others. Some of the few things that are not covered with extensive coverage include accidents that happen because the driver was intoxicated or drunk by drugs, driving without a license, theft due to the driver’s carelessness, general wear and tear and driving and driving other cars.

Contrary to responsibility coverage, extensive coverage has self -share. A driver can choose different ownership depending on some risks in each area. The deductible will be held by the company. You and your insurance provider can agree on appropriate self -part based on geographical location and driving record. For example, if a driver submits a car damage claim for a car worth £ 10000 with a comprehensive ownership of 1000 pounds. The driver can come up to $ 9000 as compensation from the insurance company. Without extensive coverage, a driver had to pay for the damage out of his pocket.

Connecticut Minimum Auto Insurance Requirements In 2024 (ct Mandated Coverage)| Autoinsurance.org

Coverage of medical payment for car insurance is part of a vehicle insurance. Coverage of medical payment for car insurance can help you or your passengers take care of medical expenses incurred from a car accident, regardless of who is the blame. Coverage of medical payment is optional and is not required anywhere in the UK. Medical payments also cover funeral expenses. It covers the driver, family members serving the car and all passengers. Medical payment covers EMT and ambulance fees, trips to the hospital, visits from the doctor, surgery and x-rays, prosthetic limbs, etc.

The cost of adding medical payment coverage to your policies usually varies depending on factors such as residence and insurance company. Before you go for one, it is important to consider what it can do for you and how much it is to maintain.

Protection of personal injury is the cover that kicks in to cover damage to a driver or their passengers suffering from an injury thanks to a car accident. Protection of personal injury, such as medical payment, will cover financial costs regardless of who caused the accident. These are coverage that can be added to your car insurance policy. But what it protects is you, not the car.

For example, if an accident leaves you wounded, disabled or killed, the coverage will ensure that your family gets a claim. Protection of personal injury can come along well while dealing with extra expenses due to the accident. Protection of personal injury can also act as a safety net if a driver or their partner ends up disabled. Pip is even useful if you are low on cash due to a terrible injury. PIP coverage is not mandatory and it costs extra to configure. Some comprehensive car insurance policies may already include personal accident coverage, so there may be no need to get the optional addition. Serious injuries that this cover insures you against include permanent vision loss in one or both eyes, loss of limbs, paralysis, complete disability and death. Minor damage such as sprains are exempt. It is also important to note that getting a payout is unlikely if the accident happened while your seat belt was off. The same rule stands for people who come in accidents while drunk or intoxicated.

Factors To Consider When Choosing Rental Car Insurance

Most times the cost of this coverage is not too expensive. It usually ranges between £ 20 and £ 30 a year. The cost can sometimes be added to your car insurance policy, but if it is not, having the extra padding never hurts.

Collision coverage for vehicle insurance policy covers financial costs for your car if you are hitting an object or other vehicle. Collision coverage will help cover repairs and even replace your car if it is damaged or badly damaged in an accident. Collision coverage is secured regardless of who caused the accident. It also covers damage caused by holes. It is best to choose this cover if you live in heavy traffic places. Getting one is also a good idea if you lend or lease a car because it can be very expensive to replace an entire car or repair some parts. Collision coverage supports you by paying you the cash value of your car minus deductible if your car is completely damaged.

An example of collision coverage is when a driver runs into an object like a protective rail or mailbox, or when a car tilts over for some reason. You should note that collision coverage does not cover any financial need after an accident.

Disclosed and under -insured motorist coverage protects you from paying for damage from accidents caused by an uninsured driver. An uninsured driver is a person who does not have a liability car insurance. Such a person may not be able to take financial responsibility after an accident because they simply cannot afford it. Under insured drivers leave you to spend money from your pockets to be treated and deal with other costs. Insurance