Car Insurance Singapore Named Driver – Here’s everything you need to know to find the best insurance in your car. We help understand the types of coverage, terms like NCD and excess.

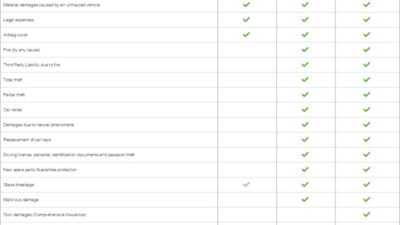

The law is to have a car insurance in Singapore to have a car as per your name. There are 3 types of car insurance plans to choose from, only a third party, third party, fire and theft and comprehensive car insurance.

Car Insurance Singapore Named Driver

TPO offers maximum insurance coverage and the minimum is required in Singapore. Includes only injured third parties and / or obligations.

Grabrentals Collision Damage Waiver

TPFT provides additional coverage in the main TPO coverage. TPFT will be covered by damage or damage to your vehicle, covered with fire and theft.

Comprehensive car insurance is a comprehensive program that includes you, your car, your passengers and your obligations in smaller and difficult accidents.

These are three car insurance conditions that every driver needs to know. They can significantly affect your annual premium, depending on how you adjust your policy.

When you select the car insurance coverage, the surplus is a fixed amount of money paid from your own damage pocket before the insurer covers the rest. You can customize excessively paid.

Essential Car Insurance Terms 101: Ncd, Excess, And Named Drivers

Adam is navigated along the pie on the way to work. The wood suddenly collapses in front of its path. Unknown to her, and car rectification cost is $ 2,000. Fortunately, his surplus is $ 500. So he just pays $ 500, and the insured accepts the rest.

1. Excess “own damage”. That excess only applies to your car. It is not a comprehensive third party damage.

2. Excess “on the third party.” This excess refers to the damage done by a third party. You may need this to pay on top of your “your own damages” excess.

3. Excess “All requirements”. This excess refers to the total amount paid to each collision, regardless of damage to unnecessary lids.

One Call Car Insurance Review

Generally, the choice of greater excess helps low car insurance premiums. However, less pay insurance, you put on a higher financial risk on the roads.

This discount stimulates drivers drivers. You earn a 10% discount for each year you stay by asking for up to 50%.

The NCD does not necessarily require needs as long as the driver’s responsibility is more than 20% of the barometry of the Agreement (Bola). If so, their NCD can be reduced by 10%.

Some drivers pay an additional fee for the NCD protective scheme. This allows them to make a request and still maintain their NCD privileges.

Which Car Insurance Sites Help You Find Cheap Car Insurance?

Your NCD is also transferred from one vehicle to another. Even if your car scratches, you can save your NCD for at least 12 months. In the case of the second pond, if you have two cars, your other car cannot enjoy the same NCD privileges as the first car.

The designated drivers recognize the fuses to drive a car. They are covered by the main ownership insurance insurance and are entitled to the same privileges / protection.

Family members are often added as a driver to keep financial risks low. If an anonymous driver is an accident when using your car, the insurer can apply a higher excess at your request.

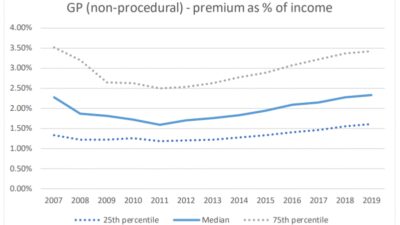

Insurance premiums vary from the driver. Generally, the higher risk of an accident, the greater premium of insurance your car will be.

Motor Trade Insurance

1. Main preparation and model – European brand cars have higher import taxes and parts parts, increasing the premium costs

2. Age of the car – car insurance costs generally decrease with age of your car

3. Secured age. People under 30, under 65 years old can expect to pay more expensive bonuses

4. Occupation – an external case shows that you will use your car more often and will risk a collision. This can translate larger bonuses

Ultimate Guide To Car Insurance In Singapore (2023)

5. Marital status. Insurers may lower your car premium if you have a family

6. Drivers for less than four years of drivers will have to pay more car insurance premiums

7 Type of use of the car. Private rental rentals are usually taller than private vehicles policy

8: Applies the history of accidents. Application “Loading Fee” If more than $ 10 in demand or two or more requirements in the last three years

12 Ways On How To Save On Car Insurance Premiums

9. There is no discount with a discount – if you have been submitted for several years, you will be awarded a recovery discount. Learn more about the NCD here.

