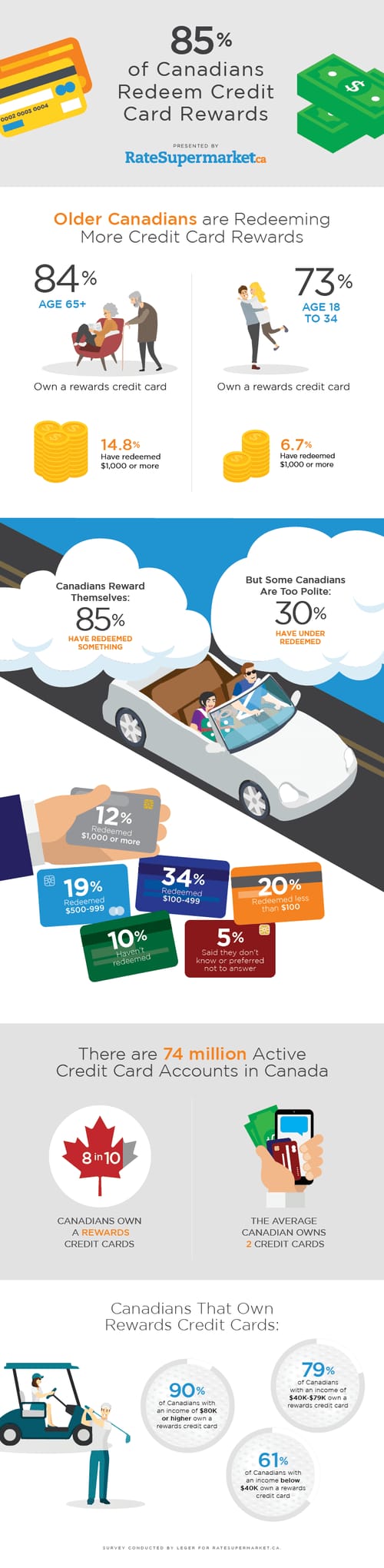

Car Insurance Quotes Kanetix – Traffic congestion, collision and high repair costs have a significant impact on the insurance premiums that drivers pay in GTA

Toronto, on (February 28, 2019) – from Hamilton to Brambon, Fujan to Whitby, drives in the Greater Toronto (GTA) car insurance more than drivers elsewhere in the province.

Car Insurance Quotes Kanetix

According to Kanetix.ca Insuramap, the average car insurance in Ontario is estimated at $ 1, $ 473, yet the most expensive city installments (also the largest boycott) exceeds this average from 500 to 1, 000 dollars.

Nova Scotia Car Insurance Guide

The installments in Marcham, Beckering, Witti, Hamilton, and Agax also exceed the average boycott by hundreds of dollars. To view the full menu, click here.

“Car insurance rates in FRS are the highest in the province,” said Janine White, Vice President of Markets and Strategy at Kanetix.CA. “The traffic density, crowding, collision frequency, and high repair costs due to the complexity of vehicles have a significant impact on the installment drivers paid by the installments of installments in the region. During the first nine months of 2018 in Ontario, for example, insurance companies paid $ 1.30 from Reforms and expenses for every dollar of the material damage that has been collected.

As the largest city of Canada, the car insurance premium comes in Toronto on average at $ 1 and $ 948 a year. However, residents who live in the northern regions of the city, whether it is the eastern or the western side, will aim to pay attention. The estimated installments in these parts of the city range from 2, 250 to $ 2, 590.

For a map showing the location of the estimated installments in Toronto, running $ 2 or $ 250 or more, and look where the insurance rates can be found on the lower Toronto cars, click here.

Buying A Vehicle Assignment In This Assignment You

Traditionally, one of the factors that will determine your insurance premium in Ontario is where you live. However, this may change in the future with draft law 42. This legislation, if passed, can make it so that the postal code is not a worker in what it takes for attention. Meanwhile, drivers are encouraged to shop for the best price.

“Regardless of where you live, cars insurance rates can vary greatly from one area to another,” said Mrs. White. “The only way to know that you get the best possible price for your interest is shopping. This is the most effective way to make sure that you don’t miss savings with another insurance supply.”

ENSURAP is an interactive map that allows drivers to know how to compare car insurance prices with other parts of their city or boycott. It is available for drivers in Ontario, Alberta, Kebbek, New Bronzwek, Noufa Scotia and Prince Edward Island.

All premium installments estimated on a 35 -year -old driver from Honda in 2015 with a clean driving record.

15 Car Insurance Myths Unmasked

Kanetix.CA announces the prices of more than 50 insurance providers, more than any other comparative platform in Canada so that consumers can find the best insurance rates for them. Use our website to find the best prices on cars, home, tenant, travel and commercial insurance. Insurance can easily be one of the most frustrating aspects of the ability to reach the road and driving. Money usually depends on money, and although some provinces or cities can be worse than others, finding the most affordable prices is slightly easier with these sites, although mixed results.

