Cash Is Which Type Of Account – If you are thinking about opening an account with an intermediary, you probably found out that there are some different

We will discuss what is a cash account, how it works, benefits and restrictions that come with it, and how to open up.

Cash Is Which Type Of Account

![]()

A cash account requires you to pay completely securities without borrowing money or using loan margins.

A Couple Rules Of Investing I’ve Adopted From The Bogleheads Are As Follows. 1. Never Bear Too Much Risk 2. Never Bear Too Little Risk Bearing Too Much Risk, Would

Monetary accounts are safer, without the risk of debt, margin or interest calls, making them ideal for beginners.

Cash accounts limit the purchase power as you can only trade with the cash available on your account.

A cash account is a type of brokerage account where the applicant (account holder) must pay for the full amount of the purchased securities.

For example, if you want to buy $ 100 Apple Stock and have money, you have to have $ 100 in your account. You cannot borrow money or use margin loans for investment.

Cash Receipts Journal Vs Bank Deposit In Microsoft Dynamics 365 Business Central

Such an account may sound quite obvious. Works like your bank account. In order to truly understand what the money account is, it is important to compare it to your colleague, margin account.

The margin account allows you to borrow money to buy securities through what is known as a margin loan.

Let’s say, for example, you want to buy the same $ 100 Apple stock, but this time you have a 50 % margin bill. You should only have $ 50 available in your account, as you can buy the remaining $ 50 (50% investment) with a margin loan.

With margin account, borrow money for investments. With a cash account, the investments you are making is entirely with your own money.

Petty Cash Account

Thus, cash accounts are usually more suitable for conservative or initial investors, while marginal bills can be a smarter move for experienced or aggressive investors.

When you set up an account (we will discuss the steps included soon), you will need to add some funds. Your broker will tell you what methods are available for this, such as direct deposit or wire transfer.

When you want to buy security, you need to have a sufficient status. Securities purchased by cash account is subject to the T+2 settlement rule, which means that the store must be fully paid within two working days after the date of the transaction.

When these funds are used to buy safety, they cannot be reused until the store is settled, for example, when you sell the stocks you have purchased.

Is Origin’s Cash Account The Only Type Of Savings Account That Does This?

Unlike marginal accounts, cash accounts do not allow leverage or short sale. However, all securities purchased by cash account is owned by investors, as there is no borrowing involved.

Finally, the account holders are forbidden to participate in “free driving”, where they sell securities before paying them in full. You have to pay for security before you can sell it.

Regulation T (often shortened to REG T) is a regulation of federal reserves governing the expansion of credit by brokers and traders.

For marginal account holders, it prevents the applicant from borrowing more than 50% of the purchase price.

Cash Flow: What It Is, How It Works, And How To Analyze It

For holders of cash bills, it prohibits free riding and borrowing. It also requires that securities be paid with a date of settlement and the proceeds from the sale cannot be used for new purchases until the store is settled.

The use of a cash account has both benefits and with restrictions. It doesn’t matter to be aware of both the benefits and the weaknesses of this kind of investment account, to determine if it is right for you.

Opening a cash account is very simple. Because it does not include any borrowing or complex trading strategies, the requirements and processes are generally relatively light.

The exact requirements for opening a cash account differ from intermediaries. However, most of the combination of the following requirements:

Definition Of Cash Account

Thinking about opening a cash account? Then you would be smart to choose the one that integrates smoothly with your accounting platform to take advantage of:

Josh Krissansen is a freelance writer who writes content. He is the owner of a small company that has knowledge of sales and marketing roles. With more than 5 years of writing experience, Josh brings clarity and insight into complex financial and business affairs.

And its branches do not provide tax, legal or accounting advice. This material was prepared only for informational purposes and is not intended to provide and should not be rely on, tax, legal or accounting advice. Consult your tax, legal and accounting consultants before joining any transaction. assumes no responsibility for any inaccuracy or inconsistency of content. While trying to ensure that the information contained in this site is from reliable sources are not responsible for any errors or omissions or for the results obtained from the use of this information. All information on this site is available “as is”, without guarantee for perfection, accuracy, timeliness or results obtained by using this information, and without any guarantee, explicit or implicit. In no case should its branch or parent company or directors, officials, agents or employees be responsible for you or anyone else for any decision or measures taken in relation to information on this site or any consequence, special or similar damage, even if advised on the possibility of such compensation. Some links on this site are linked to other web sites maintained by third parties over which they have no control. It does not give any presentations about the accuracy or any other aspect of the information contained in other sites. In addition to cash, a cash account with an intermediary can keep a number of stocks, funds and bonds, and these sources must be used to finance trading transactions.