10. Honesty and integrity. Dissionstresty about your driver’s history can pay you a greater reward if you provide fake information

11. changes in cars. Changes that do not match, will require additional coverage that will increase the premium price

• The police report gave the goal and collisions, conflict with vehicles registered in Singapore and the Government.

酒后代驾 Valet Driver Singapore

Here are some conventional mistakes made when creating a car insurance requirement. Avoid them to quickly develop your request and achieve your payment terms.

1. Failure to the need for an appropriate requirement within 24 hours, generally, should be reported within 24 hours, and the requirements must be submitted as soon as possible. Otherwise, your requirements can be resolved. You also need to have to send your car into a specific checkout schedule.

2. Failure to insurance Council; Your insurer is at your price when an accident occurs. They will focus you on the telephone line, if there are and advises you that seminars leave.

3. Acceptance of guilt or responsibility; The agreement on negotiations or submission of proposals to a private settlement means acceptance of responsibility. The on-side can use it against you, for the accident.

Are Driving Instructors Legally Allowed To Give You Mock Tests In Your Parent’s Car?

4. They do not receive the entire image: the less details you mentioned are so likely your requirements are fast. Here’s what you need to denote caused by car

5. Usually, the submission of poorly documented evidence, the insurer uses the car camera to make a part of the story together. If you don’t have a car shot camera to send evidence you need a lot of photos of different angles. Try to acquire a good mix of approximate, medium and wide angle shots.

6 Transportation is inappropriate. This affects your evidentiary documents, as you can miss certain details and allows the other side to dispute your needs. Look for a witness if necessary.

7. Visit to an unauthorized seminar – Usually the insurer uses car cameras to make a part of the story together. If you don’t have a car shot camera to send evidence you need a lot of photos of different angles. Try to acquire a good mix of approximate, medium and wide angle shots.

Singapore Driving Licence

More often, no, the best car insurance does not mean insuring the cheapest car. Here is the best car insurance for different needs and desires.

When buying internet car insurance, one motorized service guide for Singapore drivers understanding car insurance types in Singapore. There is no discount for demand. Buying a car insurance in Singapore and buying a guarantee of used cars. Let’s talk about insurance for drivers, why used car dealers.

Don’t think the ambulance is easily accessible when car accidents occur. Some insurers do not provide a return clinic and adapting an unauthorized emergency can complicate the process of your requests.

No, your discount that does not ask (NCD) do not recall immediately when you have an accident. If the fall is not your fault, you can still save your NCD privileges.

Driving To Malaysia. Ways To Make It Stress-free

No, your NCD cannot be significantly reduced based on the request. Usually searching for its own policy reduces 30% of the NCD. However, some insurers have policies allowance to protect your NCD in such events.

Modified vehicles can be ensured, but generally includes additional fees. When connecting to the insurer, declare a change of any vehicle or your insurer can recover politics or reject your misfortune.

Insurers provide loss of use / benefit or even a kind car, only if it is included in your insurance plan. It also depends on the fall and weight damage.

Not all accidents should be declared, but subject to your insurer’s preferences. Some insurers do not require drivers to declare the accidents in which they are not guilty.

Total Protect Plus With Auto Assist

Is the car classified for a sports car, a hybrid car, Council of Europe, OPC Auto, Hatchback, Static, SUV, van, trucks? Buy a new car dealer, parallel importer, car auction, etc. Check out our car blog and the price of the Council of Europe. Find machines for rent for short-term rent, long term rent, private car rental, wedding dresses and cars for P-panels Probation drivers.

Named driver insurance plan, insurance car singapore, tesco car insurance named driver no claims, cheap named driver insurance, young named driver insurance, aviva named driver insurance, named driver insurance policy, named driver insurance quote, add named driver to insurance, named driver insurance rules, car insurance named driver, named driver car insurance rules