Car Insurance Quotes El Paso Tx – Finding the right insurance requires some navigators, but our A-MAX insurance experts are here to guide you at every stage.

State law demands drivers to pay their accidents. Most people meet this need by buying “responsibility” insurance for their car. Responsible insurance pays to treat those injured in the accident. You will also pay to repair or replace the damaged features of other drivers.

Car Insurance Quotes El Paso Tx

If you have a serious accident, the minimum limit to fulfilling your financial responsibilities may not be enough. We suggest that you consider increasing the coverage range. However, increasing the coverage range will increase the policy premium.

Texas Cities With The Cheapest Car Insurance

If you are damaged in an accident that causes you (up to the limits), you will need to add “collision” coverage to your policy to cover your vehicle. “Comprehensive” coverage is a measure of repairing or repairing a car if it is damaged by heel, fire, road debris, vandalism, or other covered threats (to the extent of ACV). State law does not require comprehensive and conflict compensation. However, if you are still borrowing from your car, your lender will likely need this compensation. If another driver is damaged in an accident due to another driver, the other driver’s insurance will pay for the car repair to the other driver’s policy limits.

Driving without car insurance is a violation of law. Law enforcement officers require that you provide evidence of car insurance during traffic stops. Your insurance company will provide you with a “insurance identity card” which is eligible as a proof of your insurance. The card describes the basic features of the auto policy, including dates when coverage begins and ends. You should keep your insurance card while driving. If you are unable to provide proof of responsibility insurance, you may be fined, lock your car, or suspend your driver’s license.

Without insurance, the economic consequences of driving can be even tough. If you have an accident, you will be financially responsible for the resulting injury or property damage. If a serious accident happens, you may have to pay tens of thousands of dollars from your pocket. If you are unable to pay your owed money, you may be tried and the court may order this money to be deducted from your current and future income. In addition, this may mean that those injured in the accident have difficulty accessing medical care, which they need to be fully recovered.

No. All applicants will have to show proof of insurance to obtain the driver’s license for the driver’s license. Whether you are getting your driver’s license for the first time, renew your driver’s license, or get your driver’s license after moving from another state, you will need to show proof of your insurance.

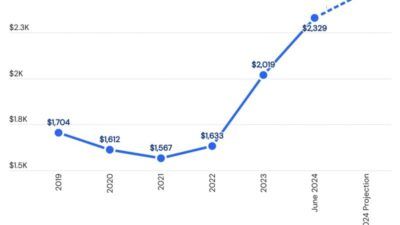

Best Cheap Car Insurance Rates In Texas (as Low As $33/mo)

Whenever a law enforcement officer asks you for it, you have to provide insurance proof. Law enforcement officers will seek evidence of insurance if you are involved in an accident, whether you have an accident or not. If the police have been stopped for traffic violations or other reasons, the police will also get evidence of insurance. When you get or renew your driver’s license, register your car, and inspect your car, you will also need to show proof of insurance.

Each company reviews the risk differently. All companies usually use some kind of equation that take into account a variety of “risk factors”. These factors usually include driving history, age, gender, marriage status and some cases, insurance credit scores.

No. Insurance can only be sold by insurance agents or brokers who are licensed by the Department of Insurance.