Car Insurance Policy – Documentation of car insurance policies can feel overwhelming with all different conditions, sections and legal requirements. Although your insurance agent is there to help in the early stages, it is not unusual to have any questions as soon as you start assessing your policy.

This guide breaks the essence of your car insurance documents, even when you need your insurance card to hand, the importance of your policy number, the most important parts of your car insurance and what happens if you lose your proof of cover. We also cover the growing popularity of digital car insurance cards and common coverage types – so that you can fully inform and ready for the road.

Car Insurance Policy

Beyond the insurance card, your policy is split into sections. If you know these sections, you can know what you pay for and what you are covered for.

6 Factors That Affect Your Car Insurance Rates

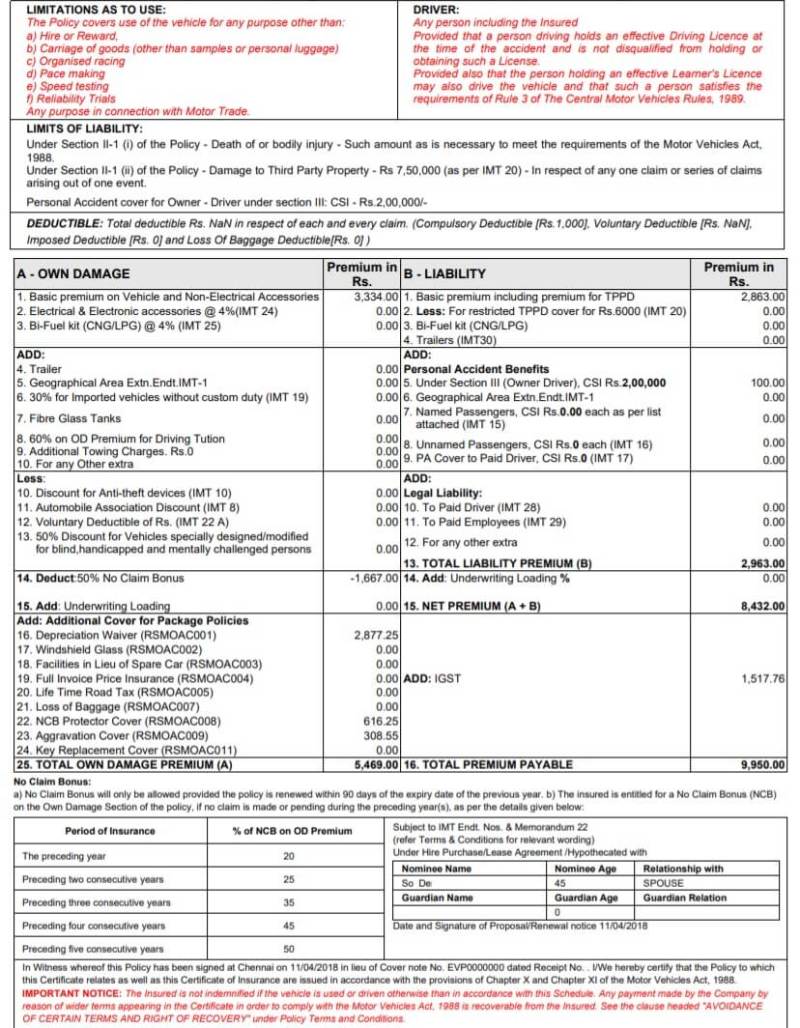

The first page of your policy is the Declarations page. It is a summary at a high level of the insurance agreement. It gives an overview of:

The insurance company will provide coverage stated in the policy in exchange for your premium. If you do not pay, they can cancel the cover according to the insurance contract.

Most important terms such as ‘family members’ or ‘insured drivers’. For example, a policy can define family members if anyone who is related to you by blood, marriage or custody who also lives in your household.

This section contains the types of coverage you have and when the insurance company will pay. It also shows scenarios where coverage do not apply – such as the use of your vehicle for business purposes without the correct coverage.

The 5 Best Affordable Car Insurance Options Compared

Here the insurer outlines what you should do if you have an accident and want to submit a claim. Common disorders are:

Each insurance coverage has a maximum amount that the company will pay. These single limits are often displayed as 25/50/20 which means:

The deductible is the amount that you pay before the company pays the rest. Higher deductible means lower car insurance premiums and vice versa.

This section clarifies which scenarios or damage does not cover the car policy (eg deliberate damage, reduced driving or inevitable natural catastrophes).

Cancelling Your Car Insurance-everything You Need To Know

Your policy number is generated when you first buy insurance and will appear on all relevant paperwork, including monthly statements, explanation pages and insurance cards. Usually consisting of eight to thirteen digits, it functions as a “social security number” for your insurance account.

Although having an active car insurance policy is crucial, proof of that policy – in the form of an insurance card – can be equally important. Think of it as a health insurance card: You must show it when you visit a doctor’s office to validate your coverage. The same logic applies to car insurance; You need an insurance certificate to check whether you legally operate your vehicle.

Because many states now accept digital car insurance cards as a valid proof of coverage, you can often store an electronic version on your smartphone. However, printing and wearing a physical copy is still a good practice – especially in states such as New Mexico, where law enforcement may not accept digital evidence.

