Car Insurance Texas – The Texas Farm Bureau has the cheapest tariffs for Texas Auto insurance for $ 87 per month, for the entire coverage policy. It is 43% or $ 777 per year, cheaper than the average state of Texas, 1 year, $ 818.

Our other elections for the best Texas insurance are the State farm, German, red and Geico. Texas can find your cheapest business, comparing the budgets of various suppliers.

Car Insurance Texas

In 50 states plus Washington, district, has studied car insurance rates offered by quadrants per postal index

Affordable Car Insurance In Texas: 2025 Review

Postal code rates, postal codes, and the two most cheapest companies specified by the average driver rates 30, 35 and 45. Our sample vehicle 2017 Toyota Camry Le, 10,000 miles a year.

Driving rates and “poor” loans, a 30-year driver is determined by a 30-year-old driver with the average rates, until 578.

Some carriers can be represented by branches or subsidiaries. The rates provided are cost samples. Your real budgets can be different.

Our assessment methodology takes into account several factors, including customer satisfaction, cost, financial forces and political proposals. For more details, see. In the “Methodology” section.

Best Houston, Texas Auto Insurance In 2025 (top 10 Companies)

Amer is one of the best global credit levels, which acquires financial strength of insurance companies, on a ++ (higher) d (poor) scale.

Using the combination of domestic and external tariffs, we calculate the value of each insurance company ($) from the most expensive to the most expensive ($$$$ $) scale.

Texas Farm Office: One of the best Texas insurance companies, thanks to the cheap fare, as well as the assessments of young and authorized drivers and customer service.

Average Texas farm office rates – it is cheaper than the average average, also offers discounts in a package, take the driving security classes and they have a safe vehicle that increases your rates.

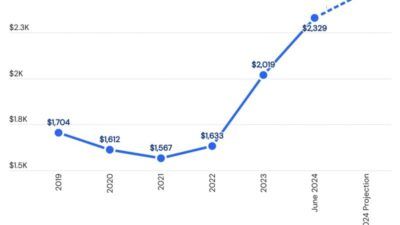

Texas Car Insurance Rates Continue Rising

The Texas farm office has not compensated for tuning options with customer care. According to the National Association of National Insurance Committees (NAIC), Texas Farm Bureau received fewer complaints than its size.

The average cost of the Texas farm office car insurance is $ 87 per month or 1, 1044 per month, 43% cheaper than average average.

The State farmhouse is one of the best and cheapest Texas cars, for many types of drivers and the cheapest fare for a great reputation for customer service.

The State farm has some of the best Texas Auto Insurance fees. State farms also offer cheap coatings for drivers who have been in an accident, or a quick card or dui record in their records.

Dallas Car Insurance

One of the things we like at the State farm is the customer service. The State farm has a high level of customer satisfaction and receives more than the average, reports of associations of national insurance companies.

The average cost of Texas state farm insurance costs $ 90 or $ 1, $ 080 per year, 41% cheaper than average worldwide.

Hermania is the best insurance company in Texas, especially if you want to work with a local company with cheaper than average fares.

Benchem Brenhem offers car insurance in Texas, so it is a good opportunity to cover a business with a good local experience and a good performance for customer service.

Best Texas Farm Bureau Car Insurance Discounts In 2025 (save 20% With These Deals)

Hermania offers a direct coating that is easy to understand, but not many applications; Although it is available to protect road and gaming support.

The average cost of the German car insurance in Texas is $ 112 per month or 1, 344, 26% cheaper than average worldwide.

Redpoint Texas is one of the cheapest insurance companies, especially for high-risk drivers with problems to find coverage somewhere.

One of the cheapest redpoint-Texas insurance companies, if you are a high-risk driver like a teenager or if you have a recently licensed driver, you have a bad loan or drive record.

Here Are The 12 Factors That Determine Your Auto Insurance Price

Even if you are not a high-risk driver, Redpoint still offers the best-star auto insurance fees. Prices are nearly $ 500 dollars with a net record of driving Texas.

