Car Insurance Rates In Bc – In Canada, each province is in charge of the Must’s Must Copy and the cost of insurance cost. The territory such as Ontario and British Columbia has a higher insurance fee than the upper insurance and fraudulent cases. Newfoundland has the highest nerves of Maritime Province because the demand of body injury is more. Preaching is also known to bring the cost of insurance value. The chart below shows the cost of car insurance car for each province of Canada. Average auto guarantee is taken by sharing all the price fee in each province by a combination of a car written in each province.

In Canada, some territories will offer cars insurance, private, however, not all provinces in Canada with a public auto insurance. Public car insurance is provided by institutions and insurance companies that belong to government. If a private car insurance is provided by personal loans, financial financial institutions and insurance companies. The required coverage will be found by government insurance insurance offers a car insurance and private. Other insurance policies that are not under the Church insurance policy will be found in the special institution and insurance company. The only province; BC, MB, QC, and Sk. All other territories have a car insurance by independent car insurance that represents the table below.

Car Insurance Rates In Bc

Sonnet has an online car insurance in Alberta, Quebec, Ontario, New Brunswick, Nova Scotia or P..i Providers. With a competitive and special price, we can save more from car insurance. Getting car insurance is not easy to apply online with the sonnet today! Vancouver, August 13, 2019 / Chum / Columbritish and the price is expected to continue the coming year, according to the latest of ICBC financial statement.

Learn How Icbc Insurance Changes Affect You In Bc

Source: GIA & MSA Data for private security (December 31, 2018), Report (2018)

“Under the ICBC monopole, the British Columbiana will pay the highest car insurance, and the IBC, the Vice President, now the market has to open to the competition and option to improve car insurance for driver. “

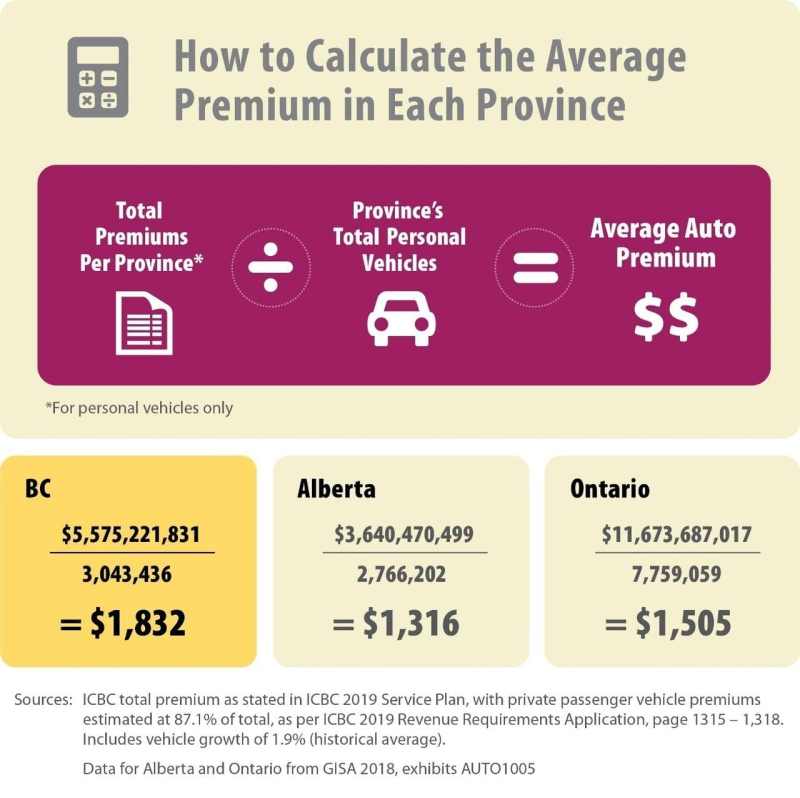

Average average average is calculated by comparing the fee collected in the passenger car in each province, and share it with the number of vehicles. Despite some organizations cannot be or cannot be compared or comparable, this way is used by the province of the province and the best comparison of the cost of money in each province. If you do so, it is more than the price of the English Columbian insurance of car insurance than other drivers across the country with competition and choice.

