Car Insurance Zero Depreciation Price – While third -party car insurance is mandatory, it does not provide extensive coverage. A global policy, on the other hand, provides coverage both for third -party liabilities and for any damage or losses for the insured car. To make the coverage still promising, it is possible to obtain insurance starting from scratch for the car included in the complete policy and improve the coverage.

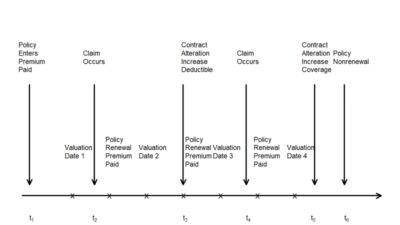

Zero amortization car insurance means that no amortization costs are paid during the complaint settlements. In a nutshell, the complaints are paid for the complete replacement value of the parts, less the franchises. This additional component, often part of complete policies, eliminates the financial impact of the vehicle wear. The zero amortization insurance is applicable for vehicles that are less than 5 years old, however, this can vary from insurer to insurer.

Car Insurance Zero Depreciation Price

If you have recently purchased a car or have a luxury car, the purchase of a zero amortization coverage makes much sense. It will reduce the expenses alive in case of damage to your car. Below are some of the reasons to opt for zero Covering Cover for your car insurance.

What Is Zero Depreciation In Car Insurance?

Exclusive plans: When you buy, you can buy this additional coverage together with a complete policy. Or you can also buy a standard global bundle plan with zero amortization performance that are exclusively available.

Bass premium: when you buy, you take care of us directly. Since there are no intermediaries involved, it translates into low operating costs. We transmit the benefits in the form of low -cost insurance plans.

Value services: when buying, not only enjoy the advantages of additional coverage for complete and zero insurance. You can also make use of premium services such as free pick-up and hand delivery in the selected city.

Zero insurance depth covers most of the expenses deriving from damage to your car. However, there are some exclusions, which are listed below.

8 Factors Affect The Premium Of Your Zero Depreciation Car Insurance

The main difference between zero amortization car insurance and complete coverage is that zero amortization is an additional component and complete coverage is a car insurance policy.

An optional additional component while purchasing complete car insurance. It will guarantee that the insurance company did not deduct the amortization of the parts of the car before resolving the complaint for the damage to your car.

A bundle of third -party liability plan and proper damage plan. Different additional components can be included to make it exclusive; However, consider the depreciation of the parts of the car before resolving the complaint.

There is a slight increase in the car insurance award, but it ensures that there is no depreciation of the parts of the car during the complaint settlements.

Zero Depreciation Car Insurance Policy Online: Coverage & Benefits Explained

The award for autonomous global policy is less than a policy that has additional components such as Nil or Zero amortization.

While the premium you pay could be slightly higher, the cost of payment for the depreciation of the parts of the car is canceled.

While the prize is less than that of the Zero Dep insurance, you can only save on the prize you pay.

Various factors come into play when zero car insurance prizes are calculated. Below are some of the critical factors that affect the zero additional component award dep.

Don’t Miss Out On These 5 Most Important Car Insurance Add-ons, 1 Zero Depreciation Insurance, Without Zero Dep Add-on, You’d Get Money For Repairs, But Not The Full Cost Due To Depreciation. But With

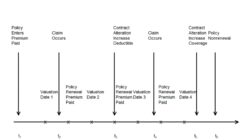

The amortization rate in cars varies according to the type of vehicle component and the age of the car. To make things easier for insurers and insured, Irdai (Authority for the regulation and development of the insurance of India) has set the amortization rate for cars. The following sections provide more details on the same.

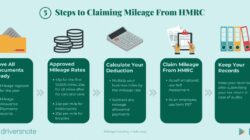

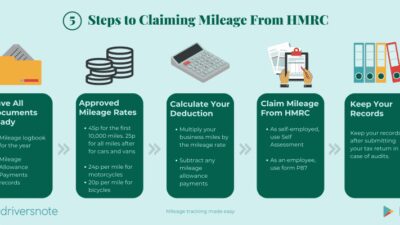

It is possible to purchase additional online coverage while buying or renewal of car insurance. The purchase of a zero amortization car insurance policy is much simpler, thanks to digital insurance providers such as. Here are the steps to buy zero cover from.

Step 3: select the complete policy with zero coverage deposit and buy the plan by paying the online premium.

The process of renewal of zero coverage deposit is similar to the renewal of a car insurance policy. The following passages will help you renew the amateur shock coverage.

Maruti Wagon R Insurance Price: Get Quote For Car Policy

Step 1: Enter the vehicle registration number by going to the top of this page or downloading the app.

