Car Insurance Oregon – Oregoon car insurance requirements may be scary, but it is important to understand all drivers, including all drivers, including all drivers. Here to make sure that the important insurance requirement in Oregan is obedient to the law and be sure to protect.

Oregin gives all drivers to ensure that all drivers are legally responsible for the use of vehicles. The minimum state request of the driver of the responsibility must have a form of 25/50/20.

Car Insurance Oregon

The minimum insurance requirements that damage the injuries and property are $ 25,000 per capita. The minimum of $ 50,000 for minimum injuries is $ 50,000 per crash. For a minimum of $ 20,000 of the minimum property.

Cheapest Car Insurance In Portland For 2025

For a person, insurance is required without thinking about $ 15,000 mistakes. This includes protection of the events and wheels related to pedestrians.

The trading car in Oregan must have coverage covered at least 25/50/20. However, they may need additional insurance for their use. The required insurance is determined by special vehicles and type of use of the vehicle. Trade and upload should reflect increasing risk and potential for increasing financial losses.

The Security Department determines the needs of the Federal Motorcycle (FMCSA) in addition to the state law. If this insurance is in danger of car trucks, the driver of the victim covers the treatment and cost of the victim and the cost.

Trucks and trucks with fmcsa period, carriers, family trucks were transported. Insurance must pay $ 5,000 per capita $ 5,000 and $ 10 for every truth. In addition, transportation and pilot, reliable or securities should be at least $ 75,000.

Recent Storms Wreaked Havoc Across Oregon. Here’s Some Information On Navigating Insurance Claims

For motorcycles, Oregan’s insurance requirements coincide with cars for cars by emphasizing the need for damage and damage to the property.

While driving on a motorcycle, you need to take into account to get additional insurance like comprehensive insurance and conflict. Although this is not required by law, it can help protect you from damage and damage.

It is important to inform the insurance request for RiderDhare drivers in Oregon. The new law provides protection for individual injuries for the company’s Uber and life, drivers and passengers. The law aims to pay for the loss of medical expenses and wages in the event of an accident, to provide timely financial support for a long time.

Participate in Riding (so far accepted at the end of the walking request):

Average Car Insurance Costs For 20-year-old Drivers

Lyft and Uber offers their coverage for drivers during all travel to complete or exceed state restrictions. Especially since the passage of walking request until the end of the trip. Both platforms provide responsibility, conflict, conflict and comprehensive coverage, which offers the driver’s policy, including this.

For the driver, in the coverage, especially during the program, especially during the program, but there is no setting of approval of its car policy.

* There is a need for commercial vehicles that add state laws in FMS. For more information, see “Trade Oregan Trucks” in the article.

The FMCSA needs trade tools that add state laws. For more information, see “Trade Oregan Trucks” in the article.

Need To Get Out Of Oregon, People Cant Drive Here

If there can be a dreaded work of private vehicles, motorcycles, commercial use, trade or driving, the complexity of the Oregoegon insurance needs, the lawyer’s lawyer, specializes in the advice and legal representatives required for the special needs of the Oreganese driver. We provide free advice to help you see your insurance duty and potential claims with your commitment to protect your rights and financial well-being. Apply to the injured lawyer at noon, support the support of experts in Oregon, which allows you to pay $ 71 or $ 849 per month, and the support of specialists to look for cheap car insurance in Oregon. The United States is the cheapest car insurance companies in the financial country, tourists, tourists and Geico Oregon.

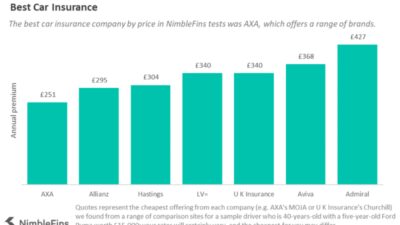

In this way, you recommend comparing comparison before buying a car insurance so that you can be sure that you have the best rate for the insurance you need.

For complete coverage policy, car insurance prices provided by the quadrant service for all regional codes in all stations of the Bastrin DCC were used for full coverage:

Interest rates for medium interest rates by zip code, zip and cheap company using 30, 35 and 45 of single drivers.

How Long Can You Stay On Your Parents’ Car Insurance?

The proportion of incentives for abuse and loan “was determined by a mid-degree of 30-year-old man with low credit points.

Some carriers can be represented by the branch or subsidiary. The proposed ratio is an example of value. Your actual quote may be different.

It takes into account many factors, including special assessment methods, customer satisfaction, expensive, financial and policy proposal. See “Method” section for details.

I was the best of the Global Credit Rating Agency, to obtain the financial power of the insurance company in A ++ (higher).

Oregon Hit-and-run Laws: What Do If It Happens To You

Using an internal and external interest rate mixture, we hold a classification of each insurance company with a minimum expensive ($$$$).

State farms are one of the car insurance companies in Origon due to low price and high customer service rates. State farms can also have favorable drivers for drivers with good notes.

We have found that public farms are often the cheapest choice for car insurance regardless of your driving record.

National Engine National Enginance National Insurance Committee, said he received fewer complaints for the satisfaction and industry of the high consumer.

Northwestern Insurance Group

The price of the state’s economy is $ 71 or $ 849 per year, which is average of 41% of the average.

Along with many coating options of financial countries, there is cheap car insurance in Oregon, even young drivers. It also receives several complaints from their customers.

The financial country is a cheap car insurance company in Oregan, even if you are in danger, are your record or your young people breaches or violations in your policy.

It also reflects the country’s insurance options, including insurance, replacement of new cars, covers personal belongings and the full coverage of the glass. However, countries do not provide gap insurance, so if tenants or lenders require you to require GQ Gat insurance, you may need to find other companies.

Auto Insurance & More In Il

The average value of car insurance from the Oregon finance country is $ 84 per month or $ 1 per year.

The United States is the best car insurance rates and the customer service assessment of any company in Oregon. Extension, service members include insurance, gaps and street bands from a special deposit.

If you are an active or pension member of a US military or part, there are lowest car insurance in Oregon. Usaa offers a space cover that can be required if you rent your car or financed.

USAA also has powerful customer service ratings and often collects the highest score in J.D. The annual power is claiming to learn satisfaction.

Best Car Insurance Rates In Oregon For 2023

The value of auto insurance from the United States in Australia is cheaper than $ 85 or $ 1 per year, more than 29% state.

Passengers have cheaper car insurance rates (along with long-term discount lists) and have a useful coating program.

Passengers are one of the cheapest companies for car insurance in the state. Although the price is below average, your coverage can be more convenient when it is a factor in about an hour.

The choice of passenger insurance is another solid dot. You can add new cars and add space insurance (if you don’t own) with more for local policies.

Cheap Car Insurance In Oregon

The average price of car insurance from the state traveler is a year or XXX, XXX, XXX, XXX, XXX, XXX, XXX, XXX.

Geico is one of what we have chosen for best insurance companies due to low prices, mobile apps, comfortable and powerful customer service.

Geico is one of the best car insurance companies in the state. If you have a new license that is often a bad credit or car, you will find cheap car insurance with Geico.

We also like Geico’s convenient mobile phone program that allows you to assess how much vehicles can cost after the accident. Although this is one of the largest insurance companies in the country, Geico has fewer complaints than their customers.

Top 10 Best Insurance Near Astoria, Or

The average price of car insurance from Geico in the state is XXX, XXX, XX $ or XX is cheaper than the state average of XX%.

Statistics show that young drivers are involved in more dangerous groups than other age groups, the most expenses for car insurance. Insurance rates usually fall into young drivers in 25, but this