Kanetix hurts insurance rates throughout Canada as a major feature of it, but it also wants to locate the site as a way to prepare a comment on -Lin as well. The range is very impressive, at first glance, also separating classic car classification applications, commercial vehicles and motorcycles, which are nice.

The site does a great job in simplifying the process from start to finish, and the easy -to -use interface for use helps in the situation, but it should be noted that it does not collect prices by all insurance companies. There are up to 42 companies and financial institutions from all over Canada in partnership with Kanetix, but it is likely to be a broader chain.

I passed offers for quotations from the site and compared them to the rate of my insurance company. The best price that Kanetix could collect was $ 700 more than I pay more than a year. A friend found the price of $ 100 cheaper, so it is clear that it was hit or lost.

17 Year Old Insurance Help?

Basically, the insurance assistance line drops users through the same process that others perform by asking all the questions that the mediator will ask. Everything is specific, and the process does not take more than 10 minutes.

Although I love what I generally saw from this site, I did not fully understand the reason for my phone number to see the full list of quotes. There is also an evacuation of the right on the right that he says that companies that provide “special discounts” do not appear in the quotation process because it can only be transferred over the phone. The problem is that you pushed you to an actor in the last stage anyway.

This should be unnecessary when you are just an unknown inquiry to find out other available prices. More than 30 companies are part of the site gathering, and the best price for me is $ 120 is cheaper than I am now. This is cute, but it would be better for the site to allow more shopping in the windows.

Initially, this site is launched as something like the government site, and provides some useful information on the left, but not worthy of others.

Buying, Owning, Driving And Maintaining A Car In North America

The biggest difference here with others is that the site seems to support a handful of companies only. I am not sure of what this means when there is a general statement like “We just represent large insurance companies”, clearly in the section that explains what is the purpose of the organization. In the case you prefer a wider range, a loop can take you on the left to another site: Quotes.ca.

The best quote could find $ 600 a year more than its current rate. But again, he found one friend cheaper for himself and was $ 150 less. However, the three sites show that the numbers are estimates, so even small details can change the final account significantly. The elegance of the car insurance land can be particularly difficult if you are a high driver in Ontario. Whether due to previous accidents, traffic crimes, or other factors, they can be classified as high -risk that can lead to the highest installments and difficulties in finding appropriate attention. However, there are strategic steps that you can take to improve your opportunities to rely on high car insurance in Ontario while continuing to ensure competitive prices. This guide determines the basic suggestions and considerations to help you in this process. Are you ready to find insurance on high -risk cars in Ontario? Explore your options with insurance today!

Before diving in strategies, it is necessary to understand the meaning of high -risk cars in Ontario. Highly dangerous drivers are usually those who have a history of accidents, multiple traffic crimes, the only identity document condemnation, or insufficient driving experience. Insurance companies believe that these drivers are more likely to make claims, thus raising higher installments to alleviate their risks.

Understanding these factors can give you an insightful look why they can be considered high risks and what steps you can take to reduce these concerns.

Hi Everyone, I Am Looking To Buy A Car Preferably A Second Hand One But Wanted To Understand How Much Insurance Is There For A Car In This Area. I Am Primarily

High car insurance in Ontario requires a proactive procedure to prove your commitment to the safer driving and financial responsibility.

One of the most effective ways to reduce your insurance installments and improve your insurance is to improve your driving record.

All insurance companies are not treated with high -risk drivers in the same way. Shopping and comparing quotes from multi -service providers can help you find a ready -made insurance company to provide better prices for you.

The deductable advanced option can reduce your insurance premiums, although you will pay more pocket if there is a claim.

Seo Bangla Best Tutorial- 08 (keyword Research In Google Planner)

Some insurance companies specialize in providing attention to high drivers. These insurance companies may have more flexible subscription instructions and will be more understanding of your unique circumstances.

When applying for high -risk insurance, honesty is very important. Providing accurate information about your leadership record, previous demands, and any other related details.

Continuous car insurance shows a financial responsibility and can prevent gaps that may increase the complexity of insurance as a high -risk driver.

By following these tips, you can inform the challenges facing high car insurance in Ontario more effectively. Remember that patience and perseverance are essential, because improving your driving record and searching for insurance companies is ready to meet the needs of high drivers can lead to more affordable coverage options.

Kanetix Travel Apk For Android Download

All information is provided on this site “as it is”, without any certainty of completion, accuracy, or adherence to the dates or results obtained from the use of this information. Information is only intended for awareness and you should speak to a licensed insurance broker for specific and related solutions.

Insurance provides the best category insurance solutions supported by excellent customer service. We have sites via Ontario and Alberta and are proud to serve thousands of customers.

Please make sure to subscribe to -lin and you can unlock any article you face, and get E -EED immediately when our website updates as well.