The process to renew the zero deposit insurance for a car is as simple as other insurance policies. However, some of the suggestions you need to keep in mind during the renewal process listed below:

During the resolution of the complaint, the insurer will deduct the amortization applicable to the parts of the car. The amortization rate will be mentioned in the formulation of politics. However, when you require cars to zero deposit, you will receive the entire amount of the complaint without any deduction due to depreciation. So, it is not necessary to pay for a pocket for car repairs. The complaint process also becomes simple with the zero amortization coverage as it is not necessary to worry about the deductions due to the amortization rate.

Purchase of zero -zero car insurance depends exclusively on your needs and the type of cars you have. For example, if you have a luxury car or you have purchased a new car, it makes sense to buy amortization coverage.

Buying A New Vehicle, This Is You Should Know About Insurance Policy. Dealers Try To Fool You But You Have To Be Aware And Always Buy Zero Depreciation Or Comprehensive Insurance Policy Only Because

The additional zero coverage department is available only for cars under the age of 5. So, you cannot buy the additional component if you have a car that is more than 5 years old.

If your car is under 5 years old, you are suitable for buying the additional zero amortization component together with the complete car insurance policy.

Yes, zero amortization is the same as the bumper bumper. There are only different names at the same additional cover.

No, the additional zero depreciation component does not cover car tires as they are subject to wear.

Car Insurance Plans

Zero Dep Insurance is an additional component that you can include in your complete policy and obtain the complete amount of the complaint, regardless of the amortization costs.

Are the questions relating to the two Wheeler insurance policy? Refer to our political words for detailed information or contact us via E -mail or telephone using the information below Storyteller, Manasvi leads to 4 -year -old figures of experience of content and marketing. Whether it’s writing articles optimized with SEO-optimized or a sought and in-depth blog, it undertakes to transform ideas into the creation of impact and engaging content.

Mayur specializes in automotive insurance and is responsible for the supervision of the development and management of automotive insurance products. With the competence in the product strategy and in the analysis of the market, it focuses on the development of insurance solutions focused on customers.

If you are worried about spending most of your savings for car repairs after an accident, the self -depreciation car insurance policy is your solution. This additional component for car insurance offers you tranquility by removing the amortization costs during the complaint settlements.

Four Wheeler Vehicle Insurance Service Online At ₹ 2400/year In Dumka

Additional zero amortization coverage, also known as bumper bumpers or amortization nil covers in a complete car insurance policy guarantees that the insurer does not deduce the amount of the demort on the car parts assessed according to the policy document.

The advantages based on the additional component zero depic can be used up to a maximum number of times specified during the policy period.

Therefore, if you have an additional zero amortization coverage, you can request the total cost of replacing the parts of the damaged car in the event of an accident and save a huge amount.

Depreciation in car insurance is the decrease in the car value of the car over time due to its natural wear. Therefore, the older the car is, the greater its amortization.

Car Insurance Online: Buy/renew Car Insurance Policy With Smc

It is a factor that comes into play when a complaint is presented for damage to your car as part of a complete car insurance policy.

The standard car insurance policy deducted the amount of the demort, therefore, leaving a lower payment than the actual repair costs. Therefore, having an additional zero amortization component reduces living expenses almost zero during the complaint, making sure to receive the complete declared value (IDV) for repairs or replacements. This is because without a zero additional component, depth is the cost of removing the parties must be incurred by you. But with an additional component to Zero Dep, it is curated by your insurance company.

Ensuring your car with an additional zero depth component means obtaining protection from financial loss and compensation for the complete amount of repair or replacement, since the depreciation from the parts of your car will not be calculated. Therefore, you will receive a higher amount during the complaint regulations.

It is possible to opt for the additional coverage of the zero amortization car insurance together with the complete car insurance policy or standard damage by paying an additional premium, which is generally low and convenient. In this way you can protect your car and your pocket at an affordable cost.

Zero Depreciation Car Insurance: Zero Dep Insurance Coverage & Benefits

The accidents are financially drained and mentally and take care to cover the repair costs should not add to the burden. Therefore, opting for an additional component to zero amortization ensures you are financially protected in the event of an accident, which can be so satisfying and really gives you a little tranquility.

In zero additional amortization covers, some things in addition to the general exclusions listed in the car insurance are not covered. We look at them in detail:

In the event that the damage caused to the vehicle cannot be inspected before it is repaired, the insurer is not responsible for entertaining the complaint.

The loss required for damage caused to the covered vehicle in the context of different types of insurance policy will not be covered by figures.

Zero Depreciation Car Insurance Vs Comprehensive Policy Differences In India

A complaint will not be payable with an additional zero amortization component if it is not covered by the OD section of the