Car Insurance Singapore Ntuc – Car insurance is compulsory in Singapore, but finding a car insurance plan.

The best car insurance premiums are almost always offered by a large car insurance company such as NTUC, Singlife and FWD car insurance. However the average costs may vary.

Car Insurance Singapore Ntuc

On average, car insurance in Singapore has around $ 850 to $ 1,000 to $ 1,000 to a regular vehicle. Most guarantees offer different types of car insurance policies, We will learn more in this article. However, the policies called policies called policies called “complete” policies called “complete” policies called policies called policies.

Why Is Singapore’s Insurance Industry So Competitive?

If you are intended to drive in Singapore, extracting the car insurance plan is compulsory and essential. There are many car insurance plans in the market. However, the best car insurance premiums can provide your unique requirements include their own accident insurance,

Different car insurance companies offer different types of cars insurance premiums and packages. You usually attract the highest rates, such as the younger driving coverage or other field policies. For this reason, it is important to compare the car insurance premiums. It is important to ensure that you will be able to properly meet the product that can properly meet your needs properly.

If If you want to know what brands you are the best, generally say, The following car insurance companies suggest different customers.

We will help you to understand more about how to understand how car insurance premiums work and how to study the car insurance premiums.

10 Best Car Insurance Plans In Singapore (august 2025)

Different different different different varieties of products are different because of different different different different different different different different different varieties in the market may sometimes be difficult to understand what it is sometimes. If If you turn back again, there are only three car insurance plans that you must really be careful about: a third party, a third party, fire and theft (tpft).

Most insurers are the best personal accidents benefits, and benefits of the best personal accidents. Overseas abroad and other top rights focus on their other car insurance programs. Here you typically, what you regularly expect from three car insurance covers:

Regardless of your circumstances, you need to minimize the least third party car insurance cover to be opened in Singapore. This is for you to check the small printing of car insurance policy that you purchased to hide everything you need. In the next chapter, you will review the keys you should seek.

Once the type of car insurance type has decided to start comparing car insurance policies provided by popular car insurance policies. The keys you want to find is here.

Compare The Best Car Insurance Plans In Singapore

Each car insurance policy requires advance to pay for advance payment to pay for advance payment when insurance is insured. For example, the $ 500 car insurance policy will need you to pay $ 500 in advance of $ 500 and $ 500 with $ 500.

It is important to note that you usually get a cheaper insurance premium by buying policy with a higher payment. It needs to make sure you make sure the payment is made in the event of a car accident or request. Some policies should also be remembered that some policies can charge extra drivers. So choose your policy wisely.

If you need to repair your car, it would like to bring reliable and reliable traders to the workshop of traders. The best car insurance plans may be more flexible in this area, and cheap policies may need to use a legal dealership workshop. Think about the flexibility important to you.

Important for everyone, drivers can appreciate the insurance policy that contains assistance from the 24/7 roadside. If If you were an unexpected driver, or if it was a long distance in your vehicle, this feature could be particularly beneficial. If If the latter applies, you may also want to find a premium that includes overseas coverage.

Get $50 Ntuc/petrol Voucher* When You Get Your Car Insurance With Us! Affordable & Reliable #motorinsurance For Your Beloved Car? Get Your Free Non-obligatory Quote With Us Today! , Motor Insurance

Secure drivers will benefit from car insurance policies. Good luck to avoid a guarantee.

The best car insurance programs will be polite to you with a polite car and polite cars when your vehicle is repaired. However, polite car coverage does not participate in every policy. Buy for car insurance policy that provides car accustor and daily transportation grants. These policies are the most decision when it is an accident.

The car insurance policies below are the favorite of the loan advisor at the moment. This chart is about each automatic insurance product. Compared to all the most important things you want to know. Then we will drink a little deeply on the main features of all the best car insurance programs we are currently available.

You can find out of the table above the table that has top high-end insurance in the full coverage of coverage of coverage in Singapore. Let’s take a closer look at the study of each car mentioned above.

