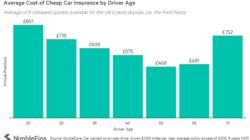

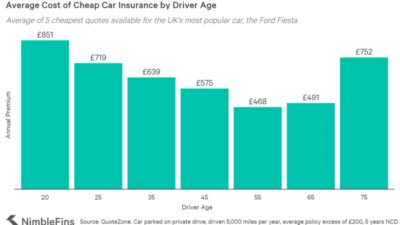

Car Insurance Quotes London – It is no surprise that young adolescent drivers pay for vehicle insurance anymore. The lack of experience of a young driver and limited management history is potentially risky for car insurance companies to ensure, so they ask for more for new driver insurance. But how much will the new driver pay? We have crushed the numbers to determine the cost of insurance of a vehicle in the UK for an 18 -year -old driver in England from the capital, so you will know what to expect, depending on where you live. The rates will be similar for 17 and 19 years.

If your priority is the price, you will probably decide for one of the cheapest plans you have. The team collected more than 400 Young Insurance offers for driver insurance in ten cities in England and calculated that the average bonus for cheap complex coverage for an 18 -year -old driver was 1, 752 per year. However, according to the area, the rates differed significantly, while young managers in Liverpool, Birmingham, Bradford and Manchester were cited more than 2000 GBP per year. Sheffield and Bristol Young paid managers at least in our study, just over £ 1, 100 a year. This means that young managers in some areas pay almost twice as well as young managers in other areas.

Car Insurance Quotes London

Among the high insurance costs and the average manager you spend more than 1,000 GBP per lessons (at a price of 34 GBP per hour lesson), the young driver is not cheap.

A Guide To Taxi Insurance Uk

To determine what a young driver usually pays for comprehensive vehicle insurance, we raised quotes for a sample of 18 -year -old male driver with a full British license run by Ford Fiesta 2016, the most popular British car. (More information on how the insurance costs vary according to brand and car model, can you find in our article worth securing the most popular vehicles in the UK?) In general, we have more than 400 quotes in London, Birmingham, Leeds, Sheffield, Bradford, Manchester, Liverpool, Bristol, Newcal – Newcal – Newcal – Newcal. Quotes included the coverage of courtesy car, deviations, personal accidents and legal coverage. Quotes were collected from the following insurance companies from plans:

The instructions on this site are based on our own analysis and help you identify the possibilities and limit your options. We do not like to tell you what product to buy; Do your own zeal before entering into any agreement. Read our full publication here.

Publication of Advertisers: Authorized and Regulated by the Financial Behavior (FCA), FCA FCA FRN 797621. This is a personal financial website based on data. Reviews that appear on this site are based on our own analysis and opinion focusing on product and prices, not services. Some offers that appear on this site come from companies from which they are replaced. This compensation can affect how and where there will be offers on this site (for example, the order in which it appears). Visit our advertiser for more information. The page may not check or include all companies or all available products. Although we use our best efforts to be complicated and higher -to date with product information, prices and conditions can change to publication, so always look at the details with the supplier. Consumers must ensure that they do their own caution before closing any agreement.

Note about saving data: *Information on the latest savings data, not -forest numbers as the payable data used for promotional purposes, click here. The instructions on this site are based on our own analysis and are supposed to help you identify the options and limit your choice. We do not like to tell you what product to buy; Do your own zeal before entering into any agreement. Read our full publication here.

Over 70s Car Insurance

Vehicle insurance experts have studied data from more than 500 quotes, and more importantly, the cheapest vehicle insurance in London can be up to 93% cheaper than the most expensive quotes. This finding is supported by an extensive recording of a ‘comparative car partner, which showed that the comparison of vehicle insurance offers can save you up to 515 GBP.

Vehicle insurance experts have studied hundreds of quotes data and found that the cheapest vehicle insurance in London could be up to 93% cheaper than the most expensive quotes.

To find out which insurance companies offer good offers for comprehensive car insurance for London residents, we have collected quotes from 45 insurance companies working over 33 London quarters. After that, we included insurance companies based on the average of their quotes in all London neighborhoods.