The average cost of Texas Redpoint’s self-insurance is $ 113 or $ 1, $ 356 per year, 25% cheaper than average.

One of the most important insurance companies in Geico Texas is at low tariffs in Texas, highly appreciated customer service and proper mobile application.

According to the National Association of Insurance Commissioners. Geicok is greater than average, J.D. with satisfaction of satisfaction claims. Power 2022.

Find Better Spring, Tx Auto Insurance Instantly

Geico does not offer many ways to set up policies as a competitor, but it is the main coverage that requires the most drivers. We also like the right application for mobile Geico. Claim, you can access your policy details and you need help on the road when you need Weiic smartphone application. You can also evaluate damage to your car after the accident to see if the repair can be used using the photo tool.

Geico’s average cost of Texas Geico is $ 122 per month or $ 1, $ 464 per year, more than average worldwide.

The best car insurance in Texas is USAA, only available to military drivers. USAA wrote. For the Power 2023 Texas region, legislators in a solitary stars refer to customer service, accounts, claims and prices. [1]

State farms and Texas farm offices are also available for the best points and general public, this is not aeeba.

Temporary Car Insurance In Texas

Teenagers and young people don’t have much driving experience, which means that they enter an accident than older drivers. That’s why young adult drivers can be more difficult to find cheap car insurance.

Choosing the best insurance company should not be a better experience. There are several factors to consider, including:

Are you ready to start buying insurance? Our insurance experts are willing to help you find the right insurance coverage for your needs

Driving history is one of the greatest factors that use insurance companies to help determine your fares. An accident or traffic ticket can have a much more expensive car insurance.

How To Find Out If Someone Has Car Insurance In Fort Worth, Tx

The cheapest insurance of Texas is a public farm for drivers for drivers for driving drivers.

The cheapest Texas insurance company is the state economy for drivers who accidental drivers in their records. On average, the state farm coat costs $ 107 per year after an accident 107 or 1, 280.

Texas drivers with DWI or DWI are likely to be significant increase in auto insurance tariffs. Texas drivers average $ 1, $ 818 pay for auto insurance a year, but the average dui driver rate is $ 2, 962, which is above the average state.

But the dui drivers can save money by comparing fees. According to our research, the Redpoint range is reciprocal, state farms and farm offices have lowest rates for drivers of record record.

How Long Do I Have To File A Car Accident Claim In Texas?

The speed card can also force auto insurance rates. Texas drivers have the average car insurance rate of their records for their records, $ 296 a year, which is 500 dollars than the average rate for drivers with clean drivers.

We found the State farms, farm offices and red on average for the most cheapest rates for their record card for their record.

Drivers with bad loan history and low credit points can expect to pay more than drivers with high credit points. Working to improve credit assessment is a way to reduce insurance fees.

On average, a bad loan with a bad loan is the cheapest car car car for drivers.

Budget Auto Quote Car Insurance In Dallas, Tx

Local factors, such as crime rate, population density or accidental accidents, affect the cost of insurance.

Texas needs anyone who owns a vehicle in the state must pay damage to an accident. The best way to satisfy this condition is to insure a car.

At least minimum insurance or greater drivers and an accident will cause.

Unsatured drivers can suspend two years by two years threatened by some driver’s license or other punishment. However, that did not stop some people, and about 20% of Texas drivers are not insured. [2]

Tomorrow Is Car Insurance Day. 🚘📄it’s A Good Reminder To Check That Your Policy Protects You And Your Vehicle In Case Of Accidents. In Texas, Drivers Are Required To Have Minimum Liability

Texas require drivers to buy large body damage and cover damage only. This means that drivers who buy the minimum insurance levels do not have a cover for damage to their vehicle, and do not protect against unprotected or unused motorists.

Complex and collided with a cover in the event of a risk covered by the risk of resolving or replacing your vehicle, and insured without insurance and insured