Car Insurance Quote Uk – A good insurance policy provides its business against financial losses in the event of an accident. In particular, the insurance transfer from the bond owner to an insurance company.

Insurance bonds should usually be renewed annually, often with the possibility of paying in advance or paying in monthly installments. Insurance companies evaluate the details of each potential new customer, providing a customized quote. The price of the bond reflects the vehicle model and age, age and driving history, along with many other criteria that are taken into account. The vehicle insurance is a legal requirement if your car is used by the UK on public roads and the vehicle drive without proper insurance is a criminal offense. In the United Kingdom, a number of insurance bonds are available and vehicle insurance can ensure the vehicle if stolen, will be fired or otherwise injured by an accident. The minimum legal level of the available insurance coverage is third party insurance. If you find a vehicle on a road or public location, without minimal insurance coverage, you can get penalty points with the driver’s license and the vehicle can be stuck or even destroyed. It can also be confronted with a leadership restriction.

Car Insurance Quote Uk

Three levels of vehicle insurance bonds exist-fully comprehensive, third party fire and theft, and only a third party. A fully comprehensive policy covers you if your vehicle suffers random damage, requires repair after an accident, or is a victim of vandalism. Third -party insurance covers only third -party damage and injuries, but not itself or damage to its own vehicle. Third-party firefighting and theft policies provide extra protection for the third party, only to the third party that covers the replacement or repair of their car if it is stolen or damaged.

Is Driving Instructor Insurance Expensive?

As mentioned above, all vehicles on the road must have appropriate insurance, and taxis are certainly no different. There is an increasing number of taxi on the UK roads that turn

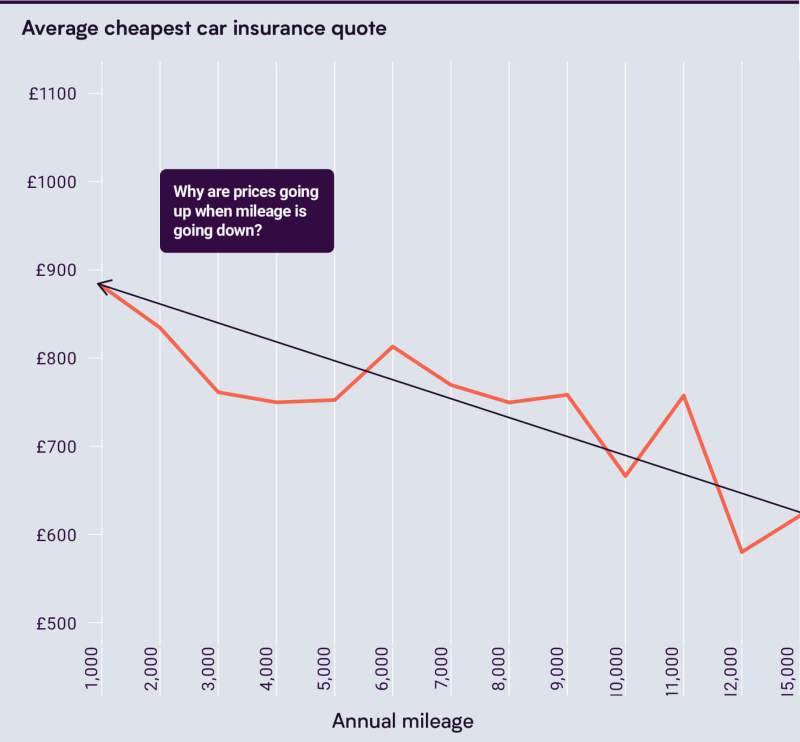

The risk of being involved in an accident. Taxi insurance is more expensive than the usual vehicle insurance, as taxi drivers have spent on the road and the risk of passengers’ payment risks. Standard taxi insurance covers you due to a third -party loss of real estate, vehicle or individuals. In the event of an accident, it covers the driver and the vehicle. The cost of insurance may vary depending on the mileage covered in one year. There are two classifications of taxis in the UK; Public rental taxis can be called from taxi rank or directly from the street, while private rental booths are pre -seized on the application, phone or website. Taxi insurance is comparably more expensive than usual vehicle insurance, but that does not mean that good deals are not found. If you compare your attempt to compare your taxi insurance quotes online, you can find the best prices at the best price. If you compare taxi insurance, be sure to make sure your policy provides adequate coverage for the vehicle and occupation, try compared to a professional customer service agents who answer the questions asked and help you find the necessary cover at a price that meets your budget. In 2024, vehicle insurance is more expensive than ever. So it’s more important to find the cheapest car insurance for you.Auto insurance in the UK is mandatory. No one should use public roads without insurance on the driver’s vehicle. Doing this may have a significant amount. In some cases, you can even lose your car. The only time you don’t have a car when it is declared as off -road.