:max_bytes(150000):strip_icc()/accountspayable.asp-Final-e4e5efa448a94289b6b17189aa72f10e.jpg?strip=all)

Investors who actively trade through a brokerage company and have cash accounts must be careful not to violate certain regulations. They must have enough money in their cash accounts to pay the transaction within two working days of the settlement. They do not have the opportunity to pay for the purchase of securities by selling other securities after the purchase date. Short sales and shopping at margin are forbidden.

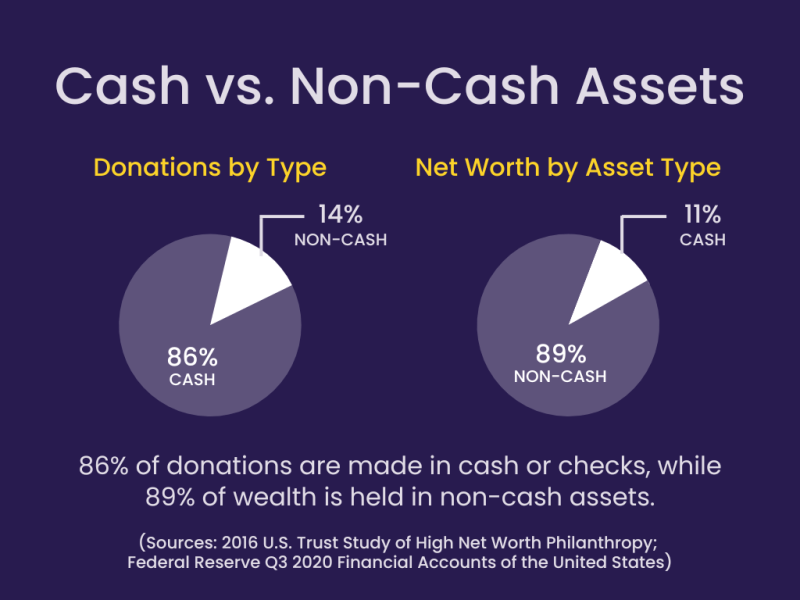

Cash Isn’t King? Non-cash Asset Fundraising, Explained

In accounting, a cash account or cash book may refer to a book in which all cash transactions are recorded. The cash account includes both cash benefits log and in cash payment magazine.

Investors who actively trade must be careful not to violate some of the regulations applicable to cash accounts. For example, they have to be sure that they have enough money in their account and do not try to pay for the purchase of securities by selling other securities after the purchase date.

For example, an investor who does not have cash in the invoice may decide on Monday that the purchase of a share worth $ 10,000 will be. For payment for this, the investor sells other shares of $ 10,000 on Tuesday. This would be a violation because the purchase will go two days later, on Wednesday before selling on Thursday. There would be no money available on the account to cover the store. This is known as “a violation of liquidation in cash.”

The active investor with cash bill and zero money must also not buy security and then quickly sell it before prior sale has been settled to provide the necessary cash. This is known as “a violation of good faith.”

Account Name Header Balance Account Type Account Number

Investors in cash with zero or available near cash must also avoid attempting to pay for the purchase of security by selling the same security. For example, an investor can buy a $ 1,000 share on Monday, but will not have enough money to pay in two days. In order to pay for it, the applicant will then be able to sell the same stock on Thursday, and the day after the purchase should be settled. This is known as “a violation of free driving.”

Unlike the Amargin Accountallows cash account, the investor who borrows according to the valuesin value is to buy new positions or to sell shorts. Investors can use a margin to take advantage of their positions and profit from both bull and bear moves on the market. The margin can also be used to withdraw cash according to the value of the account in the form of a short -term loan.

For investors looking for Tolaveragetheir positions, margin accounts can be useful and cost -effective. However, keep in mind that when the rate is created, the outstanding balance is subjected to the daily interest rate charged by the company. These rates are based on the current level of cases and the additional amount charged by the loan. This rate can be quite high.

The margin bills must maintain a certain margin ratio at all times. If the value of the invoice falls below this limit, the customer is issued an Amargin call. This is a request to return the value of the account within the limits. The customer can add new money to the account or sell some stakes to withdraw cash.

Is It Mandatory To Create Cash Account Ledger In Tally.erp 9?

For example, an investor with margin account can take a