Car Insurance Quotes For Over 80s – If you are happy to leave the AGE Co website, just click “Continue” and move to LV = relevant.

Age Co is 100 % owned by Britain and gives its profits to charities. Over the past five years, Geal Co has contributed more than 12 million pounds to Britain’s age

Car Insurance Quotes For Over 80s

Age Co provides insurance on cars, which LV =, which covers drivers in the 1950s, 1970s, and above. 5 stars classified by Defaqto Comprehensive Protection:

Senior Driver Insurance Northern Ireland

Learn about the features and benefits that your car secures will help you get the utmost benefit from your policy and choose the right cover for you. The table below provides a summary of what is covered. It also determines the optional additions available to those who want to customize their coverage.

In addition to this summary, please refer to the document and provisions of LV terms and the coverage document and restrictions to obtain full details about your policy (conditions, conditions, restrictions and generalizations apply). You can also refer to the IPID Automotive Document for Details of your quotation.

If you want to drive your car on public roads, you should be insurance on cars instead. This is a legal requirement for all drivers in the UK.

The insurance level depends on the insurance you buy on you and must reflect your personal circumstances and needs

Finding The Best Car Insurance For Seniors

Only a third party covers injuries and damage to the other side if you are involved in an accident that is your mistake. This level of coverage does not include damage to your car damage.

A third party, the cover of fire and theft, in addition to only a third party, this car insurance protects your car from the damage caused by the fire, theft and the experience of theft. It also covers the third claims, if you are involved in an accident.

Comprehensive coverage, the highest level of car insurance. It provides a third party, fire and theft and covers the cost of repair or replacement if it is damaged or involved in an accident.

Please remember, read your policy documents along with the terms, conditions and cover documents, so that you can understand all the details, including all restrictions.

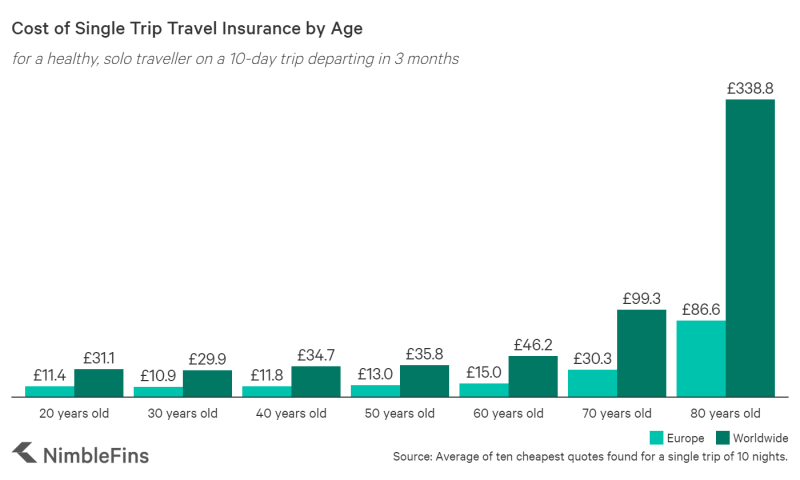

Travel Insurance For Over 70s

If you want to set your car insurance policy to suit your needs, there is a variety of optional additions.

Many insurance companies cover people over the age of 80, although others may have restrictions. Age Co, which consists of car insurance, provided by LV =, is the maximum age of 110 years. This means that more people over 80 years old can find protection through us.

The cost of car insurance depends on many factors, including: your age, your car style, and where you live. Drivers over 80 years old may have more experience, but they can also deal with more health challenges that affect their leadership. This increases the risk of participating in an accident and can increase car insurance prices. However, there are still ways to overthrow the cost of securing your car, at the estimation of the required features of a policy.

Regardless of age, you should report all of the DVLA medical conditions directly to your organization and provide insurance on your car. Some conditions may increase your insurance cost. but.

Audi Car Insurance Specialists

In addition to your health, you must monitor your vision to ensure that the legal requirements for leadership are met. Free eye tests are available in NHS for 60 years and over.

No, there are no additional papers required for drivers more than 80 asking for insurance on cars. However, from the age of 70, you will have to renew your driving license every three years. This can be done for free, on the network.

