Car Insurance Uk Cost – According to statistics, young drivers have the most affected by the highest car insurance costs on record, some with a premium of about £ 3,000.

Al-Qaeda.com, the price comparison firm said on average 17-20 years old children have seen an increase of more than $ 1,000 in insurance since last year.

Car Insurance Uk Cost

Steve Dux, the chief executive of Confused.com, told Radio 4’s Today program: “After pandemic diseases, in the last two years, the claims have been lost, but also costs them.

How To Reduce Your Car Insurance 2025

“The cost of other hand cars is higher than them, the cost of parts, the cost of labor to repair – and all this is being transferred to consumers.”

Prices for other hand -in -hand cars – the first usual car for a newly qualified young driver – has been fluctuating the epidemic diseases for a few months. Demand for used cars decreased after the global lack of computers and other material manufacture requirements increased due to increased production of new vehicles.

According to the National Statistics Office, in March 2022, the use of car markets increased by 31 %. Since then they have fallen fast.

But small drivers faced a sharp jump. For 17 -year -old children, the premium average increased £ 1, 423, £ 2, 877. For 18 -year -old drivers, the average policy price reached £ 3, 162.

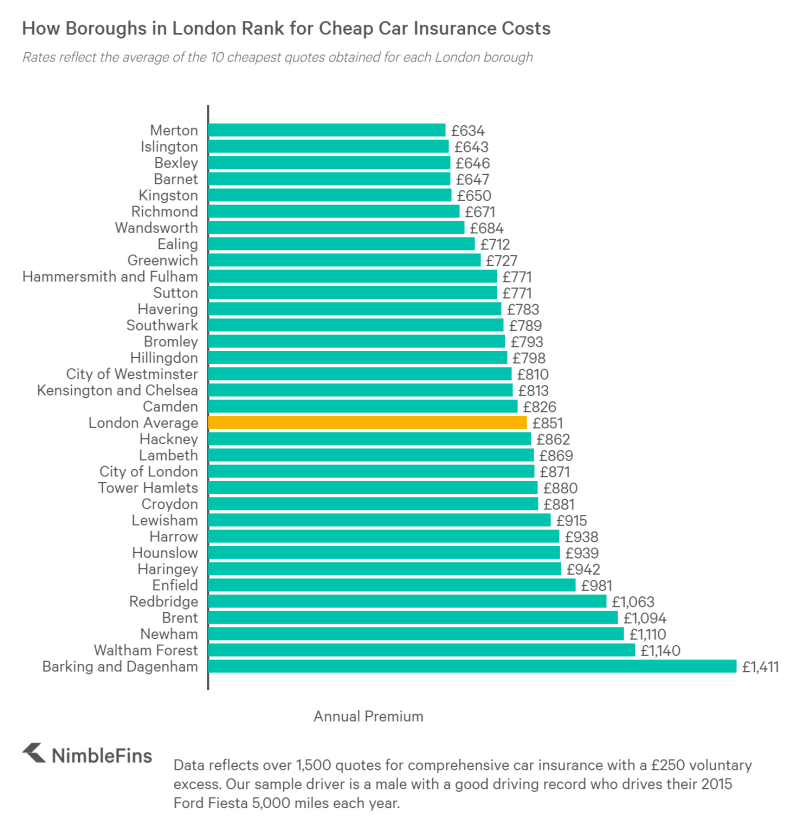

We Reveal Which Cities Have The Highest

The data is calculated on the average of the best five references received for receiving confusion rather than actually paid for book prices.

Mr Dux said there were ways to reduce the premium. “Where they can legally divide driving with more experience with an old driver and add that person as a designated driver, it can really have a significant impact and its price can be reduced to hundreds of pounds, it is really worth seeing,” he said.

Mr Dux also suggested that young motorcycles seek the use of telemosts, or discovered the use of “how you drive” insurance, where their behavior on the road is distributed with basic insurance providers or occasionally drivers insurance.

But he said that with the increase in the price of children aged 17-20, many young drivers would consider whether they could afford to drive at all.

Rising Car Insurance Costs In The Uk: What You Need To Know

“The industry should be careful not to put small drivers in other methods of transportation, and when prices are high, it is a real risk,” he said.

The Association of British Insurance Companies (ABI) said that while car insurance could be expensive, there were ways to reduce costs.

It added that it is important that the motorcyclists never run without a cover and urged anyone to struggle to talk to their insurance.

However, the ABI said that insurance is always dangerous and its data shows that the average cost of young drivers and the frequency of claims is high, which can affect the premium.

Huge Rise In Extra Charges From Car Insurers Adds £140 A Year To Bills

According to his analysis of 28 million policies, drivers’ insurance costs increased by £ 561 between July and September, which is 29 % higher than the same time in 2022.

