Car Insurance Refund Malaysia – All the owners of registered vehicles must have their renewed insurance policy every year. The coverage consists of benefits that usually vary among insurance companies.

Yes, you can cancel your insurance policy at any time. Most of the time you are allowed to cancel it for the following reasons:

Car Insurance Refund Malaysia

It is recommended to refer to customer service to find out the cancellation procedure. Request their help to help you with the procedure and all the documents requested.

Tiket 100% Refund

You can reach your insurance company to get more information. Get the hotline of your online insurance company to contact them.

It is mandatory to cancel your Roadtax before continuing to cancel the insurance. You can cancel the Roadtax into any JPJ branch near you.

You have to present your Roadtax with the JPJ counter. Without Roadtax, it is not possible to continue with the cancellation of the insurance.

For the cancellation of insurance, you don’t have to go to JPJ if you haven’t renewed your Roadtax yet.

Can I Cancel My Policy After Purchase?

You can send the message to your insurance company to tell them your intention to immediately cancel the insurance policy. Most insurance companies will give time, generally 7 days, for cancellation.

It is also necessary to send the original insurance certificate or take an account statement if the certificate has been lost or damaged during the indicated period.

After the cancellation, you have the right to have the reimbursement of the prize based on the short -term period designated. Note that the reimbursement varies among insurers.

In this way, you will be able to see the coatings offered by different companies and choose the one that best suits the budget and needs. This will therefore save you from having to pass through the drying of canceling your insurance policy and looking for someone else.

How To Maximise Your Income Tax Refund Malaysia 2019 (ya 2018)

For convenience, use the online platform to compare the light with 15 main insurance brands in Malaysia. Get your free online car insurance citations in just 3 minutes.

It is one of the largest Malaysia sites for the insurance comparison that offers policies of over 10 brands. Get your free insurance quote from today! The renewal of the toll and car insurance goes hand in hand as a guide without an active car insurance policy and the toll in Malaysia is illegal. Most of us are expert in the renewal process of both. But did you know that you can actually cancel the car insurance policy before it goes down?

There are various reasons why you as insured may want to cancel your car insurance. Here are two common scenarios:

If you sell the car to a new owner, cancel the current insurance policy as part of the transfer process for the property. The new owner requires his insurance policy with their name.

Switching Car Insurance: Here’s The Guide On How To Do It

Sometimes you may be able to move to another insurance provider for a better offer or another policy even before the current deadline. This is possible, but you will have to cancel your car insurance or the existing policy before requesting a new one.

Before continuing to cancel the car insurance, it is important to review your current policy in depth to check for any cancellation or sanctions commissions. You could also consider alternatives. For example, you can move on to another covering plan or reduce the driving mileage if you have an insurance based on mileage.

Another option is to wait until the policy is ready for renewal so that you can change insurance companies without having to cancel soon. But if you have decided to cancel, here are four general steps that you can follow:

Contact your insurance company or your customer service team for detailed guide and to understand the specific steps requested. They can help you with the process of guaranteeing a cancellation without problems and problems.

Vehicle Ownership Transfer

If you sell your car, you also have to disable the toll. You can visit the closest JPJ office to manage it alone or ask your used car dealer for help.

Some insurance companies may request a written cancellation message, which can often be downloaded from their sites. Insurance companies generally offer a seven -day cancellation period. During this period, specify the original insurance certificate together with other necessary documents.

After the cancellation, you may be entitled to reimbursement of your prize based on short -term rates, provided that you have not made any complaints. The timely return lines can vary, but generally it takes two or four weeks before the amount that can be credited to your bank account.

While the cancellation of your car insurance is permitted, it can be a drying to hurt. Make informed decisions when you choose insurance coverage to avoid unnecessary cancellations and save time and money. Now that you understand why and how to cancel the car insurance policy, consider these additional advice:

What Happens To My Car Insurance Policy When I Sell My Car?

Visit the website for multiple tips and the best options for car insurance. It offers a series of best insurance from leading companies. Renew your car insurance with a quick, easy and safe experience.

Hotline gives you access to the best insurance and financial consultants. Leave your Pesanan (message) and we will try to answer your questions and concerns as soon as possible. How to cancel the car insurance policy and get a refund in Malaysia – Recycle the money when you sell!

You knew that on average there may be up to 50% of the car owners who do not realize that when they sell their car, they could be entitled to a refund for unused insurance premiums.

This is the money that has been paid for the coverage that you no longer need. So in this story we will explain some details on the process.

Batal Insurans Dan Dapat Refund Untuk E-hailing

There may be many reasons to cancel your insurance. There are some articles out there that they also affirm that you can cancel your insurance to change the insurance companies halfway, but we do not really recommend it because the first step to cancel your insurance is to cancel the toll and get a refund for this is not as fast and direct as you will take care of a government department.

Therefore, we advise you to cancel your insurance only if you sell your car. We believe that efforts to take advantage are the highest for this reason.

If you have renewed your insurance through an agent, you can generally simply make a request to the agent and will be able to process reimbursement for you as part of their service because they have earned a commission from you.

If you purchased your insurance from a self -service online system, you must first manage JPJ to cancel the toll. You can download the JPJ K6 module to cancel the toll.

How To Renew Your Malaysian Car Insurance Online & Extra Coverages I Pay For

Now you can ask, why do you have to cancel the toll? This is because having an insurance policy that is in force is a requirement to obtain an impact first. Therefore, in order for politics to be canceled, there must be proof that the toll has been deleted.

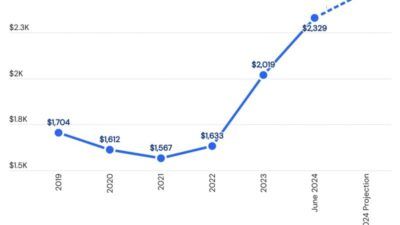

The amount that you may be entitled to reimbursement varies between insurance providers according to their commercial policy. We have prepared the reimbursement for which you can be suitable in the following table.

In general, a refund is calculated on one of the two ways through a layered system or classified according to the number of days left in their political coverage period.

What is consistent is, if more than 8 months of politics are spent, no refund is available.

Car Insurance Refund Mistakes: How To Avoid Them

Since he launched a pilot initiative 2 months ago, our insurance partner Carro Insurance has helped more than 200 customers cancel their car insurance policies and obtain a total of MRI 112, 240 in prizes, an average refund of 460 MR all ‘year. Customer!

If you have recently sold your car or plan it, contact us today to see if you are suitable for a refund. We do the quick and without paying problems of RM30.

Singh Sidhu collection thinks that there is nothing better than Formula 1, not even sliced bread. After writing about cars since 2006, he launched his head in the sector for passion for all four -wheeled things and everything else. The enthusiastic of the F1 will follow the sport since 1999 and has been following him since then. Between a race between the races, it remains engaged as a presenter of the guided automotive relationship and as a version of Joker. Why do you want to cancel the car insurance policy? It may be that you are not going to drive the vehicle for a while. Maybe you sell it and the buyer insists on the change of insurance suppliers. You may need money and ask yourself if there is a refund that is provided with cancellation. Read this guide to learn everything that is to know about the cancellation of the car insurance policy before it runs away!

The answer is yes and we think it is what you would listen to. If it is with legitimate Malaysian insurance providers, it will be possible to cancel the car insurance policy at any time. It is a practical option because it allows you to get out of a contract in which you no longer want to be.

Mpi Generali Car Insurance 2023: Find Out More!

Second