All the driver’s needs are different from each other. So take time to think about the cover you need, throughout the benefits you will produce more than others.

Age Co offers insurance on cars, which LV provides =, with a variety of optional features and additions that may be suitable for your needs. As a standard, drivers can enjoy a 24 -hour auxiliary line to 500 pounds to continue your journey or bring you a safe place if necessary.

Car Insurance Prices By Age In India 2025

Whatever it is, you will join CO customers for a thousand who help us to make difference in the lives of the elderly. We have 100 % of Britain and give our profits to charities. Over the past five years, Age Co has contributed more than 12 million pounds.

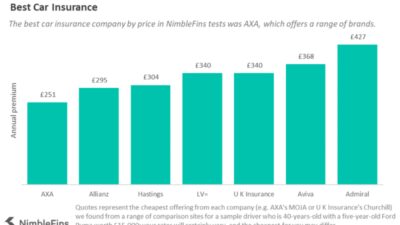

We carefully chose LV = to provide car insurance for our customers. As part of our society, lv = our values and passion for customer service. The company is also one of the leading insurance companies in the United Kingdom.

You can take out cars insurance as long as you feel enough to drive. We have used our experiences and research about the needs of the elderly and LV = to provide insurance on cars that suit our customers. LV = Cover Provider Car Insurance up to the age of 110.

Yes, there are two ways to do this using LV =. You can exclude a multi -carr insurance policy, or you can spend two separate car insurance policies. If you choose multi -carbon insurance, you will receive another opponent and you can guarantee up to 6 compounds in one policy.

Over 70s Car Insurance

If you need to add another vehicle to your policy temporarily, you will need to call LV = to quote 0330 678 5226

This is a discount on your car insurance if you may not demand a claim in previous years.

If you have nine years or more without claiming demands (NCD), you can ensure the maximum discount when a new insurance policy is released.

No. If LV releases a policy until age of age, claims in the windshoot glass will not affect your demand without claiming.

Age Co Car Insurance Review: Everything You Need To Know

Yes, you can add a protected NCD as an optional addition to your policy. In this way, if you filed a lawsuit for your policy (and LV = it cannot restore its costs from the person or persons guilty), you will not lose your NCD or reduce it.

Preparation of pre -medical conditions should not affect your quotation, but the UK law requires you to report certain conditions for the Driver and Training Agency (DVLA), and if they see that you are not qualified to drive, you will refuse to cover.

Legally, you should read a 20 -foot car from the car so that you can drive, so it is recommended to coordinate regular eye tests to ensure that your vision is at its best. You can coordinate the eye test for optics. You have a responsibility to notify your insurance provider of any change in your medical situations that you should be aware of DVLA to ensure that an existing policy is not covered.

Yes, you can add the engine details cover as an optional addition to your policy. The engine breakdown is given by LV = britannia rescue.

Motor Insurance Quote

Yes, you can take the legal coverage of cars as an optional addition to your policy. The legal coverage of cars protects you from possible costs to take legal measures (up to 100,000 pounds) if you are involved in a car accident.

If you are not using your car currently, or if you keep it in the garage in the winter months, you can inform the Driver and Training Agency (DVLA) and obtain a legal message (Sonn). The vehicles are not required with the insured Surain because they remain outside the road. However, it is important to note that you can lose your reward without claims if you do not keep car insurance oral on your name for more than two years.

Defaqto is a leading company in the UK leading financial information. Securing the car we offer from LV = 5 -star rating.

You should always contact your car if your personal circumstances change. In the case of retirement, you may find a low cost of your policy, if that means you plan to travel less. Of course, the occupation is just one factor that continues to determine the cost of insurance on your car. Retirement may not make changes to your policy, but it is used to be open with your insurance company.

Find Car Insurance For Older People

There will be restrictions on a lifetime for many car insurance products, including covering the details. These restrictions differ from supplier and resource. In Age Co, we can provide detailed coverage for drivers until the age of 110. However, all drivers will undergo our energy conditions and may include many vehicles.

You do not necessarily have a medical condition to secure you. However, the law asks you to declare any conditions that affect the Driver Licensing Agency (DVLA). Here are some examples of the conditions that will need DVLA alert about:

If you are Roy Roy, short vision or blind color,