The misplaced of your car insurance card is done more often than you might think. Fortunately, insurance companies are willing to send replacement physical cards and they can usually offer a digital or temporary version.

Buying Car Insurance In Installments In Saudi

Even if you remember your policy number, always request a new physical or digital insurance card. An outdated card can make a list of incorrect information, and it is best to have officially, updated proof of coverage at hand – especially if you are persuaded or involved in an accident.

With technological progress, many drivers store their proof of insurance on a smartphone as an electronic or digital insurance card. Although this is generally accepted in most states, you must check the local laws. In New Mexico, for example, officers are not obliged to accept digital evidence. Keeping both a digital and physical copy ensures that you are everywhere that you drive.

If you are looking for a new car insurance policy or looking for more affordable coverage, Insurancemavy can help. We offer different add-ons and coverage options at competitive rates. Make contact with an agent on 888-949-6289 for a free quote, start online or visit one of our many locations in the store.

With a better understanding of what your car insurance card looks like, why it is essential and how your policy functions, you are well prepared to tackle the road and any insurance questions that can come to you.

What Is A Commercial Vehicle Insurance Policy? A Must-know Guide For Business Owners

A car insurance policy number is a unique number assigned to your car insurance policy. Just like an account number, it links all your policy data to you and all insured vehicles.

Your policy number can be found on your insurance card, billing statements, the declaration page of your policy or the mobile app or website of your insurer.

This number is used to identify your account when dealing with your insurer. When submitting a claim, changing coverage or talking to customer service, you are often asked for your policy number.

Usually yes. If several vehicles have the same policy, they have the same basic policy number. Some insurers can add a suffix (eg “-1”, “-2”) for each vehicle, but they will still be linked to the main policy.

How To Read A Car Insurance Policy

Your policy number will not change unless your insurer makes important changes in it or rewrite them. If you cancel and start a new policy with the same company, you will receive a new policy number.

Although knowing your policy number helps to accelerate the claim process, you can still submit a claim using other identifying details such as your name, address and vehicle information. However, you can be asked for your policy number later.

Yes, usually. Such as how to verify banks accounts, your insurer can request your policy number and other personal information to confirm your identity.

Yes, your insurance certificate – whether it is physical or digital – will contain your policy number, the name of the insurer, coverage data and the name of the policyholder.

How To Choose The Right Car Insurance Policy For Your First Car?

Absolute. Keep your policy number at hand – physically or digitally through an app. You need it in the case of an accident, a traffic stop or contact your insurer for help. Plus is our most basic insurance package, it is not the same as the minimum coverage of the state or only liability.

We give you more coverage as our minimum, because the minimum liability insurance is not sufficient coverage to protect you.

If you have a state minimal car insurance and become an uninsured director, you can be liable for all costs that are not covered in your policy. This means that you can be expected to pay from your own pocket to cover the damage to your vehicle and yourself.

This is a potential financial disaster that we want to help you avoid. recommends that you buy so much liability protection if your budget allows comfortable.

Car Insurance Quote: Auto Insurance Programs And Costs

Extensive insurance covers damage to your car caused by things other than accidents, such as theft, vandalism or natural disasters.

Bots insurance covers you in situations where you drive and your car is damaged by another vehicle or object, regardless of who is an error.

Together they offer broader protection for your vehicle, with extensive handling of non-accidents related damage and collision handling-related damage. These insurance types can help you repair or replace your car in different situations, giving you more peace of mind on the road.

You can choose plus insurance if you have a parent or less valuable vehicle that can easily be replaced if it is stolen or in total. Or if you really can’t afford the extra comp & collision.

Top 10 Car Policy Diagram Powerpoint Presentation Templates In 2025

If you have a car about lease or finances, you must have the extra extensive and collision.

Plus + C & C will be better if your car is newer, more valuable or if it replaces, form a financial challenge. Newer cars are often more expensive to repair. It offers more peace of mind with its more thorough coverage.

We really recommend that you protect you and your family with as much insurance as you can afford. If you simply ensure at least (which we do not offer for the state) and get an accident with an uninsured driver, you may not be able to afford to replace your car, and it can be difficult to get money from an uninsured driver. Many of our customers do not have health insurance, so having MedPay is essential because it helps to pay some emergency costs.

Ultimately choose the insurance that matches what you need and how much risk you like.

Types Of Car Insurance Policies: Learn The Differences

Your car insurance usually covers rental cars with the same coverage as your current policy. Coverage is only expanded for personal use of the rental vehicle.

View your policy before renting a vehicle to ensure that it is active and check your current coverings. Some rental cars offer extra coverage. This cover can lower the amount that you owe if there is an accident at the rental car. We recommend that you purchase the extra coverage of the rental car.

With a recovery you can retain the coverage that has expired without having to request again. It is often easier and cheaper than finding a new policy.

Driving without active coverage can be hundreds of dollars on fines or even more costs if you get an accident. If you recover quickly, you can prevent you from having a cover gap on your record.

The Basics Of Car Insurance

Insurance companies like it if you are consistently insured. When they see holes, they will do that

Multi car insurance policy, check car insurance policy, personal car insurance policy, cheap car insurance policy, basic car insurance policy, annual car insurance policy, car insurance policy quote, car insurance policy number, first car insurance policy, new car insurance policy, monthly car insurance policy, massachusetts car insurance policy