The MNP LLP report found that the independent hired servant and updates of the product and the newcomers to deprive the cost of a BC driver to 325 per year. A recent poll shows that 82% of BC driver requires more options and competitions in a car insurance.

How Much Is Insurance For A New Driver?

“The competition is a powerful incentive for a company to deliver the best product to the best price. The car insurers are available for this rule,” says sutherland. “The current number is still a proof that opens the need to open the ICBC to the competition and provides British skills around the car insurance.”

Full Notifications of Competition Methods can save a driver to 325 a year: annual benefit: a competition of competition with a car insurance in BC insurance

About Canada Board of Canada Bureau of Canada (IBC) is the industry organization that represents the independent home in Canada, Auto and Business. Membership company reaches 90% of the insurance and Kimualty (P & C) in the insurance market. For over 50 years, Ibc worked with the government throughout the country to help with cheap houses, car and insurance company available for all Canadians. The government and the emphasis on the government and support P & C industry support is supportive. It is the big problem and helps educate customers in the best way to protect their home, car, business, and possessions.

Insurance P & C is about the lives of all Canadians and the role of maintaining business and Canadian economy. It works for more than 128, 000 Canadians, you participate in taxes $ 9 billion and have $ 59.6 billion dollars.

Regulating Icbc Basic Insurance

For more information and more information, visit the IBC Media Center on the other side of the IBC. Follow IBC on Twitter @ibc_west and like us on Facebook. If you have any questions about home, a car or insurance company, contact the IBC Customer Information Center in 1-844-25-2SK-IBC (1-844-227-5422).

If you need more information, the IBC activists can talk about details in this information publishing. To provide an interview, please contact Steve Kee, director of, outdoor, 416-362-2031 ext. 4387, [Email is protected]

Canada’s insurance board (IBC) is the industrial organization that represents the independent home in Canada, Auto and Business. The membership companies make most of the buildings and possessions (P & C) in the insurance market (P & C) in Canada. For more than 50 years, IBC … Canada’s Office (IBC), the national organization represents Canada’s private home, the car and the entrepreneur

The calculation of the average average cost was made by comparing all the fee collected from the passenger car in each province, and they share it with the number of vehicles. This is the way we use the territory. Although some organizations can not or should not compare or not compare, Ibc says that the price of the price is provided or the best comparison.

B.c.’s Vehicle Insurance Rates Now Among Cheapest In Nation: Report

According to IbC, the causes of British Columbian pays car insurance than other drivers across the country is due to the lack of competition.

“Under the ICBC monopole, the English Columbian will pay the highest cost of the driver, the vice president, now the market must be open to the insurance and car insurance for Driver. “3 minutes can save hundreds. Enter your postal code below and include thousands of Canadians storage in car insurance.

It assists as independent mediators in you, institutions and professionals with no authorization to our employer. Interesting with transparency, we let us work with some suppliers we wrote – and list many financial services. It is not working or a public servant, to guarantee the truth, our content is considered a permission professional. Our unique place means that we do not ask your stake with your policy, to ensure our mission to help the Canadians make better decisions or discrimination.

When choosing what to buy, don’t check the features and the price. You should also consider how much time do you make and the special model. There may be important effects on how much you spend on the car per month.

Car Insurance Is Getting Pricier. 5 Ways To Try Lowering Your Premium

In this guide, we will show the easiest SIP to insurance in Ontario and the rest of Canada. We will also share some of the factors that determine SUV insurance fees.

The Hyundai Kana is considered the easiest suv in Canada. It has four levels, with se and the level se and cell to the most cheapest. Hyundai Limited and Hyundai Kaho Ultimate has more expensive trim than insurance because there is more features and more valuable features.

The former is with the minimum territory and small protection features, such as automatic heads, relief technology and the help system. The latter is with successive warnings and blind trafficways and the change of the road.

The Toyota Highlander is eight passengers that are more cheap compared to other vehicles offered by the Taboots, such as alarm, such as alarm, and the speedy recovery. This special pattern also executes the importance of mining.

Getting Car Insurance When Moving From Canada To The Us

The Toyota Rav4 is often regarded as one of the most expensive suv in Canada for his protection feature. The 2025