Our example manager is 30 years old, his three -year Ford Fiesta manages about 5,000 miles a year and has a good driving record. Here are five car insurance companies with the best rates in London.

Getting Car Insurance After Cancellation In Ontario

The data shows that Admiral was the cheapest insurance company in London with average rates in all 798 GBP neighborhoods per year. In fact, drivers save about 60% of the extensive purchase of vehicle insurance of one of the cheapest car insurance companies (including admirals and their telematics, Littlebox) versus the average quotes, so don’t forget to compare prices before buying. Here are example quotes for Ford Puma on the outskirts of London (in a slightly cheaper neighborhood) showing how Admiral competes for a price.

Car insurance for drivers in London can be difficult because some companies give a huge bonus to city managers. Why? There may be a greater risk of accidents and theft in some London areas. And each business has its own pricing model that differs in prices.

For this reason, comparing quotes are more important than ever, if you live in London – for example, a company that offers reasonable quotes in another area can charge much more in London, so one of the best ways to save money is to compare quotes before buying or renewing it.

Where you live in London, it can have a huge impact on the price you pay for vehicle insurance. To show how prices in the city are changing, we have collected vehicle insurance quotes for drivers living in each of the 33 London neighborhoods. Here were the cheapest three insurance companies for each London term, listed in alphabetical order:

Taxi Insurance From Cabsurance, London’s Leading Taxi Insurance Broker

London residents who are looking for car insurance receive average quotes from 1, 829 per year for comprehensive vehicle insurance, but these priority prices should be able to find cover for about 851 GBP – the average price of the ten cheapest quotes for car insurance in all 33 London neighborhoods. Those living in Barking and Dagenham are likely to pay the most for car insurance, with an average “cheap” quote 1, 400 – 66% more than average in London for cheap vehicle insurance.

On the other side of the spectrum, the residents of Merton, Islington, Bexley, Barnet and Kingston are likely to pay the least and accept the average quotes between 635 and 650 GBP for cheap complex vehicle insurance – incredible 24% less than those living in London. In the case of the cost of car insurance costs in vehicle insurance costs and Dagenham residents, they will pay a surplus, which is on average £ 80 higher than those living in the cheapest London neighborhoods in terms of car insurance, in the case of car insurance.

Insurance offers can differ significantly from person to person based on the details of the individual, so the quotes you receive may be higher or lower than our sample offers. Use the information here for educational purposes that will help you lead the best vehicle insurance for your needs.

In addition, the ‘cheap’ plans listed here generally have a higher surplus than you can find on competitive plans. Sometimes people prefer to decide on a slightly higher bonus if it means paying less if you have to claim. It is an individual decision.

Car, Home Or Business

Using an independent broker insurance of a vehicle in London can be useful for drivers who have questions, want more personal experience or are not convenient to buy online policy. Ask their fees. Brokers often charge fees for arrangements and/or higher cancellation fees that can increase the vehicle’s insurance costs. Here is a list of car insurance agents in London, all of which have assessed at least 4.5 out of 5 stars.

To determine what the London driver can pay for comprehensive vehicle insurance and choose the cheapest insurance company, our quotes from our insurance partner Quotezone have collected for a 30 -year -old male driver with a full British license and 5 years without any three years claims, 2015 Ford Fiesta. Our sample of ripe parks on the street near the house and rises to 5,000 miles a year.

If you want to buy a vehicle insurance in London, then click the button below to get Fast offers to 99 insurance companies in your area.

Note about savings data: *Click here for information on the latest savings numbers, data without salary and data from the payment used for promotional purposes.

Car Insurance Quotes Online

Erin Yurday is the founder and editor. She has worked before

Car insurance quotes london ontario, car insurance quotes maine, car insurance quotes pennsylvania, car insurance quotes oregon, insurance quotes car insurance, london car insurance comparison quotes esurance, delaware car insurance quotes, car insurance arizona quotes, london car insurance, check car insurance quotes, car insurance quotes phoenix, car insurance quotes de