The association said the figures were based on prices that were paid for their cover, instead of being handed over.

If you are willing to talk to a journalist please add the contact number. You can also contact the following methods:

If you are reading this page and can’t see the form, you will need to view the mobile version of the website to offer your question or comment or you can email us to@. Co.uk. Please add your name, age and location with any submission.

Gap Insurance For Your New Car: How Much Will You Save?

Seven days ago, the ban on Learner Driver Day Test Center is no longer allowing learners to be allowed to use the ground during work hours. 7 days ago

July 31, 2025 Shift in automatics for EV Future Driving Instructors in Lincolnshire. More people are choosing to learn in automated vehicles. July 31, 2025

On July 26, 2025, the safety upgrade A616 will impose its speed and parking restrictions in the Crowe Edge near Barnsley on Barnsley to reduce and save lives.

July 20, 2025 returned to the first 150mph car to the beach where he returned to Pandin Sands on the 100th anniversary of the record of the record.

Car Insurance Hike As The Average Policy Tops £1,000

July 18, 2025 Volunteers are trying to brake high -speed drivers. So finding the cheapest car insurance for you is more important than ever. Auto insurance is essential in the UK. No one is allowed to use public roads without insurance they are driving. Doing so can provide you with a lot of money. In some cases, it can also deprive you of your car. Only once you may not have insurance on the car if it is declared away from the road.

This means that it is not in use and there is no insurance. Here is a wide range of car insurance companies from which to choose, and they all have different insurance references, from the prescription to the cheap. The lowest car insurance price price limit is between 1 281 and $ 333 annually. Various factors affect the price to each concerned person. It is important that you compare multiple insurance prices of different companies before making a decision.

The biggest benefit of getting cheap car insurance is that it saves money. One of the factors that insurance providers is expensive is. Another factor that your insurance will be influenced by the insurance group that belongs to your car. The car model affects how much insurance you pay for it. There are different types of cars, and depends on what group they come under, they have different insurance costs. The cheapest car insurance will be released for a car that belongs to the lower group. This means that the insurance company will spend less on it. It is believed that cars are considered less dangerous and cheap in lower groups, as can be a matter. High groups cost more in car insurance. The reason for this is that they are considered to be a high risk, it can also have expensive spare parts, and the cost of replacing them is high. This group is decided by many factors. For example, damage, replacement parts, repair costs, repair time, new car price, performance, brake and security. There are only three basic levels of car insurance coverage, of which people choose. The first is a fully comprehensive insurance that has a high level of coverage available for the car. It protects against all kinds of damage and protects the driver and the other third. Fully comprehensive insurance costs an average of $ 555. The second type of coverage is the third party, the coverage of fire and theft. These policies provide coverage for only the third party involved in an accident. Third party, fire and theft coverage. It also protects your vehicle in case of theft or fire damage. Third party, fire and theft coverage. On average costs about £ 1 841. The third basic level of insurance that you can get to the car is a third party cover. This is the least legal requirement you need to drive on the public road and is usually the most expensive type, especially for new drivers. The third party cover provides coverage for other people affected by accidents as well as their cars and property. The cost of the third party cover is about £ 1, 157. The top three national companies entering the price of high services and cheap car insurance include AXA, straight line and LV =. Your actual price will depend on factors such as your location, your car type, your driving date and more. Of the three, the cheapest is AXA (Swift Cover), with an average price lower up to $ 281. It is about 18 % cheaper than the straight line (privilege), which is costly at $ 299, and LV = is more than 30 % cheaper, with the average price of 33 333. In addition to the Axa, LV = and straight line, there are seven other providers who are known for their cheap and great service.

The Swift Cover was formed in 2005. Swift Koor just started a virtual as an insurance company and aims to present consumers to insurance at a good price. According to reports, Swift Cover was the first company in the UK to allow its clients to print their car insurance certificates instead of sending it by post. Swift Koor was acquired by AXA in 2007 and has been a subsidiary under him. The headquarters of Xa (Swift Cover) is located in Surrey, and several call centers are scattered in the UK. Swift Koor specializes in two levels of car insurance. One is a complete comprehensive coverage, and the other third party, fire and theft cover. Swift Koor offers two types of coverage: standard and pulse. Both standard and pulse usually cover two levels of insurance. The switch also offers extras such as the wrong fuel cover, stolen keys cover, and the forward travel cover. Many people consider the company the cheapest insurance provider, with an average monthly cost of £ 23 and annual cost 1 281. Axa offers a tremendous discount of car insurance, including an option that allows you to pay for the front.

Most Expensive Areas For Young Driver Car Insurance

Switch is popular in Koor