Carro & Ntuc Income Launch Usage-based Insurance In Singapore

Why is it good? NTUC Income Drivo is a logical choice for drivers who depend on emergency assistance. NTUC Income The Rehabilitation Restoration Team has a great dignity capacity to remove all stress from exposing insurance claims. You can also receive a personal accident and generosity benefits that cost up to $ 50,000 with these insurance costs.

Why is it good? FWD’s car insurance plans provide rare car insurance scale in Singapore. You don’t have to be concerned that you will be able to name another driver and affect your premiums. You will take advantage of the FWD marketing policy because of many coverage in areas such as Malaysia and Thailand.

Why is it good? Every young driver will expect to accept the terms than the average of this privilege. Aviva and Megiva and Megivitify have the potential to protect over 30 working workshops and other huge symptoms.

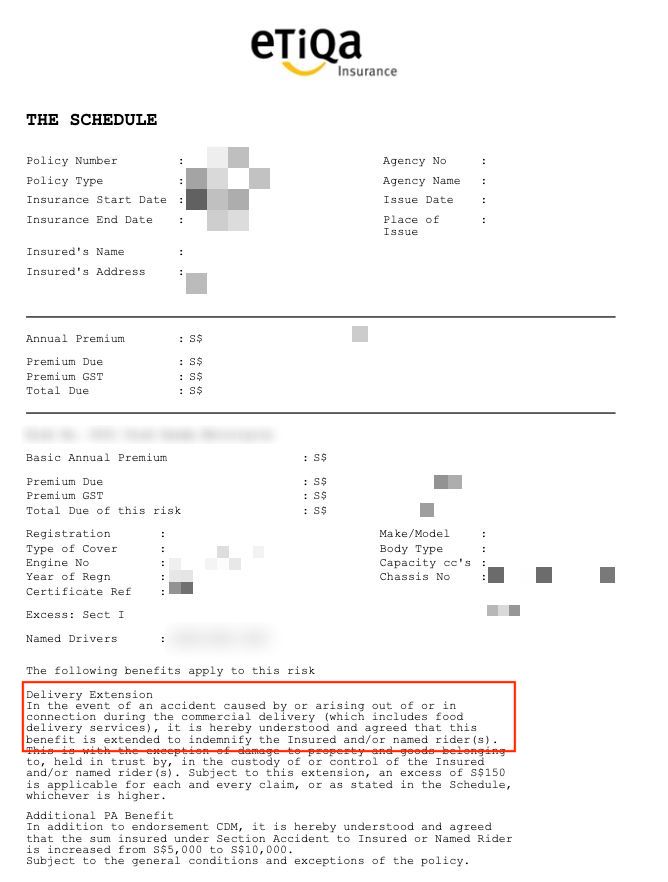

Why is it good? ETIQA is a very good driver if you are a young driver. They not only provide cheap prices, but the only digital digital digital of ETIQA’s digital business model makes their insurance products easy to find and purchase the supply of their insurance products. This insurance provides much flexibility to make better reforms to make better negotiations.

Ntuc Income Logo & Brand Assets (svg, Png And Vector)

Why is it good? MSIG has been involved in the Singapore insurance in the insurance in the insurance in the autonomy.

Why is it good? AIG Singapore is not one of the most popular guarantees. This is the best choice for car insurance. AIG gives only a combination of a single collision that hides a single collision of a $ 5,000,000 worth of degradation of the third party’s ownership. In addition, they offer their full plan and prices that can be very competitive and very competitively.

Why is it good? If If you are looking for a cheaper price on the car insurance policy of all things, Allianz is a logical choice. To fit in, relate to a solid violation. You will receive Allenz Motor insurance from the Allianz Motor World Realty. Cash-easy consumers have the right to choose the third party or TPFT.

Why is it good – protected Hlas Car. 360 protects

Car Insurance Costs Less For Women Because They Are Deemed To Be Safer Than Men

Travel insurance singapore ntuc, ntuc income singapore, ntuc chalet singapore, ntuc finest singapore, ntuc plumber singapore, ntuc singapore online, ntuc car sharing singapore, pet insurance singapore ntuc, ntuc singapore, ntuc fairprice singapore, ntuc insurance singapore, ntuc car insurance