This means that it is not in use and is therefore insured. You can choose from a wide range of vehicle insurance companies, each of which has different insurance quotes, the most favorable and the cheapest. The price range of the lowest car insurance quotes is between £ 281 and £ 333 per year. Different factors affect the quote that each individual receives. It is important to compare multiple insurance quotes for different companies before deciding on one.

The biggest advantage of getting cheaper car insurance is to save money. One of the factors that affects how costly the insurance, the insurance provider. Another factor that affects how costly the insurance will be is the insurance group to which the car belongs. The car model affects how much it pays for it. There are different types of cars and depending on which group they fall, they have different insurance costs. The cheapest vehicle insurance is the one that is issued for a car belonging to a lower group. This means that an insurance company will spend less to secure it. It is believed that lower groups cars are low -risk and cheaper to repair or replace as the case can be. Higher groups get into surplus cars. The reason for this is that they are considered high risk, they can have expensive components and the cost of replacement is high. Group A car is determined by a number of factors. For example, injuries, replacement parts, repair costs, repair time, new car price, power, brakes and safety. There are only three basic levels of vehicle insurance, of which one chooses. The first is the fully comprehensive insurance, which is the highest level of cover for the car. It protects all kinds of damage and protects the driver and other third parties. Total comprehensive insurance costs pay an average of about £ 555. The second type of coverage is third party, fire and theft coverage. These policies provide only the third parties involved in the accident. Third party, fire and theft coverage. It also protects your car in the case of theft or may damage the fire. Third party, fire and theft coverage. On average, it costs about £ 841. The third basic insurance level you can get to a car is a third party cover. This is the minimum legal requirement you need to drive on a road and is usually the most expensive type, especially for new drivers. The third party cover provides coverage for other accidents and people affected by their cars and wealth. The third party cover is about £ 1, £ 157 on average. The three most popular national companies that offer great services and cheap car insurance quotes are AXA, Direct Line and LV =. The actual price you pay depends on factors such as your location, your type, the type of car, the driving history and much more. The cheapest of all three is AXA (SwiftCover) and an average quote of £ 281. About 18% cheaper than the Direct Line, which costs an average of about £ 299 and is more than 30% cheaper than LV =, the average quote of £ 333. In addition to AXA, LV = and Direct Line, seven other insurance providers are known for their cheapness and great service.

Uk Fleet Insurance.com Launches Instant Quote Comparison For Small Fleets

SwiftCover was created in 2005. SwiftCover started only as a virtual insurance company and aims to have a good value for money for customers. According to reports, SwiftCover was the first company in the UK to allow its customers to print their car insurance certificates instead of sending them by mail. AXA purchased SwiftCover in 2007 and has since remained under a subsidiary. The AXA (SwiftCover) is located in Cobham, Surrey, and many call centers in the UK are scattered. SwiftCover specializes in two levels of vehicle insurance. One is a complete comprehensive coverage and the other is a third party, fire and theft. SwiftCover offers two types of coverage: standard and plus. Standard and plus both usually cover two levels of insurance. Switchcover also offers plus extras, such as bad fuel pavement, stolen keys cover and ongoing cover. Many consider the company as the cheapest insurance provider, an average monthly cost of £ 2,3 and £ 281. AXA offers great car insurance discounts, including an option that allows you to save your preliminary savings.

Switchcover is popular with young drivers who enjoy the great service. Below is the benefits of providing your car by Switchcover.

The Direct Line Group is one of the best -evaluated insurance providers and the third largest vehicle insurance company in the UK. The Direct Line Group was launched by Peter Wood in 1985 as a telephone insurance provider. The Direct Line Group customer service and political functions make them the most important choice of UK residents. The company offers a comprehensive car insurance cover with some good features that include a windscreen cover, a polite car and a long guarantee for repaired products. The group offered by the direct line group varies between standard and plus levels. Between the two levels they provide, a third party, fire and theft and comprehensive. The Direct Line Group not only offers a valuable service, it also offers consumers to reduce access obstacles